At a meeting of 150 business professionals attended by the head of retirement plan solutions for Cetera Financial Group, just two of the six-figure employees said they had ever had their 401(k) advisor reach out to them. The next question: Did they have financial advisors?

“It was the same two people,” says Jon Anderson. “They're saving a significant amount of money, yet they don't really know whether they have a plan on track for a retirement meeting their goals. They have no idea.”

Cetera is embracing 401(k)s in a time of rapid changes at the network, but the concept of converting 401(k) participants into full wealth management clients may be as old as defined-contribution plans themselves. Union pensions also represent a big source of referrals

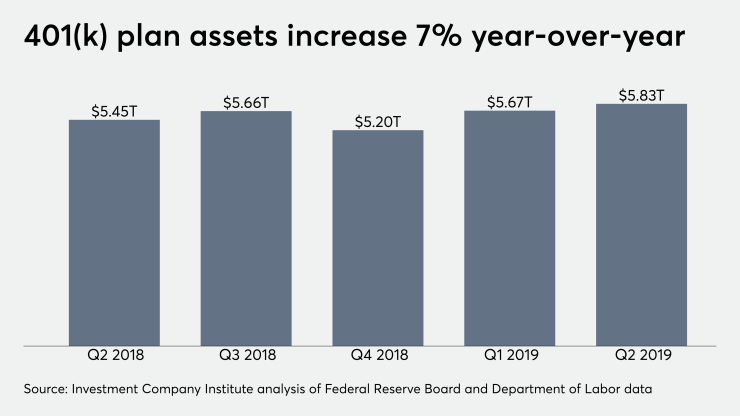

With 401(k)’s, the statistics clearly show the scale of potential business: assets in DC plans rose 7% year-over-year in the second quarter to $5.8 trillion,

Still, only about 3,000 of the network’s 8,000 advisors serve 401(k) plans — and just 50% of the industry’s advisors have at least one form of employee retirement plan in their books, Anderson says. Cetera and other

The network is currently

Cetera’s AdvicePay

“We're jumping from no interaction at all to having a fully integrated technology approach. There's a lot of low-hanging fruit that we can get right away in just freeing up the 401(k) advisors to reach out to the participants,” Anderson says.

“We can plug in our wealth management experience in the retirement plans,” he went on, “but let's build the bridges and build the conversations and start having those conversations.”

AdvicePay’s software for electronic payment processing enables Cetera’s 401(k) advisors to combine their participant advice fee with those of other kinds of advice and consulting on either a fee-for-service or subscription basis.

Cetera has also launched resources for 3(38) services, in which advisors — rather than sponsors who are often small business owners — manage the fund lineup, selection and trade execution. The network offers advisors training, third-party administrator and reporting services.

Advisors who manage 401(k) plans drive greater scale and client satisfaction, according to Anderson. “On all measures that I've been able to track, they've been more successful,” he says.

A year after Genstar Capital purchased a majority stake in the firm

The increased home-office support has come alongside M&A activity for the company. Following

Recruiting and acquisitions have already brought more than 1,000 advisors with $19 billion in client assets to Cetera firms in 2019,

The firm declined to comment on any timetable for a replacement. Its latest executive hire, former Schwab executive council member Andy Gill, reports to Antoniades and interim CEO Ben Brigeman. Gill is leading Cetera’s marketing, training, consulting and strategy teams.

In a statement, he said he’s “looking forward to contributing to the work underway to help the company in realizing its strategic objectives, bringing strategy and execution more closely together to deliver lasting value to advisors.”

Despite the major investments, Cetera parent firm Aretec’s adjusted debt-to-EBITDA ratio of 6.5x has come down from 7.5x in August 2018,

Aretec’s “B3 corporate family rating reflects the firm's weak profitability and debt servicing capacity, but also its strong franchise with a large advisor base,” Moody’s states. “Aretec has experienced stabilization in its advisor base and effective growth through acquisitions since it emerged from bankruptcy in 2016.”