Earnings

Earnings

-

The beleaguered bank has suffered from attrition since a fake accounts scandal rocked the firm in 2016.

July 17 -

The bank has been slashing expenses, but executives acknowledged they remain high. Between having to hire thousands of compliance employees and waiting on the next CEO to be named, investments in new technology or other long-term growth are limited.

July 16 -

The No. 1 IBD has stopped offering the higher-yield funds in its automated bank deposit programs, but it notes they’re easily accessible in investment accounts.

June 19 -

The two firms' boosts came amid equity headwinds — and both wealth management units now have nearly 4,400 financial advisors.

May 13 -

The aggregator introduces banking services and says it will continue to acquire new firms.

May 9 -

In a bid to further enhance its capabilities for advisors, the firm is also slashing ETF transaction fees on select funds later this year.

May 3 -

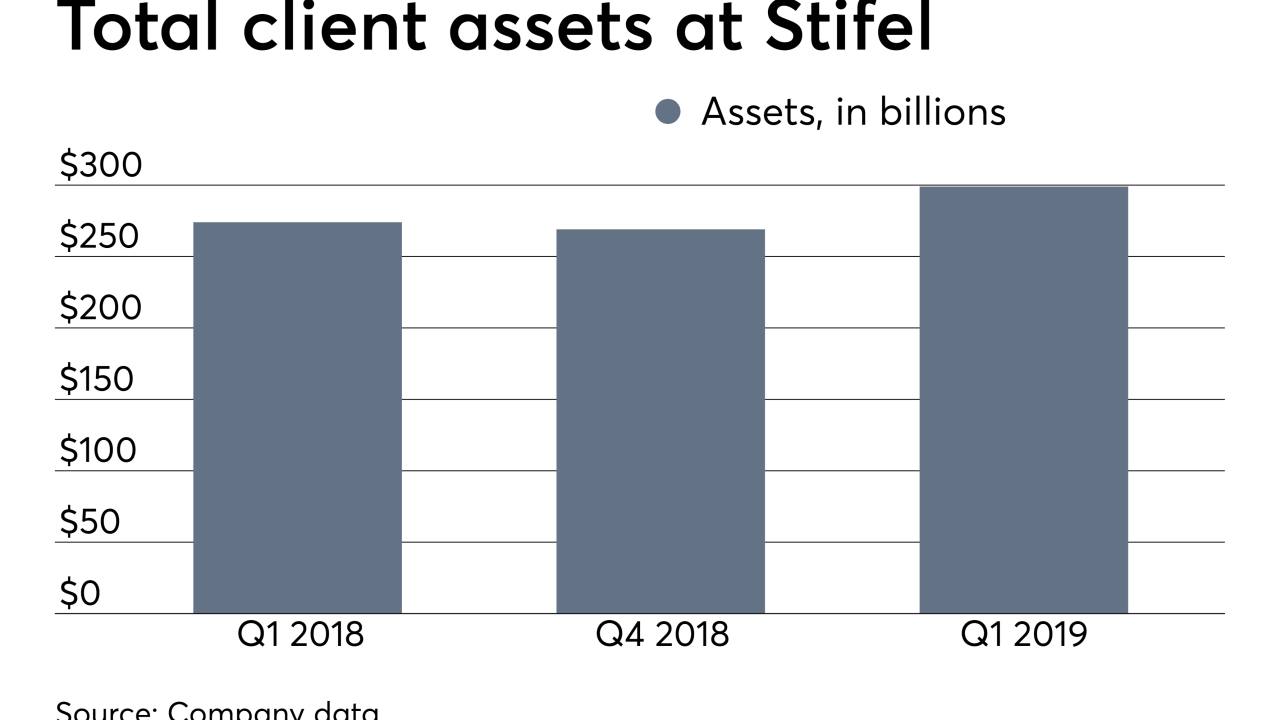

Advisor headcount reached 2,160 advisors for the first quarter, up a net 43 from the year-ago period.

May 1 -

The Invesco QQQ Trust dropped as much as 0.6% after Google’s parent company reported first-quarter sales below Wall Street estimates.

April 30 -

CEO Walt Bettinger says advisors tell him they aren’t worried about the new pricing model.

