UBS Wealth Management Americas reported strong profit growth even as its adviser headcount continued to tick down as a result of recruiting cutbacks.

Pretax profits for the unit soared 26% year-over-year, reaching $304 million from $242 million for the year-ago period,

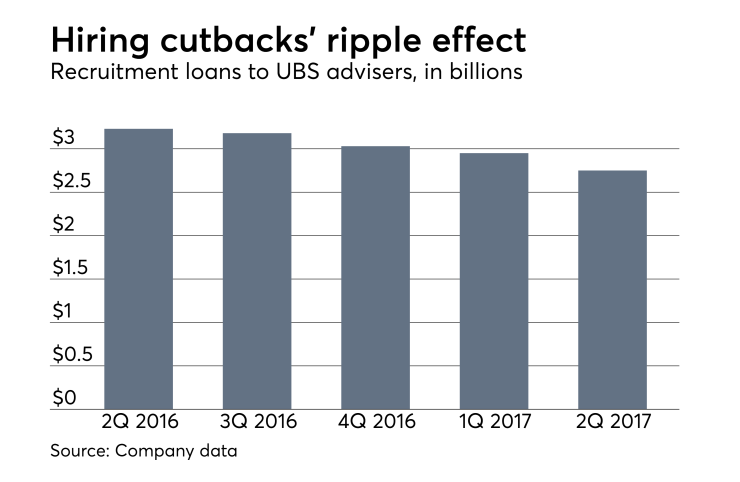

The move to reduce hiring,

That reduction allows UBS to reallocate resources to its existing advisers, the company says.

Overall, the wealth management unit's revenue grew 11% to a record $2.1 billion. That growth outpaced a 9% rise in expenses, which climbed to $1.8 billion.

The firm's 6,915 advisers ― down 201 advisers from the year-ago period ― continue to lead the industry in terms of productivity. The average UBS adviser generates $1.23 million, according to the firm. Merrill Lynch, by contrast, reported average production of $1.04 million per adviser.

Like UBS, Merrill as well as Morgan Stanley announced cutbacks to recruiting efforts.

-

It seems that a long bull market in transition deals may be coming to an end.

May 23 -

"It's always nice when one poker player folds and it's down to two or three players," one recruiter says.

May 12 -

The wirehouse's executives think they've struck on the right formula to boost growth through a simplified comp plan, greater autonomy and an attractive retirement package.

April 17

But that didn't stop Merrill Lynch from enticing away large UBS advisers ahead of a deadline to reduce hiring. For example, last month Merrill Lynch said

Net new money at UBS declined for the second quarter; the firm reported outflows of $6.4 billion, compared to a net gain $1.9 billion for the prior quarter and $2.4 billion for the year-ago period. The company attributed the outflows to adviser attrition.