-

Restoring fee-model disclosures to its website is just the first step in correcting the organization’s “monumental failure,” according to fiduciary watchdog Ron Rhoades.

March 9

-

The decision does not diminish the board's conviction that consumers have a right to know how they are paying for products and services, writes the former board chairwoman.

March 6

-

“The only reason why I could see them doing that is shame,” one critic says of the move; the board calls it an important shift in the conversation about fiduciary care.

March 5 -

The commission “failed to enact a meaningful conduct rule,” state regulator William Galvin says.

February 21 -

Trade groups warn that a proposal could end commissions in the state and play into a "fractured" regulatory environment nationwide.

January 15 -

SEC-mandated disclosures for dual registrants could put clients off brokerage options, some suggest.

January 8 -

Contributing to these accounts makes sense for clients who anticipate higher tax rates in the future.

December 30 -

While these 20 dizzying changes will throw some for a loop, financial advisors and their clients grow more powerful each year.

December 18 -

Businesses, particularly small ones, are looking for help to limit liability when sponsoring defined contribution plans.

October 25 -

“We all agree a conflict could arise in the future,” Schweiss says. “There are ways of potentially dealing with that.”

October 22 -

The advisor advocate’s’ term, to begin in 2021, also will focus on increasing FPA membership.

October 17 -

More than 11,000 advisors have earned the education provider’s AIF designation.

October 10 -

Who guards the guardians? Regulators, yes, but as CFPs we must also police ourselves

October 10 Mercer Advisors

Mercer Advisors -

CFPs aren’t excused from acting as fiduciaries — even if they work at a firm that requires them to recommend proprietary funds.

October 7 -

In five bite-sized offerings, Chairman Jay Clayton fails to tell the public what it needs to know about RIAs vs. brokers.

October 4 Life Planning Partners

Life Planning Partners -

A task force will issue recommendations to shore up the disciplinary process ahead of the board's November meeting. Here’s what advisors need to know.

September 19 -

The regulator’s move follows a Financial Planning investigation into whistleblowing by former JPMorgan financial advisor Johnny Burris.

September 16 -

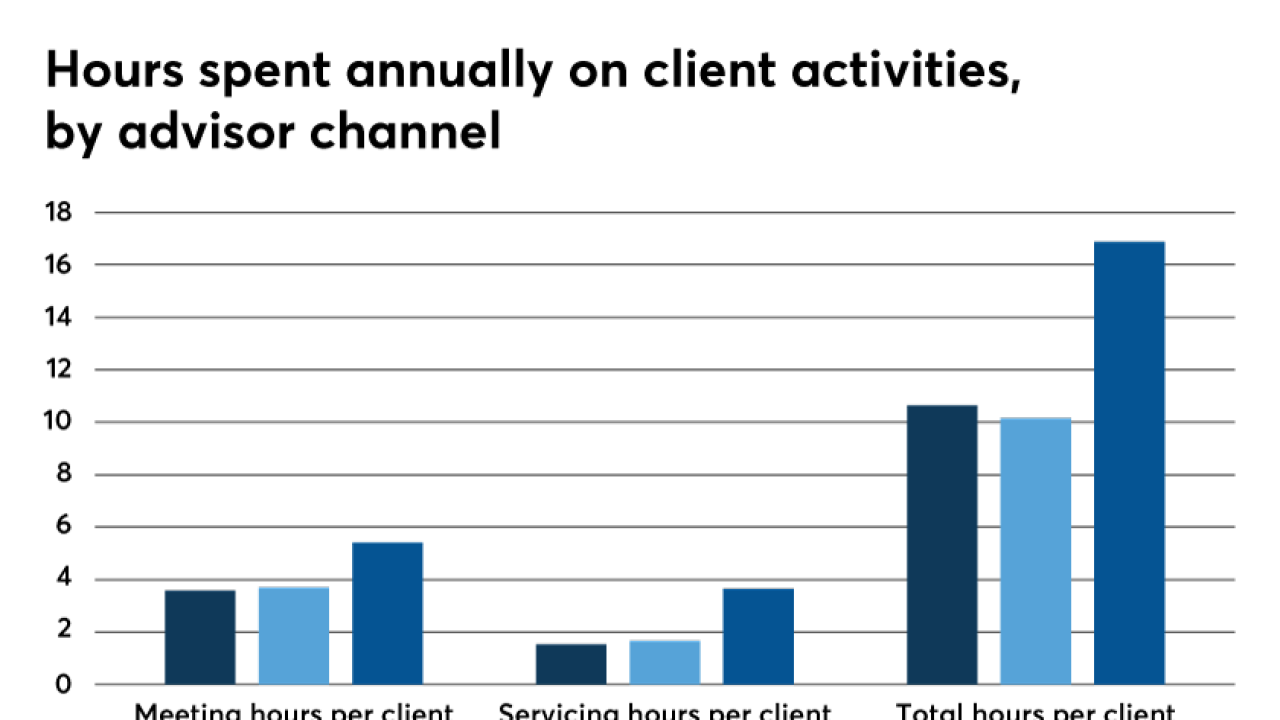

Alternative compensation structures may provide more consumer protection, and drive higher client satisfaction.

September 16 -

The rule unfairly gives brokers a leg up in the marketplace, harming the network’s 1,000 independent advisors, the firm claims.

September 10 -

Elias Herbert Hafen, “every client’s worst nightmare,” could face years in jail. The wirehouse says it is repaying clients.

September 9