Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

The nation’s largest IBD made its first tech deal this year for a firm that has $120 billion in assets on its platform.

October 27 -

Know a talented young advisor? Now’s your chance to nominate them for our annual rankings.

October 27 -

In the first episode of the five-part documentary series, we look at how disparities in net worth and mortgage discrimination impact Black home ownership — and why it's impossible to close the gaps without attacking systemic racism.

October 26 -

This five-part series is a comprehensive effort to explain the racial discrimination Black Americans face in our financial system.

October 23 -

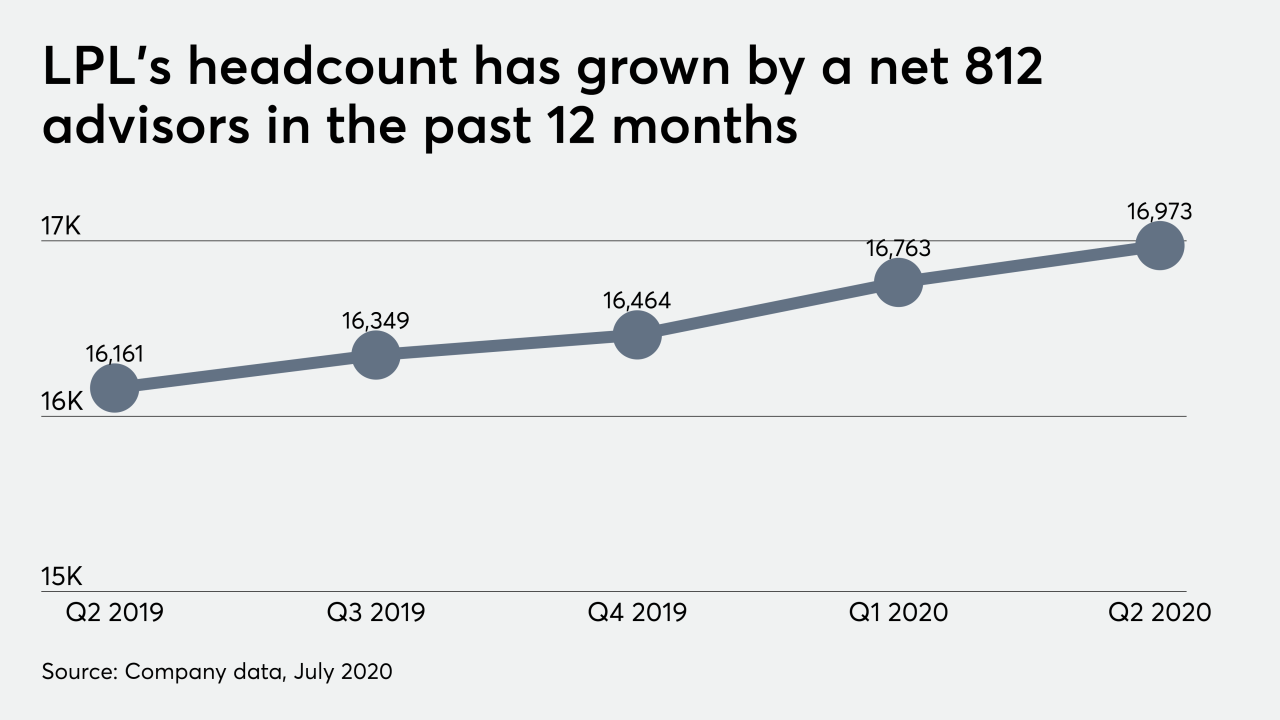

The No. 1 IBD is keeping up the recruiting momentum that’s sustaining record headcounts and billion-dollar moves.

October 23 -

If approved for an IPO, the blank check company will face stiff competition among the growing ranks of RIA acquirers.

October 22 -

The former J.W. Cole advisor’s practice allegedly sold more than $40 million worth of unsuitable and unregistered promissory notes.

October 22 -

The move represents the third largest out of the IBD channel in 2020, according to company recruiting announcements tracked by Financial Planning.

October 20 -

Genstar Capital Managing Partner Tony Salewski spoke openly with advisors about the firm’s investment strategy for the IBD network.

October 15 -

It comes as part of “an unprecedented series of extremely low” annual increases, according to an analyst with the nonpartisan Senior Citizens League.

