Regulation and compliance

Regulation and compliance

-

Regulatory relief applies to advisors and investment funds but the commission stresses that fiduciary obligations still apply.

March 19 -

Wealth management firms should track the lives they impact beyond the size of their client books, KMS Financial Services CEO Erinn Ford says in an episode of Financial Planning’s Podcast.

March 17 -

Some attorneys say it's welcome relief, but how long will it take to get new hearing dates?

March 17 -

After resigning last year under pressure from federal policymakers, the former executive received no severance benefits or annual incentive award.

March 17 -

Convenience accounts, power of attorney, trusts: The benefits and drawbacks are legion. Here's a guide.

March 13 -

Senior officials are growing wary of how firms are trying to recoup revenue amid the "race to zero" commissions.

March 12 -

The bank says it has decided to “effectively eliminate the net leverage” of its MLP Income Opportunities Fund and MLP and Energy Renaissance Fund.

March 10 -

The regulator is giving firms more flexibility in supervising employees working remotely and in relocating personnel to temporary locations.

March 10 -

Guidance on new advice rules coming this month as OCIE and enforcement divisions struggle to expand oversight with limited resources.

March 9 -

Restoring fee-model disclosures to its website is just the first step in correcting the organization’s “monumental failure,” according to fiduciary watchdog Ron Rhoades.

March 9 -

The decision does not diminish the board's conviction that consumers have a right to know how they are paying for products and services, writes the former board chairwoman.

March 6 -

"If rules are too broad or vague, we may end up circumscribing conduct that we never intended to capture,” Commissioner Allison Herren Lee said.

March 6 -

“The only reason why I could see them doing that is shame,” one critic says of the move; the board calls it an important shift in the conversation about fiduciary care.

March 5 -

In an hour-long session, justices considered the agency's use of “disgorgement” to collect money from someone the commission sues in federal court.

March 4 -

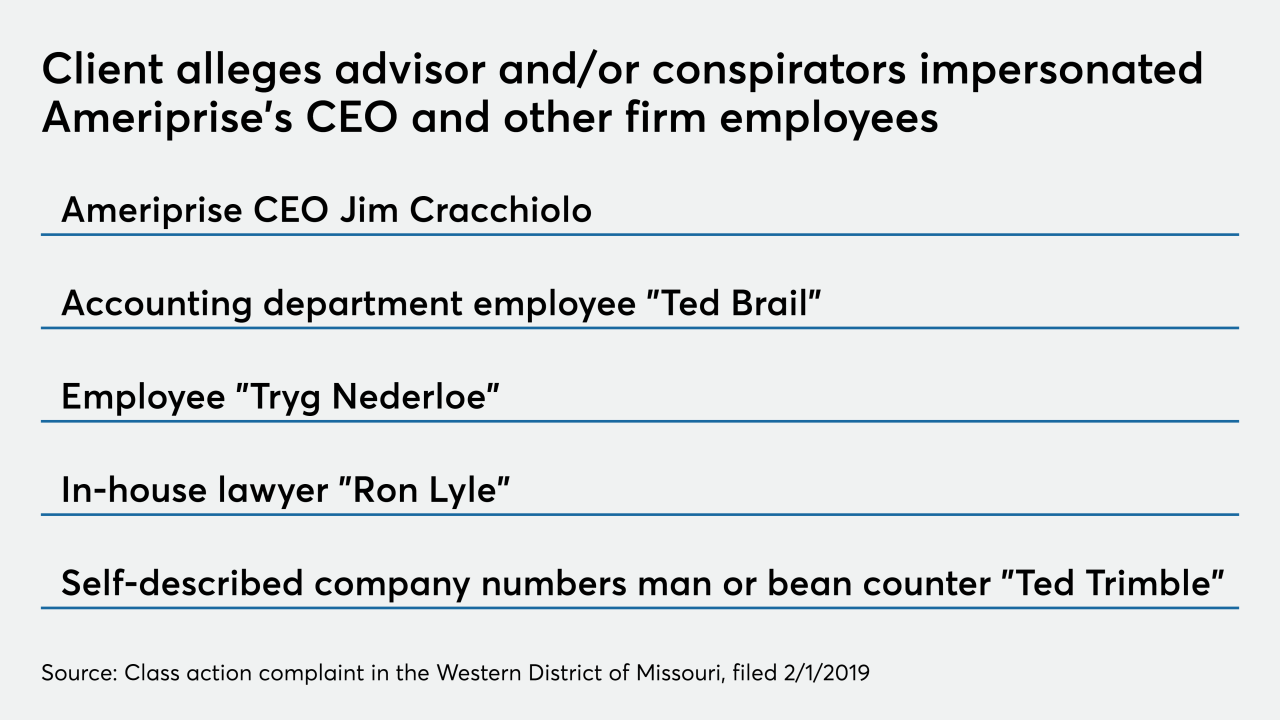

Five years of alleged promises, checks that never arrived, and a mysterious employee named “Tryg Nederloe” add up to a bizarre saga with wide ramifications.

March 2 -

A Supreme Court ruling could eviscerate one of the agency’s most potent weapons.

March 2 -

That would be a big “no,” in most cases, according to FINRA, but gives rise to another question…

February 28 -

The bank failed to implement its own supervisory procedures around single-inverse ETFs, costing clients millions, the SEC says.

February 27 -

The major custodian lost its second arbitration case — with even more filings likely — over the services it provided to a brokerage later proved to be engaged in massive fraud.

February 27 -

Two years after the tax law eliminated write-offs for investment costs and advice, lawyers say they have found a loophole hidden in years-old IRS case law.

February 24