-

The low interest rates pushing down sales across most fixed and variable lines are also boosting certain products.

November 25 -

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

Wealthy clients are the fastest growing segment of the company’s retail division.

November 2 -

It’s a dilemma that could reshape the classic investing strategy as the Fed holds rates near zero for the foreseeable future.

October 20 -

Chairman Jerome Powell and other officials have stressed that recovery is highly dependent on the nation’s ability to better control the coronavirus.

September 16 -

The decisions entrench a prolonged decline for prime funds, and could hurt a market that thousands of companies rely on for funding.

September 8 -

Innovator ETFs, an asset manager, will debut its so-called buffer funds at a time when Treasury yields are hovering near historic lows and duration risk climbs.

August 14 -

As anxious as they may be to take advantage of the opportunity, there are pitfalls and hidden costs, advisors warn.

August 4 -

Crush of inflows to money-market funds has come even as the funds’ own yields approach zero.

May 8 -

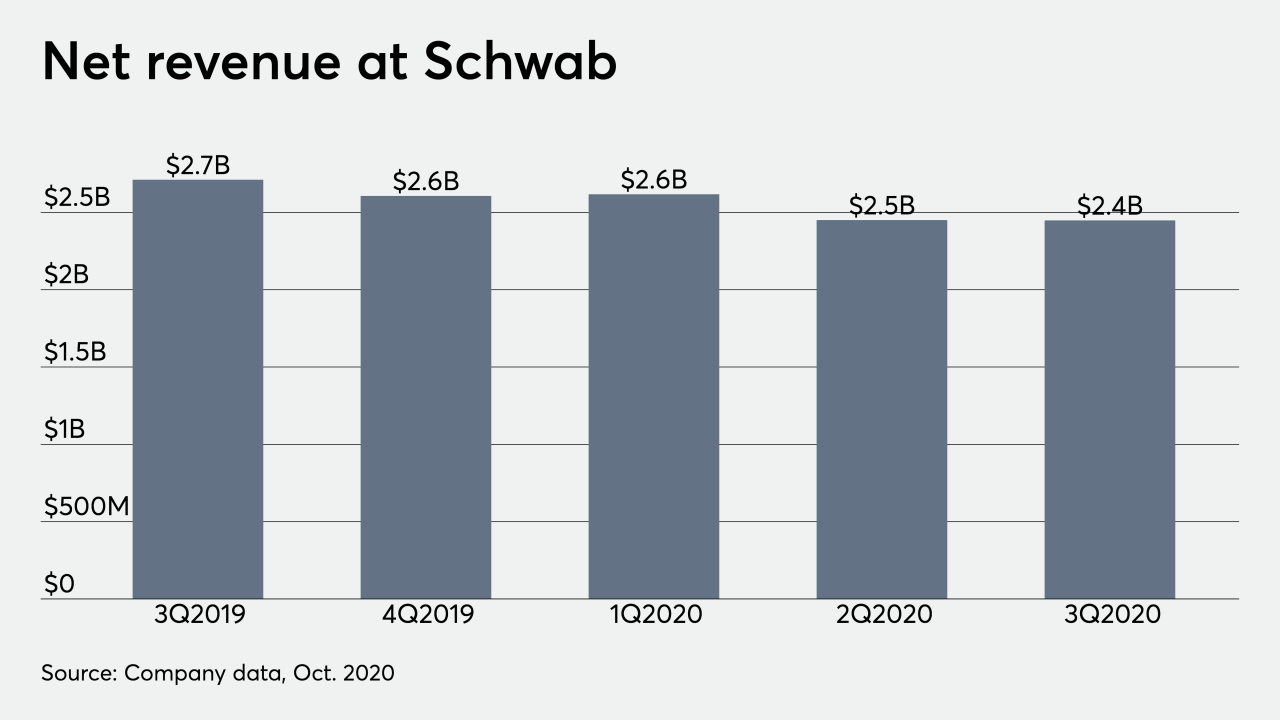

Even as Schwab, TD Ameritrade and E-Trade attract billions in new assets, company cash yields suffered from Fed cuts.

April 26 -

Total net assets in Michael Hasenstab's Templeton Global Bond Fund slumped to $22.6 billion as of March 31, public filings show.

April 21 -

Lenders have been ringing up investment firms and hedge funds to garner interest in financing to companies in industries upended by the coronavirus.

March 16 -

These retirement vehicles can be less complex and cheaper than alternatives.

March 12 -

The richer they are, the more options clients have to insulate themselves from the coronavirus and its effects.

March 9 -

The Federal Reserve has voted unanimously to cut the interest rate 50 basis points to 1.10% effective March 4, in the first emergency rate cut since 2008.

March 3 -

The SPDR fund saw a one-day exodus of $372 million as the sector struggles amid bets that the Fed will cut rates to mitigate damages from the coronavirus.

February 25 -

While the deadly virus threatens to harm the world economy, the funds have remained popular as the Fed signals low rates for the foreseeable future.

January 29 -

"We seek to finance the government at the least possible cost to taxpayers over time," said Treasury Secretary Steven Mnuchin.

January 21 -

The $6 billion fund saw almost 3 million shares hit the tape after DoubleLine’s CEO touted its potential for retirees in his annual markets webcast.

January 9 -

In what was a stellar year for corporates, governments nearly missed the list entirely.

January 8