-

Bill Hamm’s Independent Financial Partners has grown more than fivefold in 10 years with the No. 1 IBD.

April 10 -

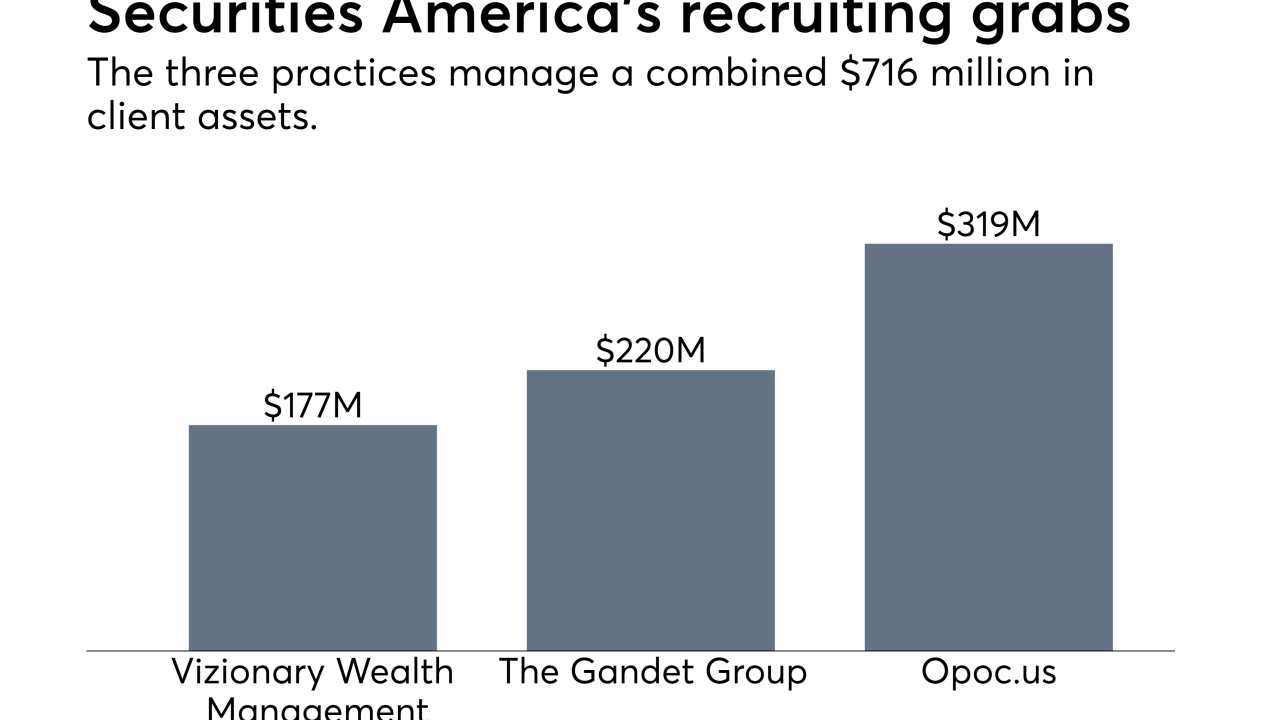

The Advisor Group IBD added three new teams, but state regulators required enhanced oversight of one new recruit.

April 4 -

The deal is only the first step in a major growth plan, according to the acquiring firm’s founder.

March 13 -

The No. 9 IBD has emerged as one of the major players in a tough recruiting fight after the massive acquisition.

March 7 -

An advisor who is a former ballplayer set ambitious goals for 2021 with an alternate take on the hybrid strategy.

