-

The New York-based firm has secured over $62 million in equity funding since its founding in 2014.

March 27 -

“Just like equities, last year was a volatile year and the fourth quarter of 2018 did a number on the returns of risk assets,” an expert says.

March 27 -

In the last five years, the universe of sustainable funds has increased almost 70% to $760 billion in European and U.S. mutual funds and ETFs.

March 27 -

Frequent communications with clients, candor and reassurance will increase a firm’s credibility and attract new business.

March 26

-

The regulator is going back to some of the firms that voluntarily settled, requesting information on revenue sharing.

March 26 -

The drop in wealth was equivalent to the GDP of Italy.

March 26 -

While a broad-market stock ETF generates fees of as little as 20 cents for every $1,000 invested, AI products range from $1.80 to $8.

March 25 -

Despite the weakest one-year performance, these funds had double-digit annualized returns the past three years.

March 20 -

After expanding into a $7 trillion industry, index funds are facing slower asset growth and declining fee revenue.

March 20 -

Misinterpreting the Fed’s announcements continuously trips up advisors. Here’s what I tell clients who want me to predict the future.

March 20 Wealth Logic

Wealth Logic -

Harassment, belittling, defamation and crass comments plague advisors in the online public eye.

March 19 -

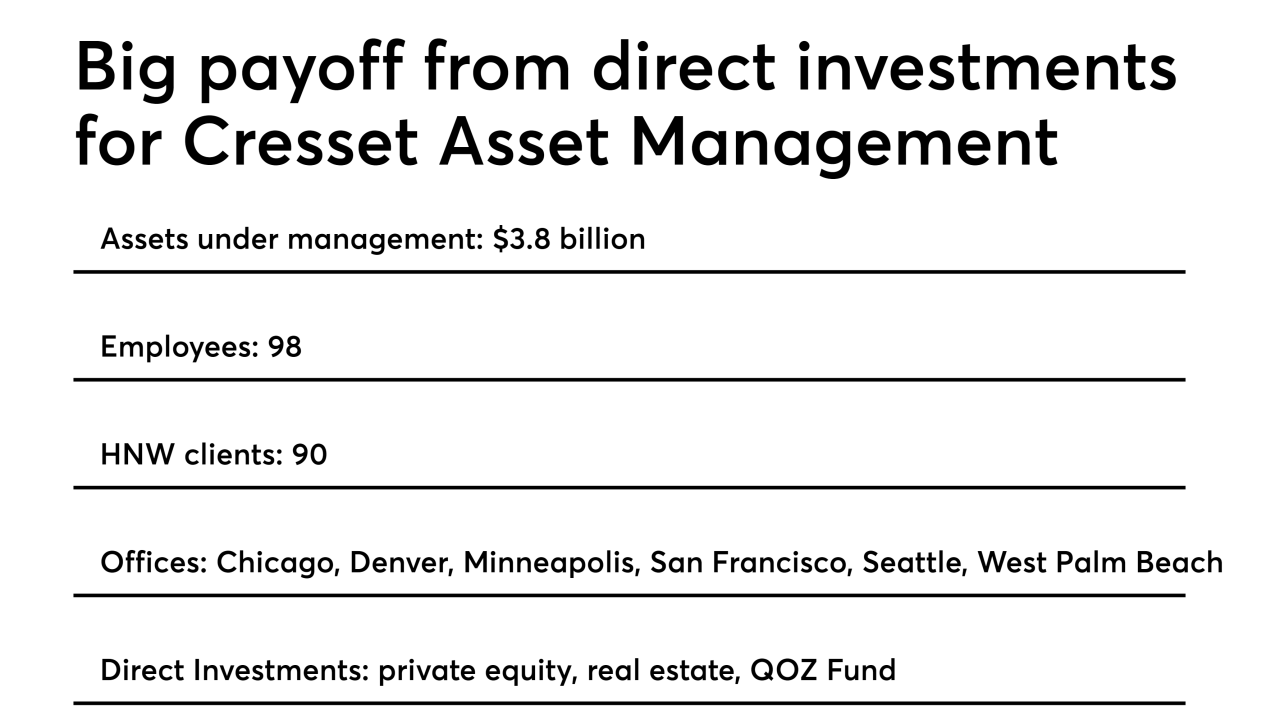

The $3 billion-plus RIA seeking scale via acquisitions.

March 19 -

The deal to add ready-made packages of funds to the firm’s asset management arm is expected to close in the first half of the year.

March 19 -

Outperformance has been driven in part by a push among investors to cut their tax bills after new limits were set on state and local deductions.

March 19 -

Evidence-based portfolios have been a bust over the last decade, and they may become a tough sell for the average investor.

March 19 -

The products have already attracted $1.3 billion in new assets this year, more than half what they took in during 2018.

March 15 -

The products invest in private equity, hedge funds and real estate for the bank’s wealth management arm.

March 15 -

The sector has seen an inflow surge in recent months as Treasury yields continue to fall.

March 15 -

It’s not just clients in high-tax states buying up muni bonds.

March 14 -

Alternative asset managers are under pressure to broaden their offerings as institutional investors seek to make big allocations to fewer firms.

March 14