Regulation and compliance

Regulation and compliance

-

But the regulator also ordered record payouts in 2020, including restitution through a self-reporting program that drew industry ire.

November 5 -

Regardless of who wins the White House, the scope for tax legislation in the near term will be limited.

November 5 -

The uncertainty could lead to market volatility, delayed stimulus negotiations and complicate planning for a potentially new regulatory environment.

November 4 -

What different outcomes could mean for financial planners and their clients.

November 4 -

The rule has faced a host of criticism from investors, environmentalists, asset managers and others.

November 3 -

Unclear — or no — disclosures were among a number of concerns regulatory officials expressed about initial examinations.

October 29 -

CEO Jamie Price says the change will reduce potential conflicts of interest related to transaction fees and come with lower prices in wrap accounts.

October 29 -

The legislation would encourage saving earlier by enrolling employees automatically in their company’s 401(k) plan, whenever a new plan is created.

October 29 -

In the first episode of the five-part documentary series, we look at how disparities in net worth and mortgage discrimination impact Black home ownership — and why it's impossible to close the gaps without attacking systemic racism.

October 26 -

Although in-person hearings aren’t banned outright, none have taken place since the onset of the coronavirus pandemic.

October 23 -

The former J.W. Cole advisor’s practice allegedly sold more than $40 million worth of unsuitable and unregistered promissory notes.

October 22 -

More than 130 fund management and financial advisory firms have written letters opposing the plan. And the complaints keep coming.

October 21 -

A recent study suggests sales of "expensive" VAs fell as a result of the vacated rule. But there are other factors at play, writes Raymond James' Scott Stolz.

October 16 -

The firm determined that the staffers defrauded the SBA “by making false representations in applying for coronavirus relief funds for themselves.”

October 15 -

At the center is a pledge not to increase rates on those making less than $400,000, and that various changes would only impact earnings above the threshold.

October 14 -

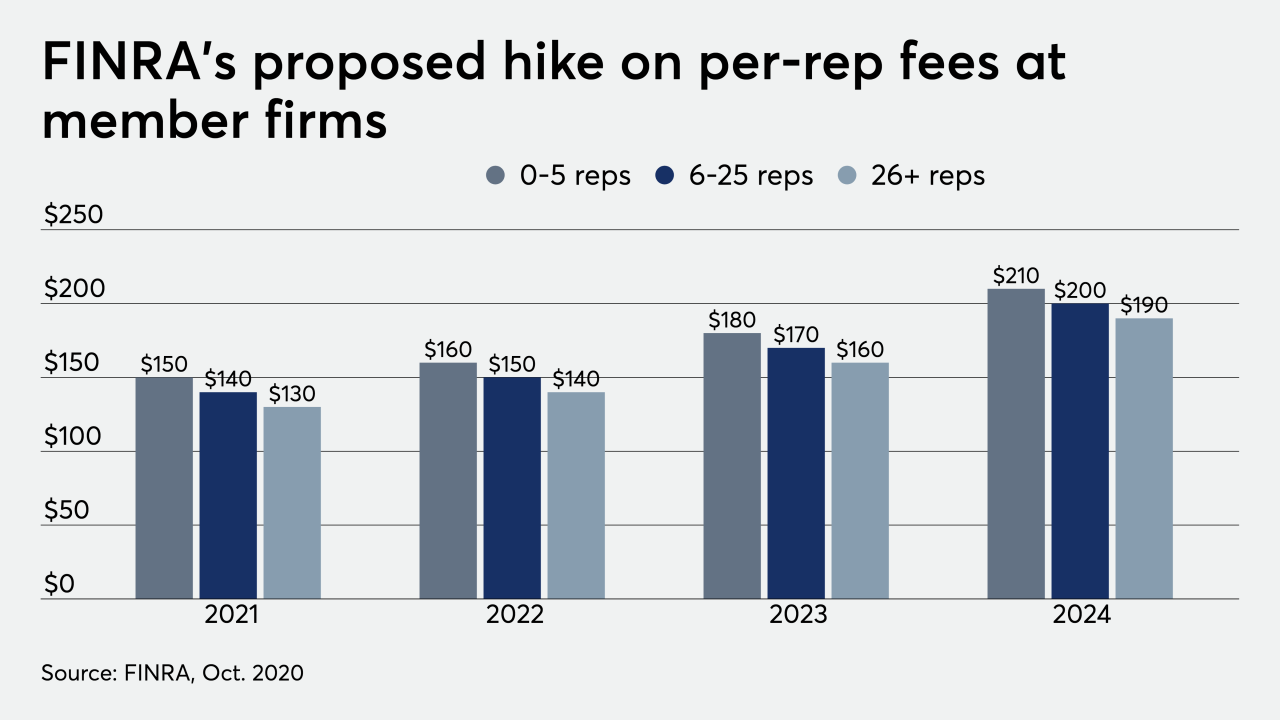

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

The regulator found that the financial services company failed to take precautions in disposing of hardware that contained sensitive customer information.

October 8 -

Insiders see a Democratic administration backing tightened investor protections as industry advocates look to tax legislation.

October 8 -

The agency began digging into the massive tax law addressing issues that needed immediate clarification.

October 8 -

The advisor allegedly carried out a 20-year scheme defrauding at least 15 clients through forgery and misrepresentations.

October 7