-

One size fits all? The single form for disclosure of client-advisor relationships applies even if firms offer multiple products and services.

December 16 Cipperman Compliance Services

Cipperman Compliance Services -

The SEC says broker-dealers may treat investment advisors as if they were subject to the AML Rule — under certain conditions.

December 16 -

Brokerage firms that sell the funds must determine whether clients understand their risks — a requirement that could discourage offering them at all.

December 6 -

-

What advisors need to know about revenue sharing, wrap fees and outside investors in the wake of Reg BI.

November 20 -

SEC Commissioner Robert Jackson Jr. said his office studied 15 years of data to assess how the firms utilized their power on hundreds of proposals.

November 19 -

The fact that it’s impossible to track the amount of revenue sharing kickbacks demonstrates the problem, says the research firm’s lead policy wonk.

November 18 -

Rather than disclosing their portfolios every day like conventional ETFs, the nontransparent products will reveal their holdings at least once a quarter.

November 15 -

Sixty-six SEC whistleblowers were awarded $387 million for a “job well done,” according to the commission's whistleblower attorney Stephen Kohn.

November 11 -

The SEC's recently passed ETF modernization rule is just one regulatory change industry leaders expect will impact asset management in the years ahead.

November 7 -

An extension from the agency comes amid warnings from brokerages that breaking out stock and bond analysis would threaten their own research businesses.

November 6 -

The agency floats proposal to expand regulations to accommodate new online channels, allow for third-party ratings and testimonials.

November 5 -

The SEC’s recently passed ETF modernization rule, which expands choice in the market, “is probably the end of the mutual fund industry.”

November 1 -

In a little-noticed rule change, mutual funds no longer disclose their shrinking BD commission load-sharing payments.

October 16 -

The change, the regulator says, will facilitate greater competition and innovation in the ETF marketplace, leading to more choice for investors.

October 10 -

A patented structure allows ETFs to report once a quarter in an effort to protect their intellectual property.

October 1 -

Wild price swings that have exceeded double-digit percentages in a single day have spurred the regulator to keep a close eye on volatility.

October 1 -

Charlie Scharf’s most immediate priorities include mending fences with regulators and getting the bank out from under a Fed-imposed asset cap.

September 27 -

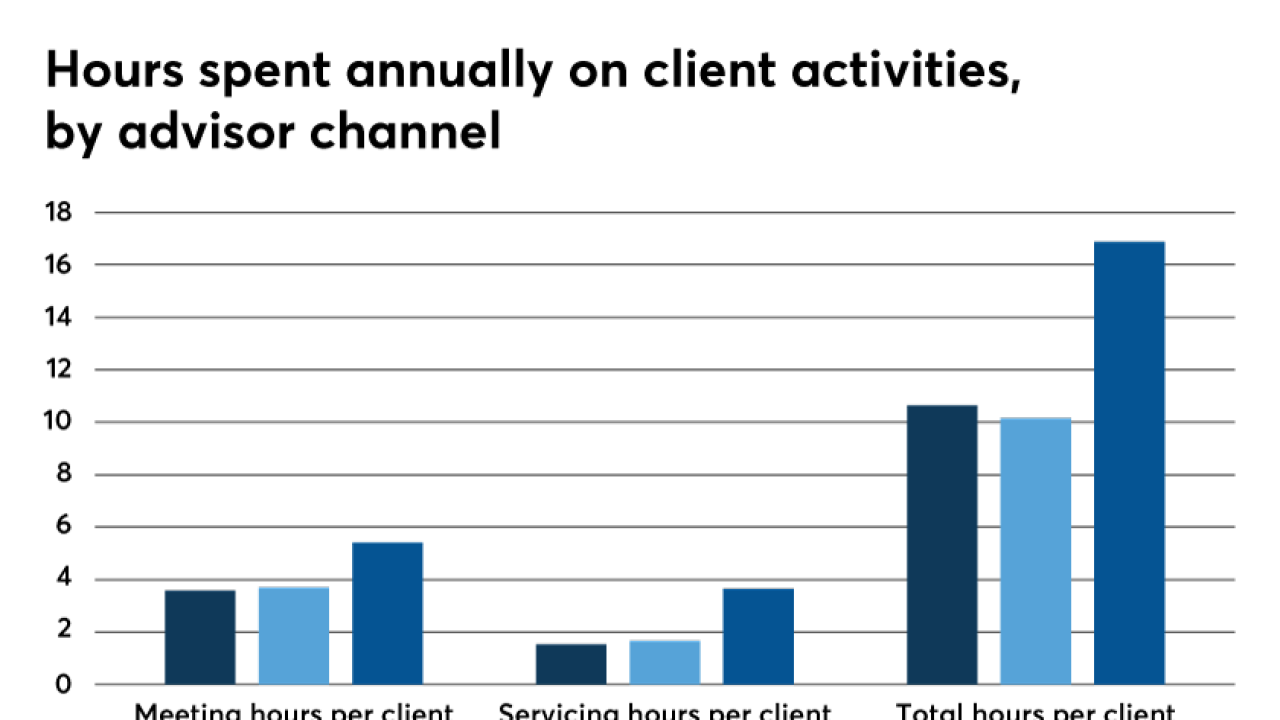

Alternative compensation structures may provide more consumer protection, and drive higher client satisfaction.

September 16 -

The rule unfairly gives brokers a leg up in the marketplace, harming the network’s 1,000 independent advisors, the firm claims.

September 10