Strong recruiting and robust markets helped drive profits and asset levels to record highs for Raymond James's wealth management unit.

Even CEO Paul Reilly, who has overseen notable growth during his tenure at the firm, found something surprising in this quarter’s earnings.

"If you told me a year ago this September that Trump would be president, that the market is up [this much]… that we would have these financial results and the Cubs won the World Series, I don't know what I would believe more," Reilly said during an earnings call Thursday.

The firm's Private Client Group reported assets under administration of $659.5 billion for the recent quarter, up 15% from the year-ago period. The unit's pretax income rose 34% to $142.3 million.

The firm is the latest to report robust earnings and rising AUM levels, boosted by strong markets. Merrill Lynch, Morgan Stanley and Ameriprise all notched new records.

The strong results come after the Department of Labor's fiduciary rule has transformed the wealth management landscape. Many industry executives opposed the regulation's implementation, saying it would curtail customer choice and raise prices. The Labor Department is currently reviewing the regulation with an eye to amending or reversing it.

The rule seems to have energized the shift to fee-based accounts at many firms, several of which have reported higher inflows this year. However, the industry had already been moving toward a more fee-based model.

Fee-based accounts for Raymond James's Private Client Group grew 27% to $294.5 billion, the company said.

-

CEO Jim Cracchiolo reported record client assets and a sharpened focus under the fiduciary rule.

October 25 -

The company also said that its advisor ranks are growing.

October 19 -

As a result of CEO James Gorman’s strategic moves, the firm earns the biggest share of revenue from wealth management of the six biggest U.S. lenders.

October 18 -

The firm's advisor ranks increased slightly during the third quarter, ending three consecutive periods of decline.

October 13

Independent and regional firms have been maintaining strong appeal with new recruits.

MORE ADVISORS, MORE SUPPORT

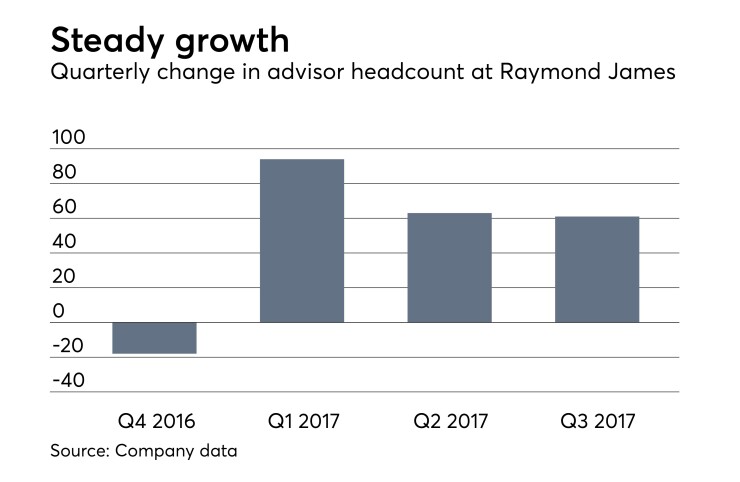

The company's brokerage headcount continued its upward trend, increasing by 61 independent and employee advisors from the prior quarter to reach 7,346.

Non-wirehouse firms have ramped up recruiting efforts this year just as UBS, Merrill Lynch and Morgan Stanley have cut back. These medium and small-sized firms have been able to attract wirehouse talent with promises of less bureaucracy and more broker-friendly cultures. In Raymond James's case, Reilly added another factor: technology upgrades.

"The investments we made over the last few years certainly helped our retention," Reilly said.

Yet those and other investments have also added to the firm's bills. Overall non-interest expenses rose to $1.4 billion from $1.2 billion, a 16% increase. Among the fastest growing line items were communications and information processing, up 26%, and occupancy and equipment costs, up 15%.

The company, which has acquired boutique wealth management unit Alex. Brown, has had to add to the capacity of its back office and support systems. Raymond James's headquarters in St. Petersburg, Florida, grew by 300,000 square feet of office space, according to CFO Jeffrey Julien.

"We do need a place for people to work," Julien said during the earnings call.

Compliance costs have also risen due in part to the fiduciary rule. Reilly, like other industry leaders, expects the Department of Labor to follow through on a proposal to delay implementing the rule's remaining elements. But he added that Raymond James was moving ahead to be ready for full compliance by year's end.