Earnings

Earnings

-

The fast-growing firm has added 300,000 square feet of office space to its headquarters.

October 26 -

CEO Jim Cracchiolo reported record client assets and a sharpened focus under the fiduciary rule.

October 25 -

The company also said that its advisor ranks are growing.

October 19 -

As a result of CEO James Gorman’s strategic moves, the firm earns the biggest share of revenue from wealth management of the six biggest U.S. lenders.

October 18 -

The company's broker headcount declined slightly, but it remains the largest wirehouse by number of advisors.

October 17 -

The firm's advisor ranks increased slightly during the third quarter, ending three consecutive periods of decline.

October 13 -

The bank is testing several trading and investing platforms and will be talking about "what might or might not work," CEO Jamie Dimon said during its third-quarter earnings call.

October 12 -

Adviser headcount continued a slow, but steady decline, slipping to 6,915 from 7,116 for the year-ago period.

July 28 -

CEO Dan Arnold said advisers’ uncertainty about the fiduciary rule is waning.

July 27 -

"This is a challenging time for the firm with the DoL rule," CEO Paul Reilly said.

July 27 -

The rule has cost the firm tens of millions of dollars in compliance and lost revenue.

July 26 -

Second-quarter revenue from brokerage services fell 3% year-over-year while assets under management jumped 26% to $14.8 billion.

July 21 -

The Buffalo-based institution generated $127 million in second-quarter revenue from trust services, up 5% year-over-year.

July 20 -

Rising markets boosted revenues for wealth- and asset-management arms at the largest U.S. banks to $18.4 billion in the second quarter, according to data compiled by Bloomberg.

July 20 -

The firm needs a digital advice offering for clients who don't want a traditional relationship, CEO James Gorman said.

July 19 -

The bank's wealth management businesses earned $124 million on $600 million in revenue in the second quarter.

July 19 -

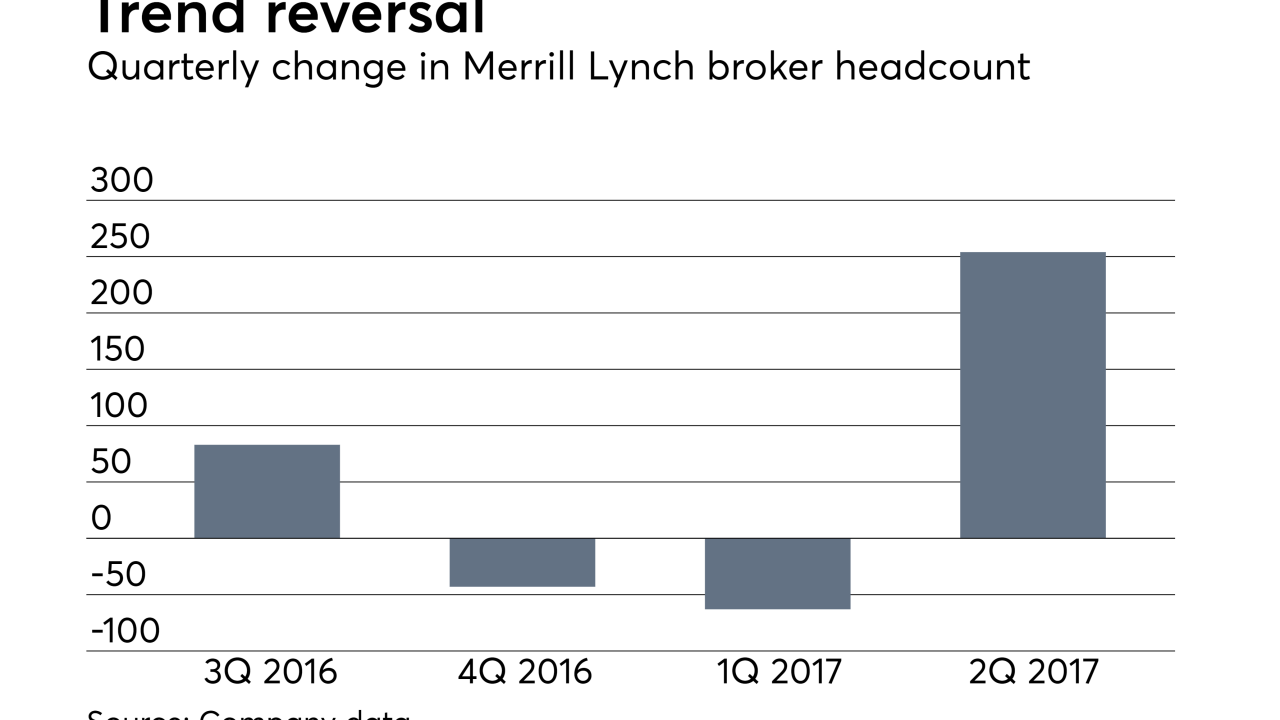

The firm also said it has benefited from low attrition and its training program.

July 18 -

The firm's headcount has steadily declined since the bogus account scandal came to light last year.

July 14 -

Second-quarter revenue climbed 9% year-over-year even as the number of advisers dropped by 6%.

July 14 -

The wirehouse’s pre-tax earnings jumped 42% year-over-year despite losing 176 advisers in that time.

May 1