For the first time in an annual compliance report, FINRA devotes a section to AI risks, including from third-party vendors and scammers.

-

Year-end client meetings, Dec. 31 deadlines, oh my. It can be a lot, but it doesn't have to be overwhelming.

-

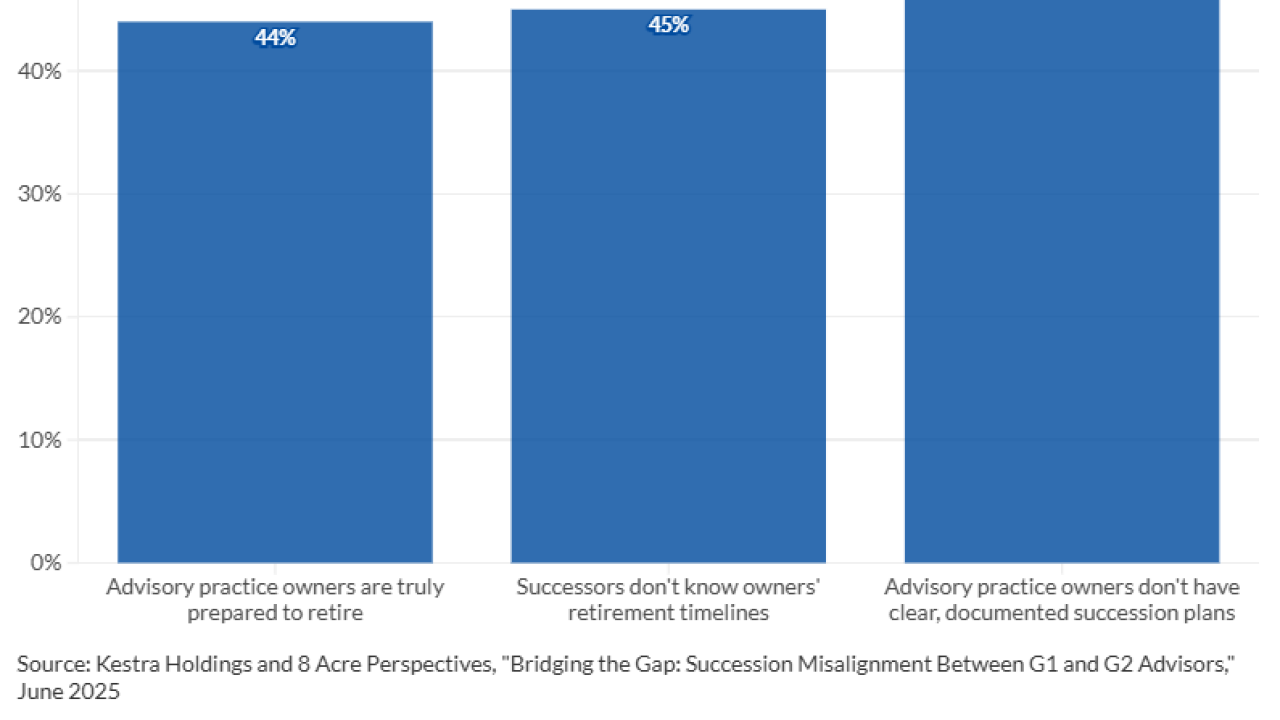

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

-

UBS chief data and analytics officer Joe Cordeira says AI won't replace advisors. But it can help them by providing little nudges to do everything from rebalancing a portfolio to wishing a client happy birthday.

-

For clients holding crypto, about half have experienced notable losses. But 70% have experienced notable gains, the latest Financial Advisor Confidence Outlook found.

-

Financial Planning's September Financial Advisor Confidence Outlook found that equities are growing hotter and cash is cooling off in client portfolios.

-

Respondents in this month's Financial Advisor Confidence Outlook cheered the prospect of a Fed rate cut, but they didn't feel good about much else.

-

Volatility, concerns over security and custody, and a lack of clear regulatory framework are the key barriers to adoption, according to Financial Planning's August Financial Advisor Confidence Outlook survey.

- RetirementEvery WednesdayAnalysis and strategies for all phases of retirement planning, including Social Security.

- Wealthtech WeeklyEvery ThursdayMust-read stories highlighted by our editors.

- Tax TuesdayEvery TuesdayActionable ideas and savvy strategies advisors can use to guide their clients on tax matters. Delivered every Tuesday.

- DaybreakDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

-

A penny-ante approach to allocating digital assets may not be as risk-averse as it sounds.

-

How charitably inclined taxpayers can use donor-advised funds and other tax strategies to get ahead of the OBBBA's revised rules on charitable deductions.

-

Step away from the rote 30-second spiel. Instead, forge connections with advisory prospects based on trust, not tactics.

-

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

-

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

-

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

-

Consolidation has been ongoing for more than a decade in wealth management, but it accelerated to unprecedented levels this year.

-

As Filed co-founder & CEO, Leroy Kerry leverages expertise from scaling some of Europe's fastest-growing fintechs, including scaling Iwoca from a team of 5 to unicorn status to serving as a founding member at Juni. Leroy's experience blends strategic growth, operational scaling, and talent development, uniquely positioning him to transform legacy industries through technology.