-

Taxpayers are advised to thoroughly review their tax withholding to ensure there is enough to cover their 2019 bills.

August 13 -

FNG is one of a growing number of actively managed ETFs that have the freedom to tune their exposure whenever they want.

August 2 -

Managers will actively evaluate an asset’s characteristics — its value or momentum, for example — to determine what to buy.

August 1 -

The revamped fund from BP Capital will now track an index of companies that derive “significant revenue” from sustainable energy.

July 30 -

The IBD network joins asset managers and other companies developing new methods to display how the products integrate into client portfolios.

July 26 -

A team of Bank of America specialists help the superrich diversify with farms, ranches and other alternative investments.

June 17 -

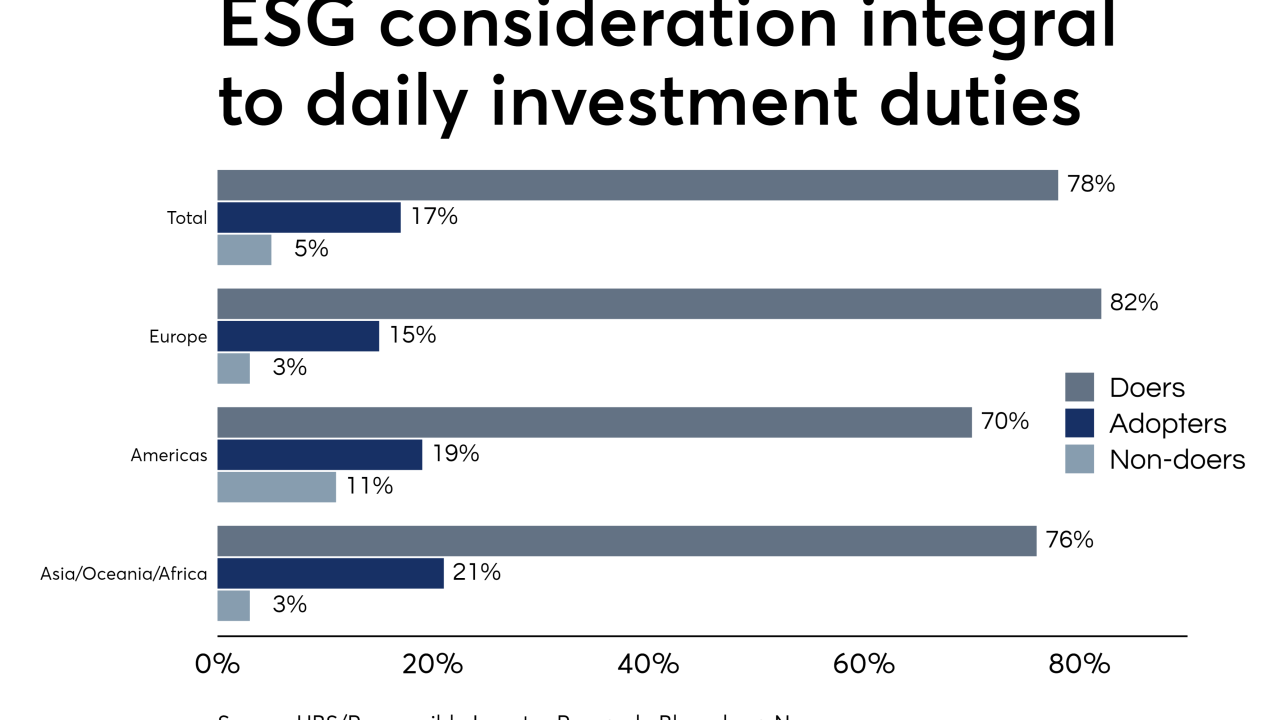

The “materiality of risks with not considering" the strategy is the primary consideration for its implementation, a UBS survey finds.

June 17 -

The firm hopes to follow advisors' lead on what's best for their business in its outsourced advisory models, says CIO Burt White.

June 12 -

The longer the investing view one has, the easier it is to measure the effect of rebalancing on a portfolio, and to see if it adds value over time.