April 29 -

The firm is looking at a range of “different opportunities” for potential wealth management deals, CEO Jim Cracchiolo says.

April 25 -

The company hopes to recruit new advisors by taking a version of its home office tour on the road.

April 25 -

The slowing is part of an overall industry slowdown that experts don’t think will last.

April 24 -

C. Allen Parker was interrupted more than a dozen times as he tried to deliver opening remarks at the bank's its annual meeting.

April 24 -

With the board still conducting a hiring search, the strategy for fixing past problems and returning to revenue growth remains in flux.

April 22 -

The company’s acquisition will allow it to target prospective clients who are still in the wealth creation phase of life, says CEO James Gorman.

April 17 -

The firm is benefiting some referrals from Bank of America’s other business units.

April 16 -

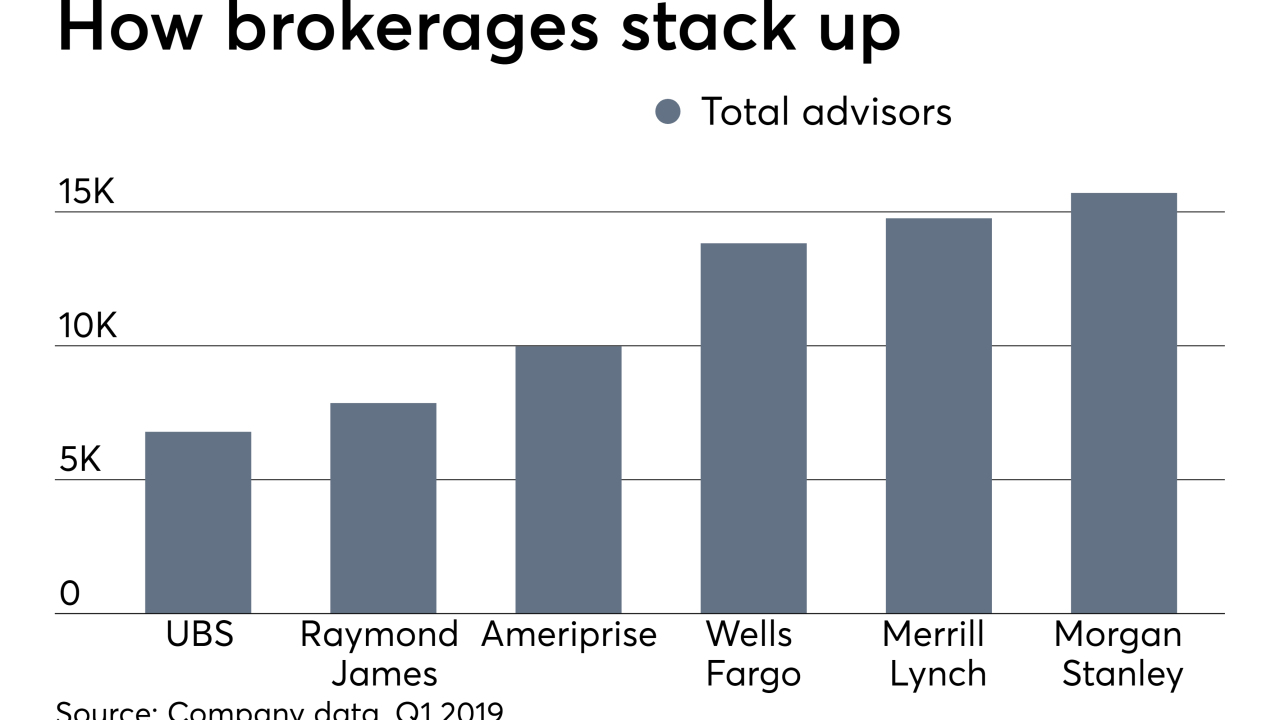

Headcount is down more than 1,250 since a fake accounts scandal came to light in 2016.

April 16 -

Dan Arnold received $7.1 million in 2018, far below the longer-tenured chiefs of rival firms Ameriprise and Raymond James.

April 1 -

The hit to wealth management from a difficult trading environment was already visible in the fourth quarter.

March 21 -

Commissions and cash-sweep revenue jumped by more than a combined $100 million in 2018 — even as the parent firm’s longtime chairman left the company.

March 15