-

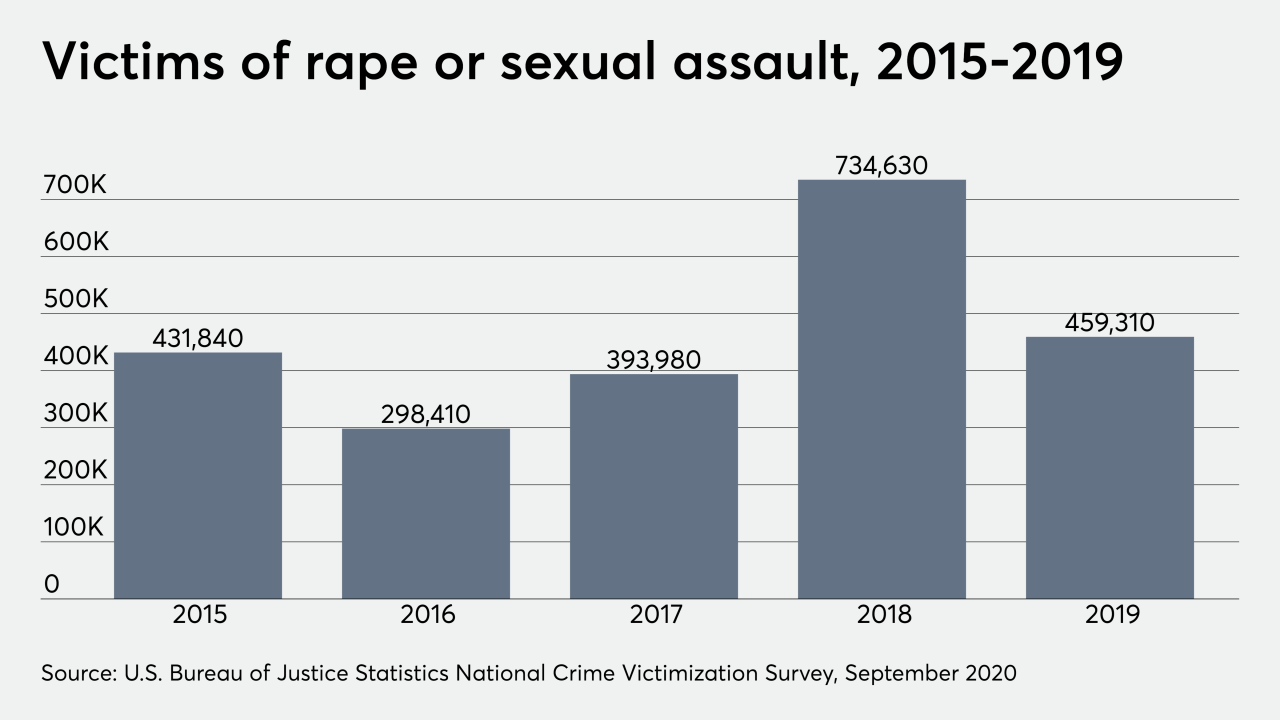

SA Stone Wealth Management representative Gregory Frank Estes had already registered as a sex offender after a 2002 conviction, records show.

January 21 -

The 25-year industry veteran of four wealth managers and a trust company faced a charge of unlawful entry on public property.

January 15 -

Two former FINRA employees are joining the fast-growing brokerage app.

January 14 -

The firm’s use of third-party compliance vendors came under scrutiny after an ex-rep pleaded guilty to bilking clients out of $5 million.

January 5 -

In the first wave of cases under the regulator’s self-reporting initiative, it garnered more than $2.7 million in payments of restitution plus interest.

December 30 -

The wealth manager whose parent firm also owns an insurer and asset manager settled its third case involving the same time period.