May 30 -

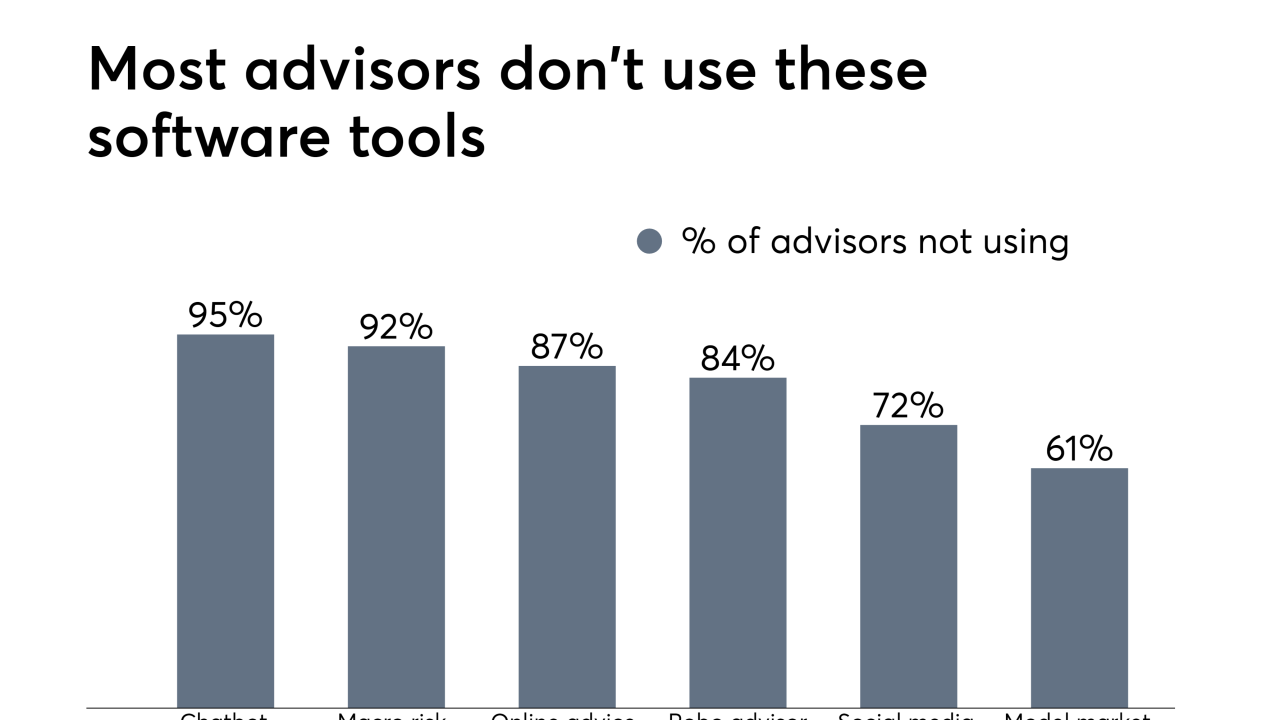

Technology has created efficiencies for RIAs. It’s also a danger, says the firm’s COO.

May 22 -

They’re taking the asset management on themselves in a larger push toward disintermediation, says the firm’s global head of software products.

May 10 -

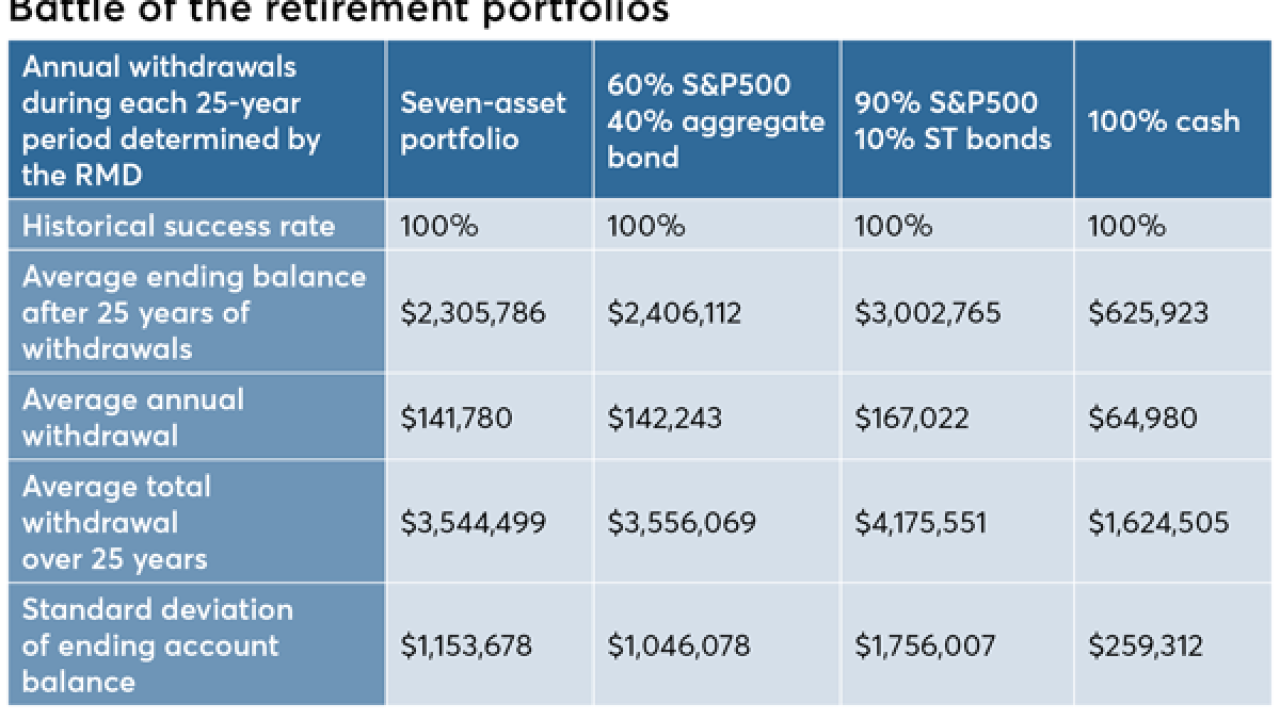

I would rather have my clients come back to me saying they had too much money in retirement than telling me they are running out.

May 8 Wealth Logic

Wealth Logic -

Advisors have a dizzying number of ways to answer. Over a five-year period. Over 30 years. Compared to a certain sample portfolio. Which should you choose?

May 3 -

Still, some products with higher yields also have higher Sharpe ratios. Could that indicate better risk-adjusted performance?

April 15 -

Procure Holdings’ intergalactic foray is part of a broader industrywide push into so-called thematic funds.

April 12 -

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3 -

By scrapping the $100,000 requirement, the asset allocation tool becomes accessible to all of the firm's clients.

March 29 -

It’s crucial to know how much of a drawdown an investor can tolerate before panic sets in.

March 25 -

Evidence-based portfolios have been a bust over the last decade, and they may become a tough sell for the average investor.

March 19 -

Heavily weighting any single stock has the potential to make a portfolio more volatile.

March 15