-

Major repairs are needed to ensure Social Security’s long-term stability, according to an expert.

November 12 -

Clients with children are advised to start saving early in a 529 plan to take advantage of the “tax-free or tax-deferred growth.”

November 12 -

The full balance won't belong to them until they are fully vested in their plans — especially if they're receiving an employer match.

November 8 -

The products provide advantages that “help women build savings faster: tax deferral and generally higher rates than CDs or Treasurys,” an expert says.

November 7 -

The IBD network's AdvicePay integration could help the firm convert more retirement plan business into wealth management clients as it completes a record year for new assets.

November 7 -

Researchers blame the immaturity of the system and poor choices made by those planning to retire.

November 6 -

Certain financial moves could push their income above a certain threshold, potentially triggering an income-related monthly adjustment.

November 4 -

Raising the assumed age for decumulation to 67 from 65 could dramatically reduce the percentage of families at risk, an expert says.

October 31 -

Retirees who have no need for the RMD can fund their grandchildren's college costs, a CFP writes.

October 30 -

Although the elderly often lose the most from scams, younger clients are more likely to fall victim, according to a report.

October 29 -

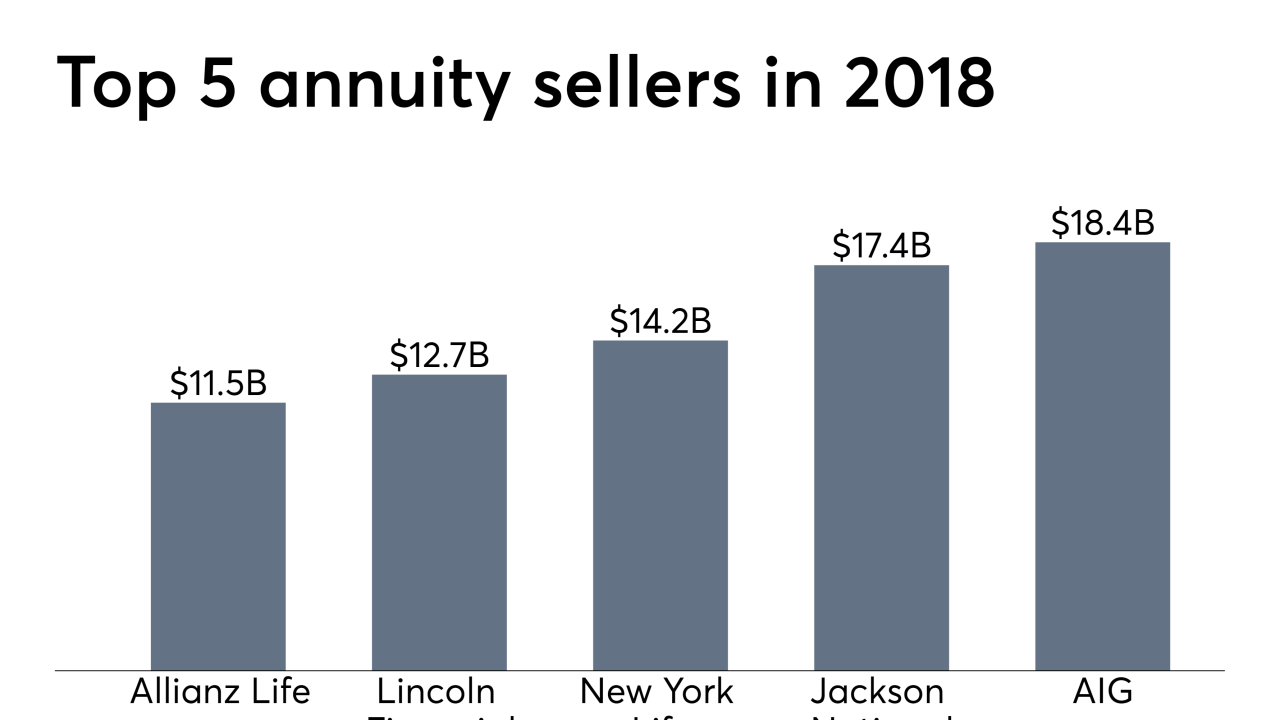

While many workers don’t have access to pension plans, annuities can provide a source of guaranteed retirement income and address longevity risks.

October 28 -

Without a rollover, they can experience “untold impact to their plan for securing retirement," an expert says.

October 25 -

Businesses, particularly small ones, are looking for help to limit liability when sponsoring defined contribution plans.

October 25 -

These employers offer plans that pay as much as $6.52 per hour in contributions.

October 23 -

Around 40% blame their lack of preparation on housing costs, according to a report from TD Ameritrade.

October 23 -

Those planning to head back to the workforce are advised to set boundaries at their new jobs and continue doing the things they enjoy in retirement.

October 22 -

High-deductible plans open the door to tax breaks for high-income investors, an expert says.

October 22 -

“Building and adhering to a budget that accounts for these types of expenses will create long-term security in retirement,” a CFP says.

October 21 -

The RobustWealth and Wells Fargo acquisitions are boosting the firm’s technology and scale as firms of its type diverge on their approach to a changing industry.

October 21 -

When searching for the right plan, it is important that retirees assume their health will one day change.

October 18