-

Fixed-income represented a surprising bright spot in 2025, despite the warnings of "bond vigilantes" and inflation pressure. Here's the outlook for 2026.

December 30 -

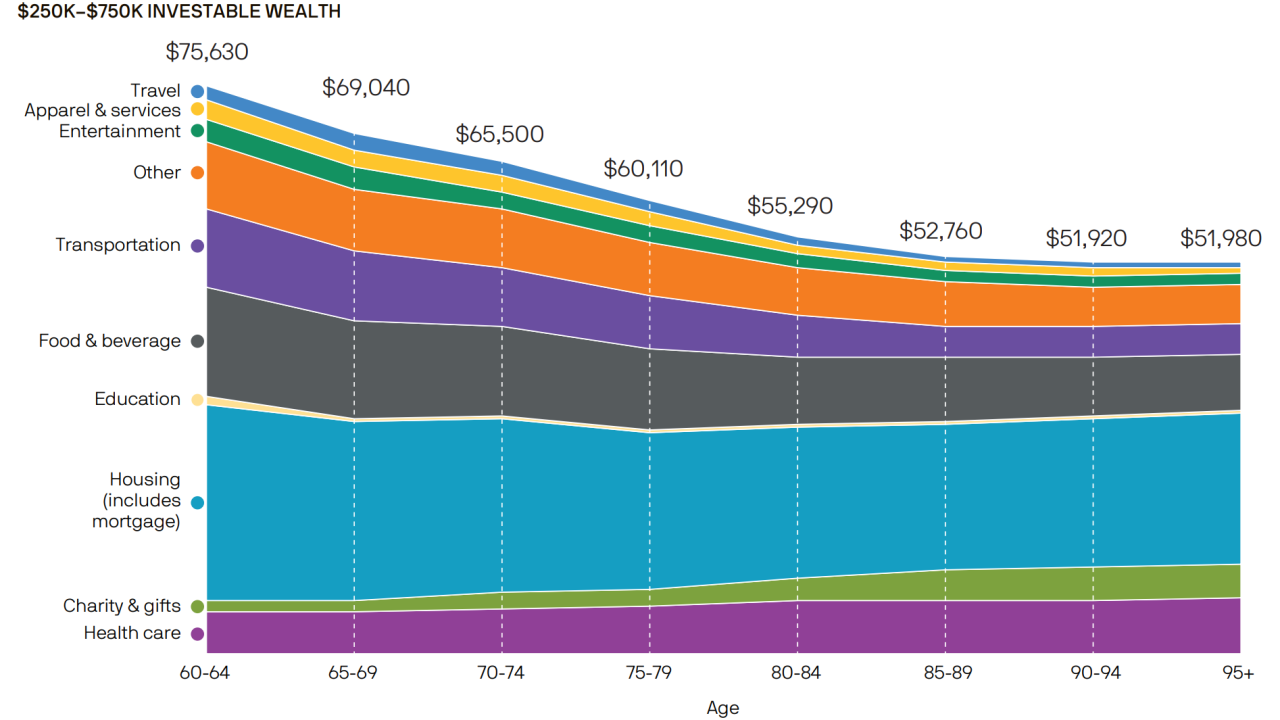

Popular retirement withdrawal strategies like the 4% rule assume a steady rate of spending for retirees. But new research from J.P. Morgan shows that premise is often disconnected from reality.

December 29 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

Even as markets sometimes touched all-time highs, there was a general feeling of uncertainty among advisors and clients. Experts say that's why several tried-and-true strategies became more attractive this year.

December 23 -

The recent fall in the price of bitcoin and other cryptocurrencies is likely to blame, experts say, but don't expect that decrease to continue forever.

December 19 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

FINRA identifies new ways firms and investors are using technology like AI to spot changes in market sentiment and asks the industry to chime in on how finfluencers and others are using social media.

December 17 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

An industry lawyer warns that RIAs often don't do enough to delineate their responsibilities and shield themselves from liability when they add tax preparation to their service offerings.

December 16 -

From crypto to private markets to AI and beyond, here are the investing trends and themes to watch in the new year.

December 16 -

An increasingly popular form of lending enables financial advisors and their clients to offset capital gains and find other tax savings.

December 15 -

President Donald Trump is reportedly considering moving cannabis from a Schedule I to Schedule III substance. Experts say this could go a long way toward establishing the industry's legitimacy.

December 15 -

The One Big Beautiful Bill Act makes the opportunity zone program permanent and also introduces some changes in the real estate investor tax breaks.

December 15 -

Steve Lockshin and Michael Kitces tied what they view as some mistaken assumptions around fees to the competitive need for more estate planning services.

December 11 -

A new report from Cerulli notes big differentiating factors for firms that specialize in working with clients with $20 million or more to invest.

December 10 -

Rethink bonds and hedged funds while prepping clients for a market correction — or worse — in the coming year, counsels the CEO of Toews Asset Management.

December 10 Toews Asset Management

Toews Asset Management -

Morningstar's study of this growing area of asset management suggests that 529 plan quality is rising, despite the research firm's lackluster grades for it.

December 8 -

CEO Mark Mirsberger said turnover is practically nonexistent at his firm, which goes to great lengths to accommodate its employees and hires people who value teamwork.

December 8 -

Our latest ranking of money managers' workplaces in conjunction with Best Companies Group produces a return champion and some new additions.

December 8 -

Prediction markets like Kalshi and Polymarket, growing in popularity, allow users to essentially bet on nearly everything. If your clients have questions, here's what experts say you should tell them.

December 5