Washington – Chalk up another win for ETFs. Advisors say exchange traded funds make up the largest portion of their clients’ core holdings.

What’s more, 69% of advisors surveyed by Charles Schwab Investment Management say they’ll increase their clients’ core allocation to ETFs in the next five years.

“ETFs are here to stay,” Anthony Davidow, vice president at the Schwab Center for Financial Research, said at a press briefing at Schwab’s annual Impact conference. “They are the single greatest innovation in financial instruments and they have democratized the financial markets.”

Tax efficiency, built-in diversification and liquidity were primary reasons for the increasing popularity of ETFs, according to Jonathan de St. Paer, president of Charles Schwab Investment Management.

Slightly more than half of advisors surveyed said ETFs are already the primary investment vehicle in client portfolios. Even more (64%) say they plan to make ETFs their go-to investment option in the future.

Mutual funds appear to be declining in popularity.

Among advisors surveyed by Schwab, 41% said mutual funds were the primary investment vehicle in client portfolios today and only 30% said they would be in the future.

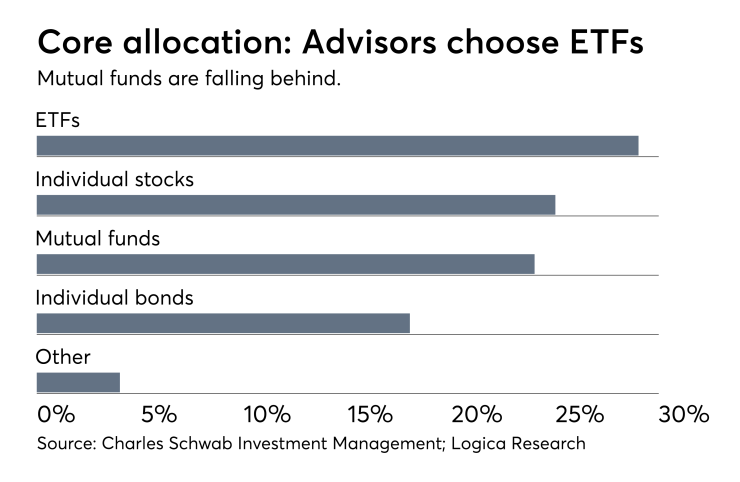

Advisors told Schwab ETFs made up 29% of their core product allocation, followed by individual stocks (25%), mutual funds (24%) and individual bonds (18%).

On average, advisors said 62% of clients’ holdings should be allocated to core investments, defined as broad large, mid- and small-cap equities, international equities and corporate and treasury bonds.

Omar Aguilar, Schwab Investment Strategies CIO for equities and multi-asset strategies, noted that core holdings change with the size of a clients’ wealth and the market environment.

“In a bull market, there’s more room for non-core allocation,” Aguilar said, “but when there’s more risk clients go back to core holdings.”

The survey also found that 60% of surveyed advisors said they are investing in smart beta strategies, primarily in growth, quality, value and fundamental investments.

Nearly three-quarters of those advisors said they will increase client investments in smart beta strategies next year.

Davidow called the smart beta findings “the most exciting numbers in the survey.”

Smart beta has advanced beyond “do they work to how they work,” he said.