Independent broker-dealers backed by private equity capital continue to be major players in the turbocharged M&A market.

Woodbury Financial Services will acquire Capital One Investing’s $10 billion in-branch, full-service investment management and brokerage division, the firms announced on April 10. Woodbury and Capital One did not disclose the terms of the deal, which is expected to close in the second or early third quarter.

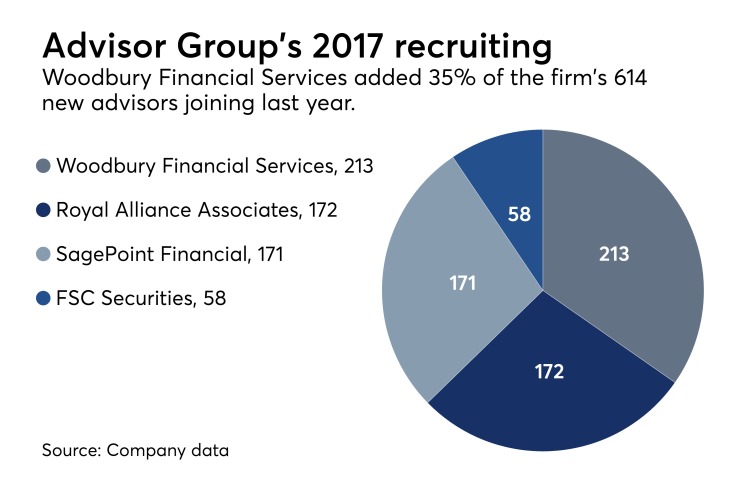

Woodbury, a subsidiary IBD of Advisor Group, which is partly owned by private equity firm Lightyear Capital, will add 51 producing registered reps to its roster of 1,200 affiliated advisors under the deal. Capital One reported brokerage revenue of $56,164,000 and investment banking/management income of $67,557,000 in 2017, according to Michael White Associates, a banking industry consultant.

In January, E-Trade

"This deal underscores the importance of private equity firms providing liquidity for firms to grow through acquisitions," says Carolyn Armitage, managing director at Echelon Partners, a California-based M&A advisory firm."IBDs are breathing a sigh of relief after the current DOL ruling and have turned their sights to bolstering their growth plans. We have seen a dramatic increase in the number of IBD firms seeking strategic partners."

Brooks Hamner, vice president at Mercer Capital, agrees.

"This deal is further evidence of PE’s interest in the IBD and RIA space for its recurring revenue and scalable business model," Hamner says. "I would not be surprised to see more deals like this one as an aging investment management industry looks to PE as a viable exit opportunity in a relatively favorable market environment.”

-

"We've been waiting for the finicky sellers and now they're here," says Echelon Partners CEO Dan Seivert.

March 7 -

The nation’s largest IBD paid $325 million, but it may spend as much as $508 million in the deal.

August 15 -

The buyer of the broker-dealer to some 1,200 hybrid advisors is not a private equity firm.

December 5

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

Recent M&A deals in the IBD space include LPL Financial's

Oakdale, Minnesota-based Woodbury added 213 new advisors with $5 billion in client assets under administration, boosting its total AUA to $39 billion. The Capital One deal represents the IBD's first foray into the bank channel.

“Woodbury is focused on holistic financial planning and is committed to helping advisors and their clients thrive in this fiduciary era,” CEO Rick Fergesen said in a statement. “We look forward to working with Capital One to ensure a smooth transition for advisors and their clients.”

In addition to Woodbury, the other three broker-dealers in Advisor Group's network are Royal Alliance Associates, FSC Securities and SagePoint Financial. The IBD network disclosed $1.3 billion in 2016 revenue from 4,809 producing representatives, according to Financial Planning’s