-

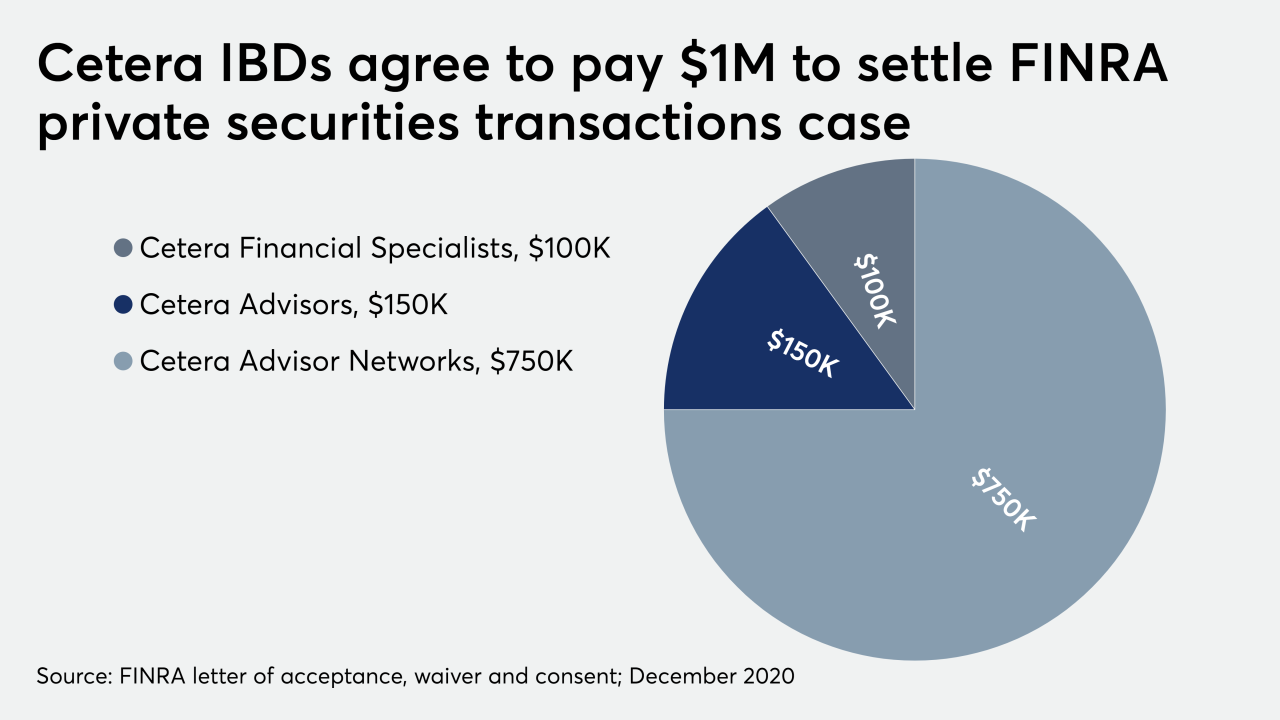

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

LPL Financial and indie rivals like Raymond James, Wells Fargo FiNet and Kestra Financial completed at least 17 recruiting grabs of $800 million or more this year.

December 18 -

It’s one of the largest teams to quit a wirehouse this year.

December 14 -

Regulatory shifts, M&A, new technology — there’s a lot on the horizon for the industry.

December 13 -

The OSJ scooped up teams from Edward Jones, Wells Fargo Advisors and Wedbush Securities.

December 11 -

The latest deal by a wealth manager for an employee services firm enables the Raymond James Private Client Group to expand its reach.

December 11 -

Waddell & Reed had been working in recent years to transform its “proprietary broker-dealer into a fully competitive independent wealth manager.”

December 10 -

Funding is getting tighter as advisors look towards marketing automation as an engine for growth.

December 9 -

The Boston-based boutique oversees the assets of roughly 140 full- service clients and 800 individual households.

December 3 -

As part of a two-step deal involving Australian investment bank Macquarie Group, LPL will pick up 900 advisors and $63 billion in assets.

December 2 -

In a bid to attract clients left out by AUM fees, IBDs are enabling advisors to take approaches first made popular in the full RIA channel.

December 1 -

Planners and experts dive into wirehouse pay, charging clients at a higher rate, emerging business models and other key issues.

December 1 -

For its next leader, Ohio National turned to a veteran executive with prior experience leading its independent broker-dealer.

November 25 -

James Booth’s seven-year fraud bilked investors out of nearly $5 million.

November 24 -

The No. 1 IBD is responsible for nearly half of the dozen mega-moves in its sector this year.

November 24 -

Necessary new approaches include better cultural understanding, more flexibility for new entrants and more outreach, advisors and executives say.

November 19 -

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

In a surprise announcement, Private Advisor Group tapped Moore as CEO nearly two years after he left Cetera for undisclosed medical reasons.

November 18 -

It’s one of the largest recruiting moves of the year in the independent broker-dealer sector.

November 16 -

Five firms agreed to pay $3 million to settle an SEC investigation into unsuitable sales of complex exchange-traded products.

November 16