M&A

M&A

-

The firm has parted ways with its CEO Alex Friedman and launched a restructuring plan.

November 26 -

Industry pioneer Mark Hurley is out as Karl Heckenberg becomes the aggregator’s new CEO.

November 20 -

Mariner Wealth's and Mercer Advisors' deals for RIAs totaled over $3 billion in AUM in just two weeks.

November 19 -

Its purchase includes the manager’s mutual fund and ETF businesses.

November 15 -

Bob Oros is a leading candidate to head the RIA, but he, or any other successor, will be under “super pressure” from the firm’s owners.

November 14 -

The advisors retained from shuttering Broker Dealer Financial Services will add more than 80 advisors now able to tap into the buying firm’s offerings.

November 14 -

The New York aggregator’s performance to date “will make it easier for other RIAs to go public,” says industry analyst Chip Roame.

November 13 -

The 4,300-advisor network is investing in insurance distribution after benefiting from rising interest rates and record client assets.

November 7 -

The market can't go up indefinitely, says Facet Wealth CEO Anders Jones, who predicts RIAs looking to fund growth-by-acquisition might find themselves cut off.

November 7 -

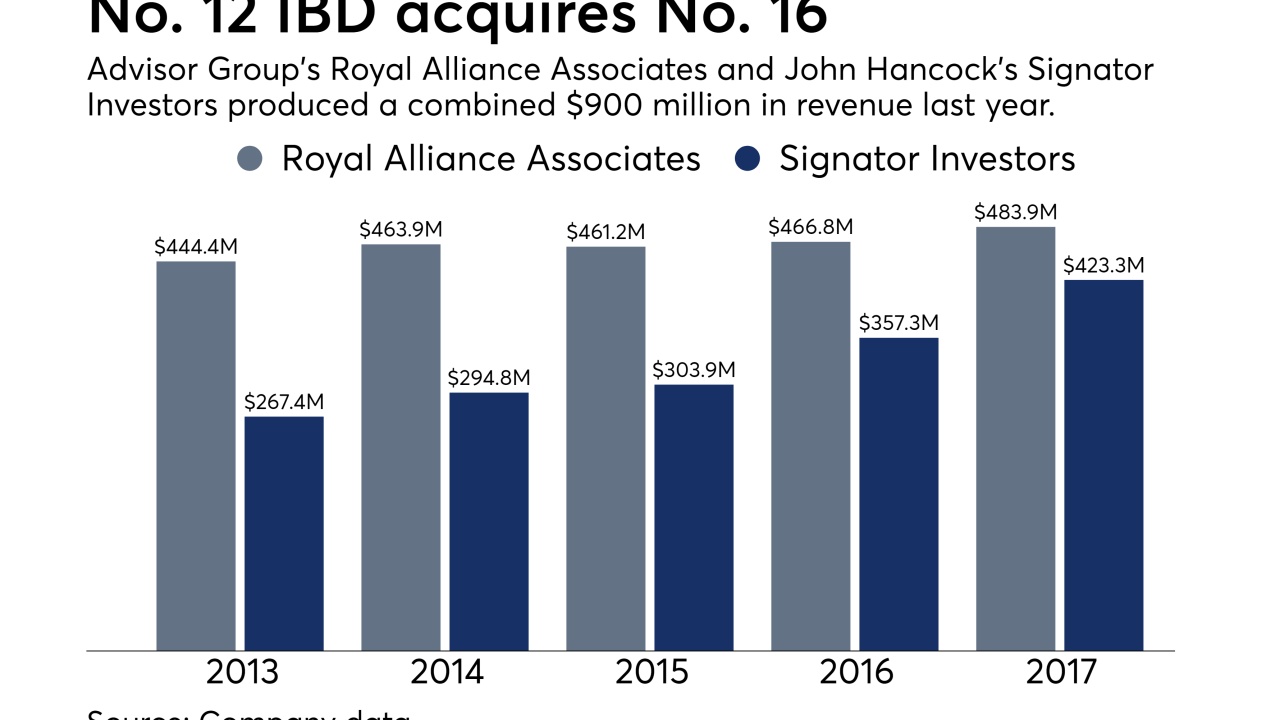

CEO Jamie Price and other executives met with some 1,000 prospective advisors after inking one of the largest M&A deals in the IBD space this year.

November 6 -

A $6 billion RIA deal may signal a reversal of lackluster market activity.

November 5 -

Being a fiduciary isn’t enough anymore, says BlackRock’s Hollie Fagan. At the same time, firms are losing specialized talent to retirement. Here’s the best way for them to stay relevant and profitable.

November 5 -

The insurance-related securities market has grown as pension and hedge funds seek diversified bets less tied to interest rate or stock market swings.

November 1 -

Be prepared for hard decisions and setbacks, say RIA executives.

October 31 -

While firms cater to millennial clients, or solve retirement issues for baby boomers, a large swath of the population is overlooked.

October 30 -

The No. 1 IBD’s major spending on recruiting, technology and organic growth is yielding big returns.

October 30 -

Seven IBDs turn 50 this year. Here's why most of them won't survive another half-century.

October 30 -

The Wealth Enhancement Group has reached $9.7 billion in client assets under a slew of M&A deals and substantial organic growth.

October 23 -

Consolidators and large RIAs were leading buyers in the third quarter.

October 22 -

The deal is the latest consolidation in the industry, which is experiencing pressure on revenues as investors flock to low-fee, passive index and ETFs.

October 18