October 13 -

The group of fee-only practices and networks have 1,187 IARs who manage a combined $95.7 billion.

October 13 -

The No. 1 IBD’s 2,500-advisor bank channel will add 285 more reps when two massive investment programs affiliate next year.

October 9 -

The advisor allegedly carried out a 20-year scheme defrauding at least 15 clients through forgery and misrepresentations.

October 7 -

The advisor allegedly used an omnibus trading account to help himself and hurt his clients to the tune of tens of thousands of dollars, according to the regulator.

October 5 -

Director tenures, nominations and committees are changing after an independent task force identified weaknesses.

October 1 -

The discrimination case revolves around allegations of disparate treatment in the firm’s agency distribution channels.

October 1 -

These firms oversee more than $185 billion in combined assets.

October 1 -

The firm is maintaining control but dropping its FINRA registration as the sector’s rising expenses and lower margins fuel consolidation.

September 30 -

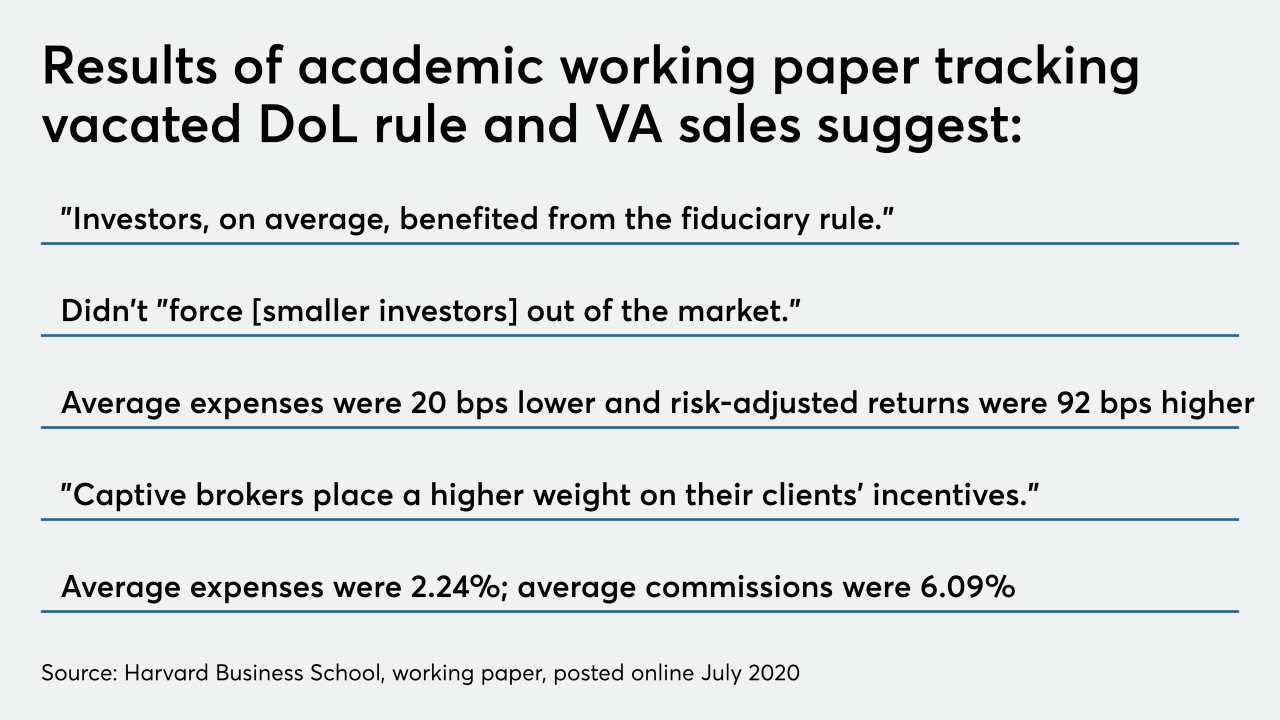

Actions hit a nine-year high and restitution climbed to the highest total since 2013 — even before the rule’s heightened scrutiny.

September 25 -

Expenses fell by 20 basis points and risk-adjusted returns climbed 92 bps, according to the study.

September 24