Advisors have bigger problems on their hands at the end of this year than the client or friend who cornered them to ask if they should get into cryptocurrency in 2017.

In the broad scheme of things, avoiding a global recession fueled by overheated equity values and

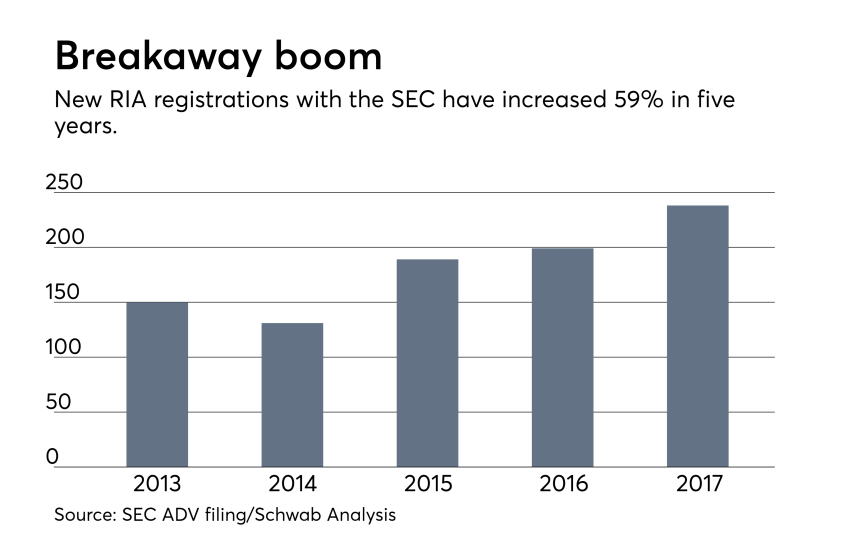

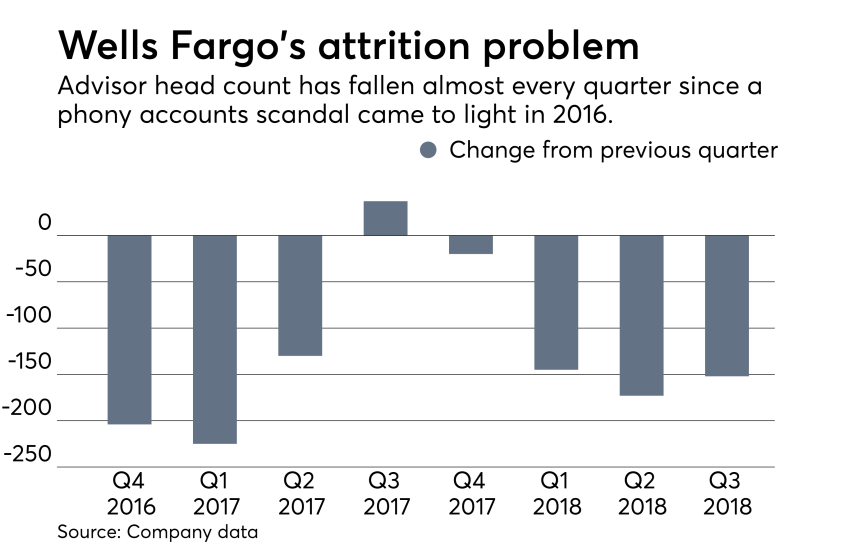

On top of the day-to-day economic headlines, advisors will be watching to see which firms are embracing the independent movement — and which ones are suing them to try to hold on to their books. With tens of thousands of advisors switching firms each year, it’s no small matter.

This recruiting movement takes center stage in an industry where the balance of power continues to shift away from brokerage firms and toward advisors. The quandaries of hybrid RIAs and the Broker Protocol, to name two examples, display how independence threatens firms’ business models.

Likewise, millions of clients' relationships with their advisors may or may not change under the SEC’s Regulation Best Interest proposal, which is expected

Democrats set to take charge of the House of Representatives will command clients’ attention, though, as the industry grapples with the implications of a divided Congress. The consensus view holds that there will be partisan gridlock — but President Trump’s time in office has been nothing if not surprising.

One thing is for sure: This ever-evolving industry will not stay the same in 2019. Scroll through our slideshow below for what trends could shape wealth management.