-

Some unresolved issues haven’t received as much attention as those related to federal securities laws.

September 26 Withersworldwide

Withersworldwide -

But the benefits are not evenly distributed among taxpayers.

September 20 Shidler College of Business, University of Hawaii at Manoa

Shidler College of Business, University of Hawaii at Manoa -

Regulators in Massachusetts launched a “sweep” of more than 60 firms that sold nearly $1.3 billion in limited partnerships sponsored by GPB Capital.

September 13 -

The actively managed offering aims to invest in corporate and non-corporate obligations, excluding government-guaranteed issues.

August 15 -

UBS wades into relative-value strategies with short-term structured notes

August 9 -

To get back into investors’ good graces, funds have had to alter traits like their liquidity, fees and even their overall structure.

August 7 -

The pool of money will primarily buy investments from so-called side pockets of illiquid stocks created before 2008.

August 6 -

Expected to raise $1 billion, the listing could encourage new offerings from many of the country’s cash-starved property firms.

July 26 -

Inflows have persisted since the infamous “volpocalypse” in early February.

July 13 -

Bryan Mullin, CFA, Head, Alternative Investments, RBC Wealth Management, James Waldinger, CEO, Artivest

July 12 -

Scrutinizing recent performance isn’t a recipe for long-term investment success.

June 26 -

The concept of ROI is shifting for young investors.

June 21 The Rudin Group

The Rudin Group -

The planned closures come just months after the firm introduced a lineup of artificial intelligence-driven products.

June 19 -

Morningstar’s annual study reveals how investors are catching up to funds by making better-timed trades.

June 13 -

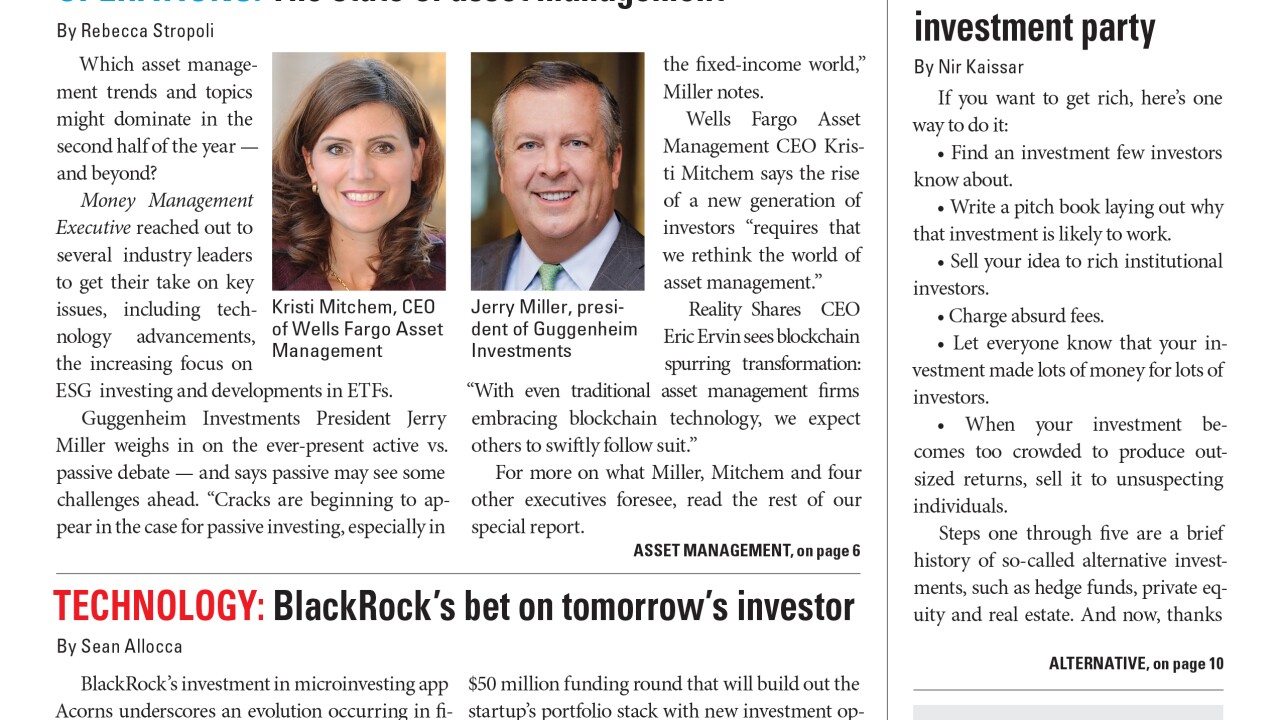

Industry leaders discuss advancements in technology, the increasing focus on ESG and developments in ETFs.

June 8 -

Since becoming Franklin Resource's first woman president, Jenny Johnson oversees a majority of the firm’s investment management services.

May 21 -

This move shows how large asset managers have taken note of certain trends.

May 17 -

Banks such as UBS aim to offer money managers refuge from jittery markets by combining bonds with more exotic options.

May 17 -

It’s largely hedge funds that have been bailing out while equity and bond fund managers have remained on the sidelines.

May 7 -

Less than a third of those polled analyze transaction costs before a trade.

April 20