February 22 -

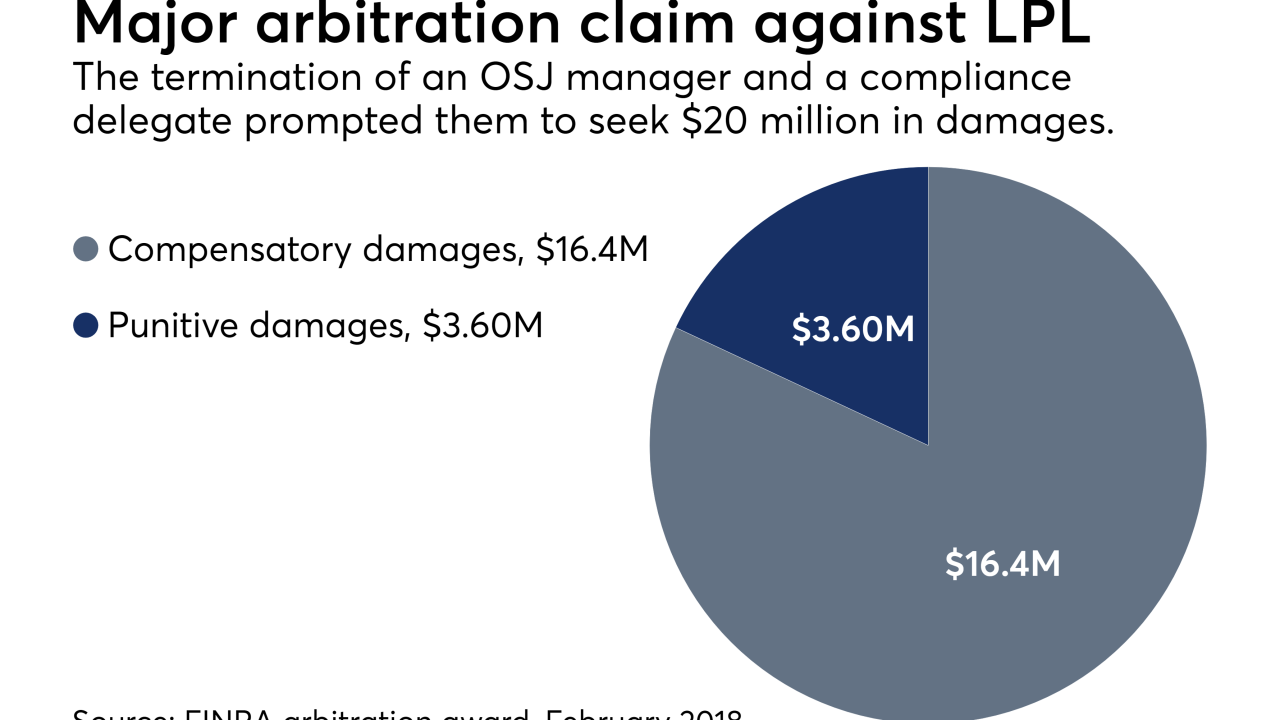

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20 -

The firm is tapping a pool estimated by LPL to be as large as 1,200 brokers with $35 billion in client assets.

February 14 -

Pole-vaulting advisor Mark Cortazzo’s practice marked at least the second hybrid in three months to leave the firm for Mutual Securities.

February 6 -

The practice’s managing director blamed the No. 1 IBD in part for its move to Securities America.

November 13 -

The fourth largest IBD added a super OSJ with $650 million in AUM.

November 7 -

The firm has signed four big recruiting deals in the past three months.

November 6 -

The Arizona-based firm serves as a super OSJ, supporting advisors who work for 13 affiliated credit unions as either employees or independent financial advisors.

October 19 -

Implementation of fiduciary rule could drive more IBDs to seek safe harbor with large partners.

June 22 -

Here's what smaller firms hoping to get out of the broker-dealer business need to know.

June 9 Kovack Securities

Kovack Securities -

Two of its Royal Alliance firms form a $2.5 billion powerhouse.

March 8 -

The nation's largest IBD vows to take a “proactive approach” to the fiduciary rule.

February 9 -

The firm says it "terminated" its relationship with the large OSJ. It’s the third large split in two months.

February 1 -

Regional directors are “sorry to see Doug go," a Cetera adviser says. Tom Taylor, now COO, will take his place.

January 26 -

Too much growth has led to a slowdown in business efficiencies. Smart firms need to fix their operating models.

January 25 -

Casady provides both consistency and a fresh approach, leaders of the firm's OSJs say.

December 5