December 23 -

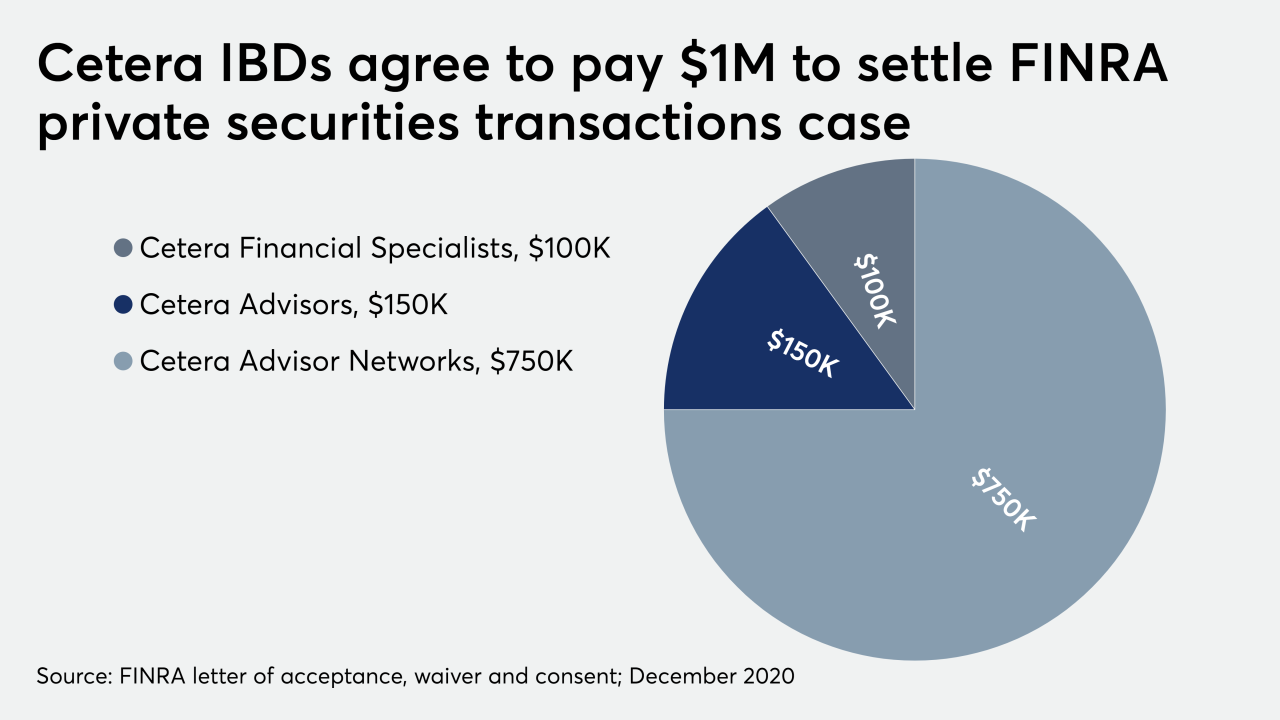

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

Maybe not, says FINRA — but if you’re IM’ing, using slides during the virtual meeting, or recording it, probably yes.

November 25 -

While FINRA rules spell out what brokers generally need to determine a client's financial situtation, there can be gray areas, an expert says.

November 16 -

Unclear — or no — disclosures were among a number of concerns regulatory officials expressed about initial examinations.

October 29 -

Although in-person hearings aren’t banned outright, none have taken place since the onset of the coronavirus pandemic.

October 23 -

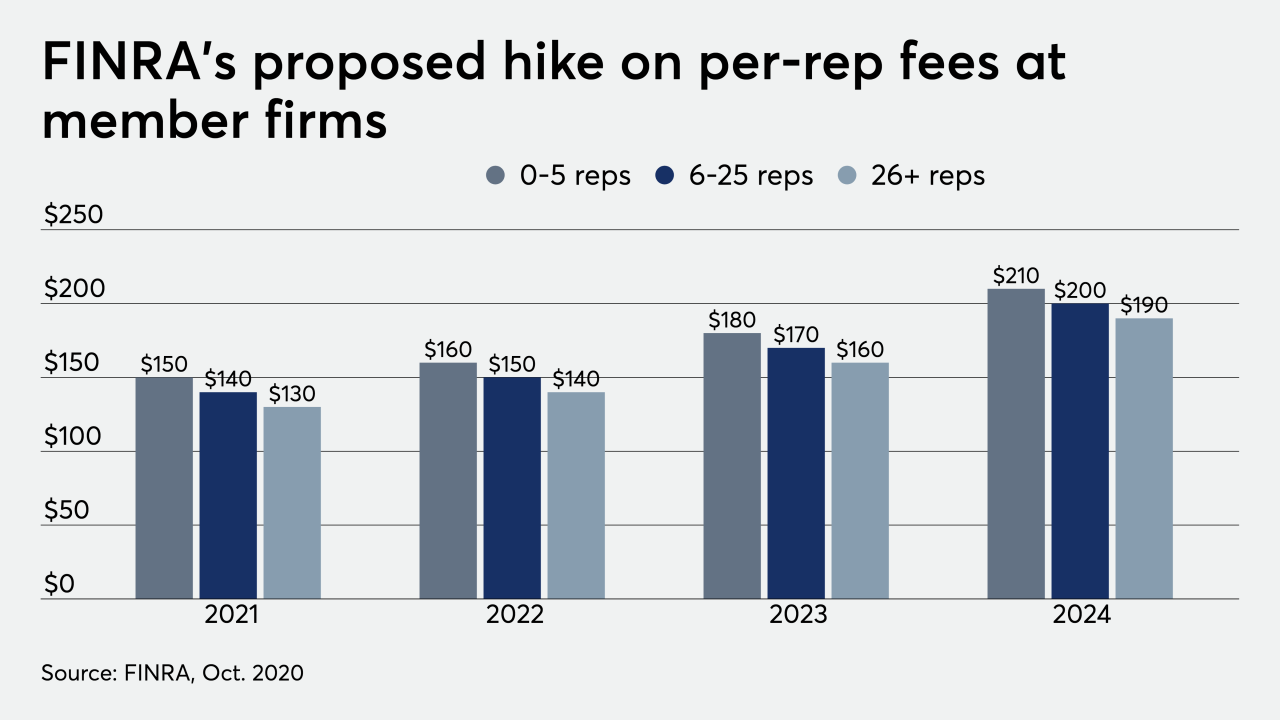

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

The advisor allegedly carried out a 20-year scheme defrauding at least 15 clients through forgery and misrepresentations.

October 7 -

Based on the “forced experiment” of its remote periodic examinations of broker-dealers, the onsite portion “may not be necessary,” Robert Cook said.

September 24 -

CEO Robert Cook has launched a task force and started assessing his own actions, he said in a panel at the Quad-A Vision conference.

September 16 -

Sales are tumbling and gravitating to different products as Wells Fargo settles a FINRA case and researchers examine the defunct fiduciary rule.

September 3 -

Regulators will conduct surveys and sweep exams to assess how your firm’s BCP handled — or didn’t — the COVID-19 pandemic

August 31 -

Yes, they’ll be going up in September — but not as much as you may have heard.

August 14 -

During rapid growth, the firm allegedly failed to detect a cascade of red flags.

August 10 -

The number of advisors registering with FINRA has fallen since 2016, as more planners elect a fee-only model.

August 4