-

Asset managers are increasingly using the products for targeted adjustments and risk management, a survey finds.

February 27 -

A record number of fund openings and closures were reported last year. What does this mean for the future of the industry?

January 4 -

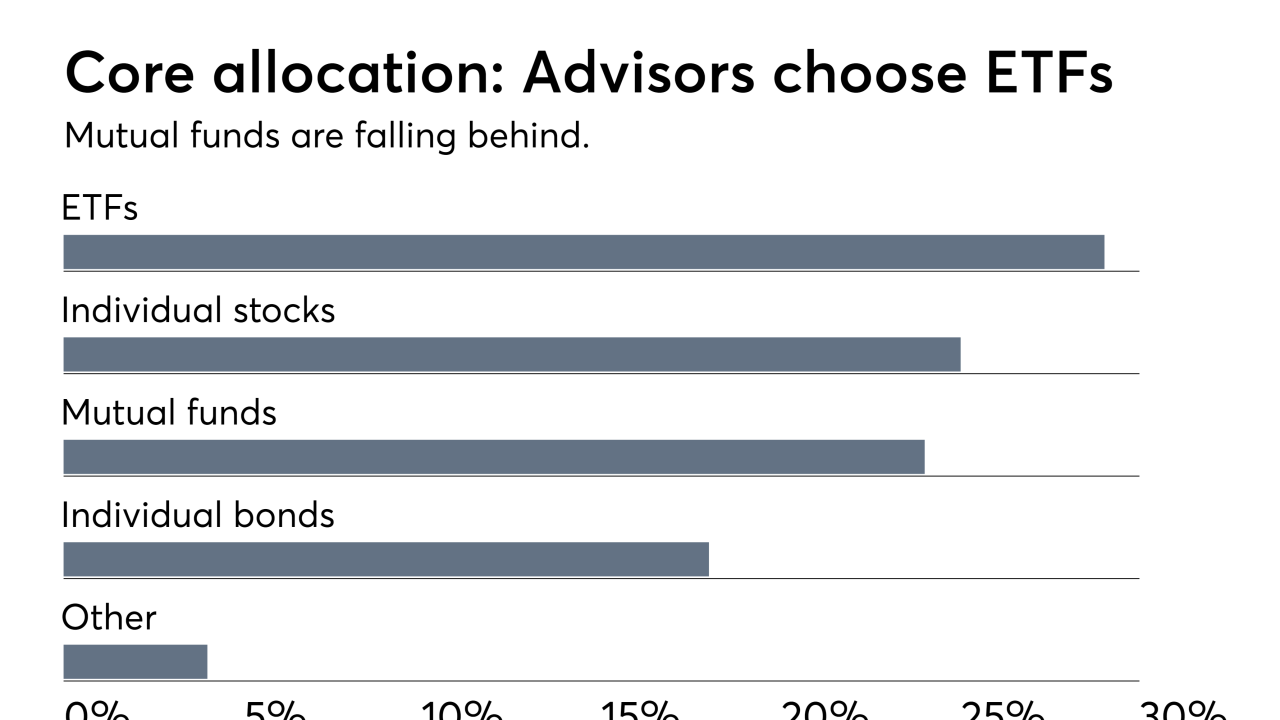

Advisors are planning to increase ETFs as a primary option, the firm finds. Plus, “the most exciting numbers in the survey.”

October 31 -

More than half of advisors would consider buying a smart beta muni bond ETF for clients, according to a Columbia Threadneedle poll.

September 6 -

In light of recent losses, risk models will tell managers to cut their exposure to the factor, which could cause a systematic sell-off.

June 26 -

The planned closures come just months after the firm introduced a lineup of artificial intelligence-driven products.

June 19 -

The once-hot investing strategy seems to have cooled off. Advisor Allan Roth hasn't lost all hope, however.

June 12 Wealth Logic

Wealth Logic -

The investment research firm debuted three new data sets that can help advisors evaluate investment options for clients.

June 11 Wealth Logic

Wealth Logic -

Outliers aside, fundamental indexing is still more expensive than old fashioned capitalization-weighted indexing.

June 11 -

One thing that excites Dana D’Auria about the industry right now is factor investing, which helped draw her to Symmetry Partners 12 years ago.

May 17 -

The strategy has been one way asset managers have pared losses after 10-year Treasury yields reached 3%.

April 26 -

A new tool from the firm allows clients to analyze 2,400 equity-mutual funds and ETFs through the lens of factors.

April 26 -

Known for his “safe and cheap” investing mantra, he distinguished his style from that of Benjamin Graham and David Dodd, the fathers of value investing.

April 18 -

The new fund tracks the S&P 500 Dividend Aristocrats Index.

April 17 -

While investors have been won over by the promise of better returns than plain-vanilla funds, issuers can justify charging more for the additional complexity.

March 1 -

Investing in certain uptrends may pay off for clients.

February 28 -

Both long and short investments focused on volatility were mostly crushed lately.

February 14 -

Dec. 18: The proposed active offerings are set to debut in February.

December 15 -

With plans to offer six new funds, the passive investing giant is seeing strategic beta as an opportunity, not a threat, says one contributor.

December 8 Wealth Logic

Wealth Logic -

The $284 billion asset manager aims to track municipal bond prices in its mutual funds with the service.

December 5