When robo advisors began disrupting wealth management, Principal Financial Group “didn’t jump, we paused,” according to Jerry Patterson, senior vice president for retirement and income solutions. The firm then opted for a strategic partnership with a startup called RobustWealth.

Fast forward a few years into their time working together. Principal now has “a team of paddle-boarding, biking software engineers, super smart people over on the Delaware River in Lambertville, New Jersey, knocking walls down in the old spoke factory,” Patterson says.

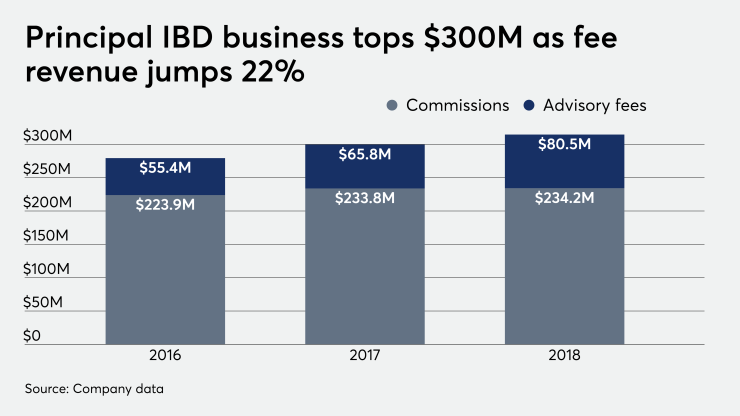

The insurer and fund company is ramping up its 401(k) and wealth management even as other insurance firms exit. Besides

With technology and regulatory costs

In addition to Principal, the group includes MassMutual, Northwestern Mutual, AXA Advisors, Lincoln Financial Group, Voya Financial Advisors and Securian Financial. Principal Securities also represents one of the early BDs that

The Des Moines, Iowa-based firm’s other related business in asset management also makes its stand out from other firms at a time when financial services firms are trying to offer everything on one platform. Last month, Vanguard announced plans for

While other firms have failed to blend existing businesses with newly acquired firms or struggled to articulate how they will sustain themselves in a digital-first market, Principal and RobustWealth say their marriage has proven to be mutually beneficial.

Principal recently launched its third generation online onboarding tool for 401(k) participants, and the BD completed a custodial switch to Fidelity Clearing & Custody Solutions’ National Financial Services from Pershing in 2017. RobustWealth is also expanding as its subsidiary.

“We know people we serve want advice, they want it to be easy and they want it to emanate through technology,” says Patterson. “We also know that advisors need technology to bring scale to their own businesses as they deliver advice.”

RobustWealth’s footprint spans 108 employees in six offices, including outposts at Principal’s headquarters, Denver and India, up from about 40 at the time of the deal, says CEO Mike Kerins. The firm plans to hire 30 or 40 more staff members by the end of the year.

Some 1,600 client accounts use RobustWealth’s digital planning software under white-labeled tools leveraged by 90 advisors. Principal is also deploying the software for direct retail clients on a digital-only or hybrid-advice basis and in its 401(k) plans, Patterson notes.

The RobustWealth platform developed under the team led by Kerins, who launched the firm after serving as head of asset class research at Franklin Templeton Investments. It remains open architecture, but with Principal integrations “where advisors see them as a fit,” he says.

“We've spent the last year very focused on product building rather than sales,” Kerins says. “We enable them to focus their time on the important things.”

Most RobustWealth employees and new hires are engineers, but the growth is also extending to its product, sales, marketing, trading and investment teams. The new parent’s retirement plan business doubled in size to 7.5 million clients under its Wells Fargo deal, Bloomberg

Principal opted for its tech over that of Wells Fargo for employer plans in migrating an influx of nearly $830 billion in assets under administration across 401(k) participants, pensions, executive deferred compensation and institutional trusts and custody, Patterson notes.

Wells Fargo also brought “people resources and expertise and knowledge” to the integration, he says. And the new 401(k) onboarding app has helped 50% its users either start at 10% of their salaries or escalate to the level, which “shatters anything we've ever created,” Patterson says.

“We keep engineering and re-engineering every button, every click, every color in all the tools we use to increase the chance we're going to get people to take positive action,” he says.

Principal has altered its business multiple times over its 140-year history, even as Patterson notes it has reached more than 80 countries over the past two decades with its traditional asset management, employee benefits, annuities and insurance services.

It dropped earlier businesses focused on health and property casualty insurance and residential mortgages along the way, though. The custodial change after 20 years with Pershing also came as Principal prepared for implementation of the now-vacated Department of Labor fiduciary rule.

In addition to adopting Fidelity as its custodian and clearing firm, Principal moved to Envestnet MoneyGuide as its main planning platform, Patterson notes. The firm was just “preparing for a world where scale matters, efficiency matters,” he says.

“If we would have said, ‘Hey, what are the 10 things we could do to rock our advisors’ worlds, we had all 10 of them and each one of them had a different slope,” Patterson says. “But they would have never been as equipped as they are today.”

The fiduciary rule made a lot of positive changes, he adds. “It forced us to address gaps in technology and capabilities that probably would have just happened separate and apart from each other.”