Earnings

Earnings

-

CEO Philip Sanders admits the past two years of the segment’s overhaul have been “a grind,” but he says it’s now ready to grow.

August 5 -

The firm has been picking off talent from rivals, primarily wirehouses.

July 30 -

Dan Arnold deployed a five-pronged argument for why consolidation is a recruiting boon for the No. 1 IBD.

July 26 -

The Advice & Wealth Management segment added 72 experienced advisors who affiliated in the second quarter.

July 25 -

The firm isn’t “the high bidder,” and that’s just fine, according to Paul Reilly.

July 25 -

Profitability is improving and all divisions, except the firm’s biggest — wealth management — surprised the market on the upside.

July 24 -

The declining headcount comes even as the firm pulls in several big hires.

July 23 -

Investors wary of an intensifying trade war have piled into the firm's bond products, boosting net flows to $151 billion, according to the company.

July 22 -

On the wealth management side, Morgan Stanley posted $4.41 billion of revenue, which was 2% higher than last year and blew away analysts’ estimates for a 9% decline.

July 22 -

James Gorman dismissed any speculation after the unit posted record revenue and pretax profit in the second quarter.

July 18 -

The beleaguered bank has suffered from attrition since a fake accounts scandal rocked the firm in 2016.

July 17 -

The bank has been slashing expenses, but executives acknowledged they remain high. Between having to hire thousands of compliance employees and waiting on the next CEO to be named, investments in new technology or other long-term growth are limited.

July 16 -

The No. 1 IBD has stopped offering the higher-yield funds in its automated bank deposit programs, but it notes they’re easily accessible in investment accounts.

June 19 -

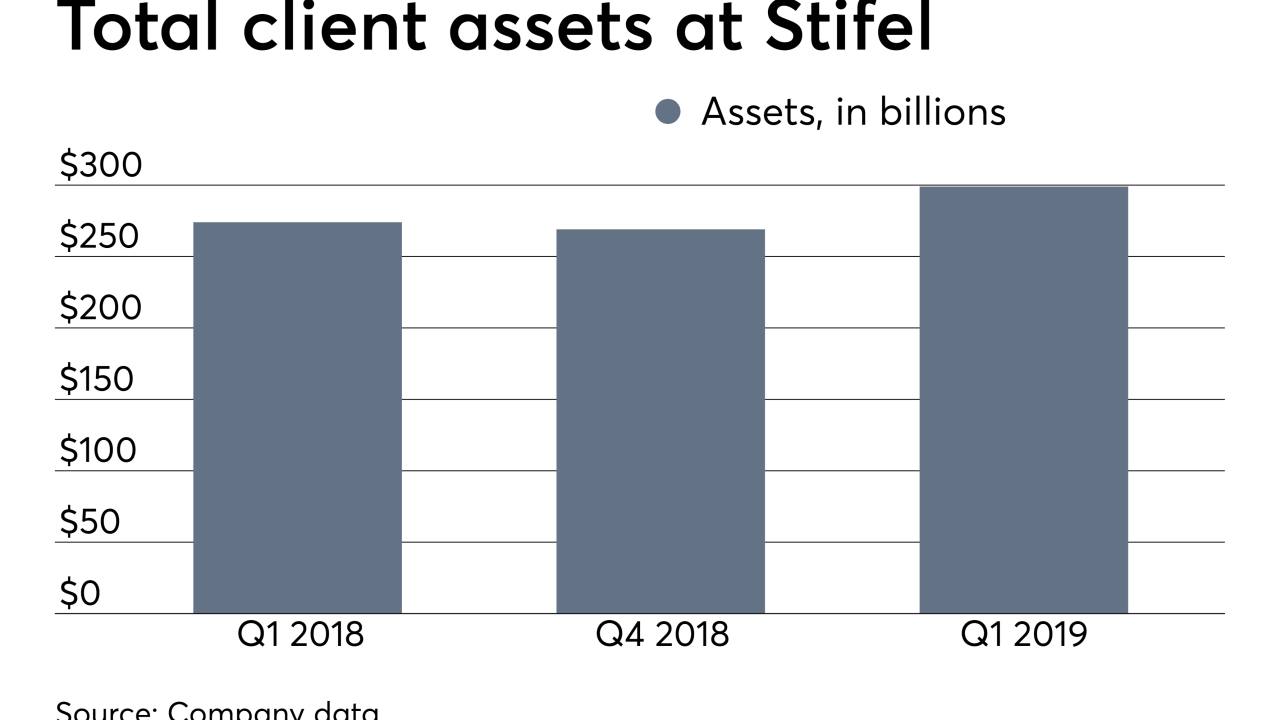

The two firms' boosts came amid equity headwinds — and both wealth management units now have nearly 4,400 financial advisors.

May 13 -

The aggregator introduces banking services and says it will continue to acquire new firms.

May 9 -

In a bid to further enhance its capabilities for advisors, the firm is also slashing ETF transaction fees on select funds later this year.

May 3 -

Advisor headcount reached 2,160 advisors for the first quarter, up a net 43 from the year-ago period.

May 1 -

The Invesco QQQ Trust dropped as much as 0.6% after Google’s parent company reported first-quarter sales below Wall Street estimates.

April 30 -

CEO Walt Bettinger says advisors tell him they aren’t worried about the new pricing model.

April 29 -

The firm is looking at a range of “different opportunities” for potential wealth management deals, CEO Jim Cracchiolo says.

April 25