Earnings

Earnings

-

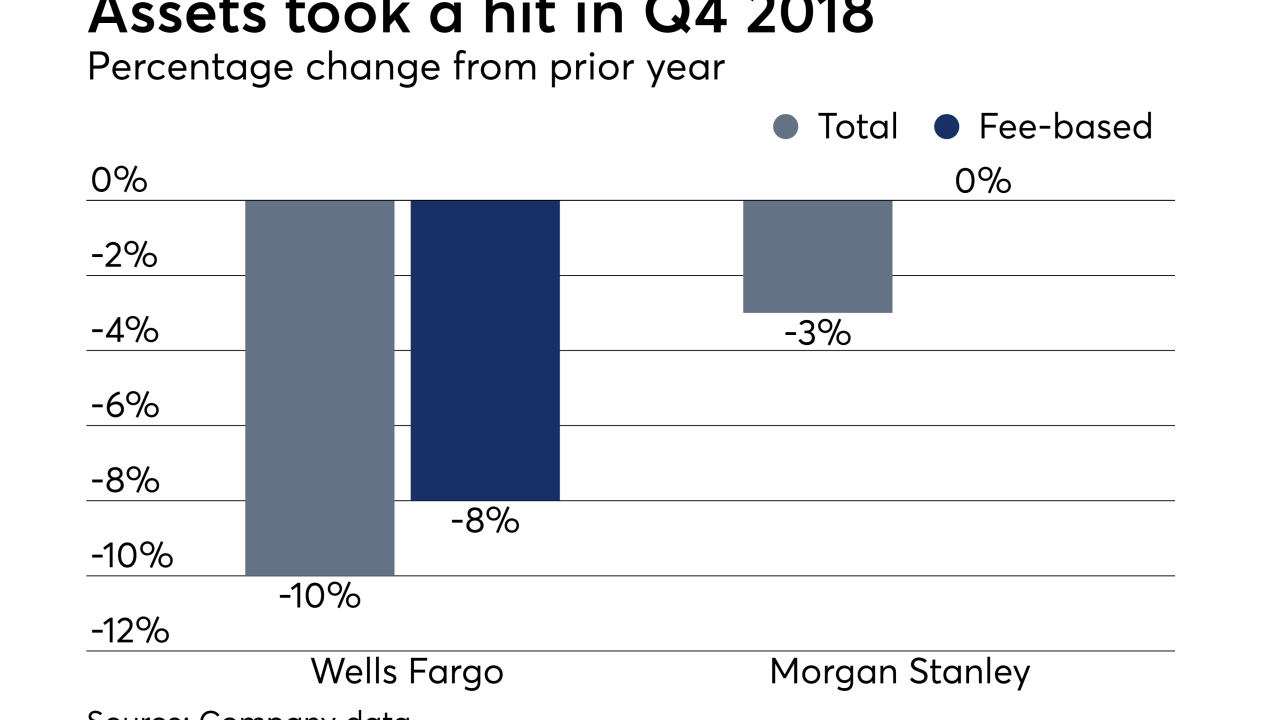

Fourth-quarter equity losses stanched client assets at wirehouses, indies and other brokerages — but their stocks are regaining ground after reporting earnings.

March 11 -

The network’s parent disclosed the results of its first year under a new accounting standard affecting the top line at many large U.S. businesses.

March 8 -

The tax-focused IBD’s custodial and platform transition is taking longer than the company or its advisors expected.

February 14 -

The firm cut its headcount by 22% while boosting productivity by 48% in 2018, and it plans to roll out a new desktop platform for its 1,060 representatives.

February 6 -

The firm’s efforts to attract talent away from rivals boosted headcount by a net 57 advisors in 2018.

February 1 -

CEO Dan Arnold pledged new tech-enhanced support for advisors as part of a larger cultural transformation.

February 1 -

The firm suffered from market volatility in the fourth quarter.

January 31 -

An uptick in retirements dampened the firm’s efforts to expand its brokerage ranks.

January 24 -

The firm’s new leader Penny Pennington tapped managers, one a longtime veteran of the firm, for the executive committee.

January 23 -

Increased volatility, rising protectionism and geopolitical tensions are still weighing on investors, the firm said.

January 22 -

Overseeing money for the rich is supposed to be one of the best businesses in banking, but even the world’s biggest wealth manager is finding that it doesn’t always work out like that.

January 22 -

Market volatility spurred clients into cash during the fourth quarter.

January 17 -

“The thundering herd is on the move,” boasts Andy Sieg, head of Merrill Lynch.

January 16 -

The firm has lost more than 1,100 advisors since a phony accounts scandal came to light in 2016.

January 15 -

For investors who were hoping for a turnaround quarter, better luck next time.

January 15 -

They’re going into the season with weaker earnings expectations as they contend with a pileup of share downgrades.

January 10 -

The New York aggregator’s performance to date “will make it easier for other RIAs to go public,” says industry analyst Chip Roame.

November 13 -

The 4,300-advisor network is investing in insurance distribution after benefiting from rising interest rates and record client assets.

November 7 -

A multi-year reorganization of the firm has lowered head count by more than a quarter but boosted productivity by nearly a half.

November 2 -

A total of 86 publicly traded companies approved new repurchase plans so far this year. That’s nearly twice as many as all of 2017.

November 2