-

Three recent criminal cases raise concerns that wealth managers and regulators aren’t detecting alleged fraud quickly enough or disclosing basic information about crimes and disciplinary problems.

March 12 -

The rare move to set aside the regulator’s ruling came more than a decade after the rep ran into trouble by adding notes about his client into a software program.

March 11 -

The rep reeled in at least a dozen victims to the complex scam even though he was suspended from the industry for a different case, according to investigators.

March 9 -

More than one-third of U.S. brokerage clients opened their first accounts in 2020, according to new research from the FINRA Foundation.

February 10 -

Using a Paycheck Protection Program loan to fund businesses outside your day job may be costly for brokers.

February 5 -

Following through on its staged approach to new advice standard, industry regulator expected to be less patient with the "laggards."

February 5 -

In the new Form CRS, firms must justify whether they place client assets in advisory or broker accounts.

February 4 -

Does a poor stock pick, for instance, constitute a sales practice violation?

February 2 Foreside Financial Group

Foreside Financial Group -

A dead client, an advisor accused of murder and fraud, and an industry that didn’t see it coming.

February 2 -

Letters sent to reps ask for extensive information on why they applied for a loan, how funds were received and used, and all compensation under the federal program.

January 22 -

SA Stone Wealth Management representative Gregory Frank Estes had already registered as a sex offender after a 2002 conviction, records show.

January 21 -

The 25-year industry veteran of four wealth managers and a trust company faced a charge of unlawful entry on public property.

January 15 -

Two former FINRA employees are joining the fast-growing brokerage app.

January 14 -

The firm’s use of third-party compliance vendors came under scrutiny after an ex-rep pleaded guilty to bilking clients out of $5 million.

January 5 -

In the first wave of cases under the regulator’s self-reporting initiative, it garnered more than $2.7 million in payments of restitution plus interest.

December 30 -

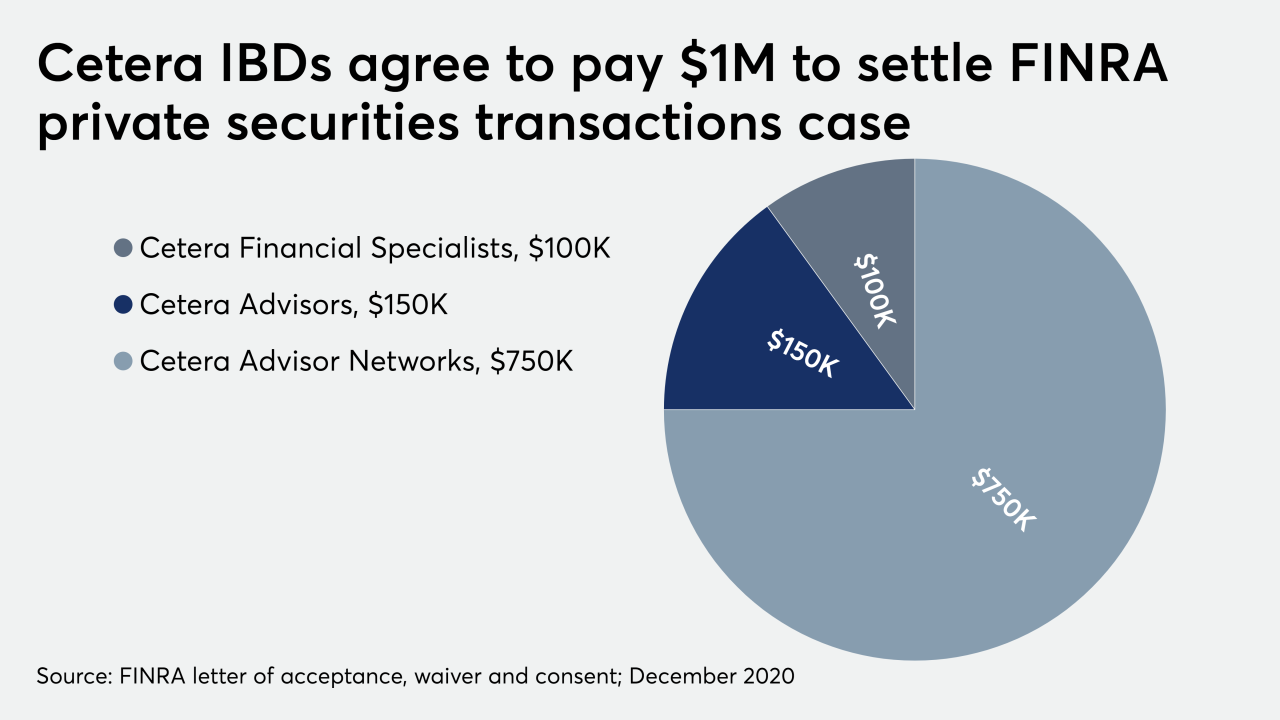

The wealth manager whose parent firm also owns an insurer and asset manager settled its third case involving the same time period.

December 23 -

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

Maybe not, says FINRA — but if you’re IM’ing, using slides during the virtual meeting, or recording it, probably yes.

November 25 -

While FINRA rules spell out what brokers generally need to determine a client's financial situtation, there can be gray areas, an expert says.

November 16 -

Unclear — or no — disclosures were among a number of concerns regulatory officials expressed about initial examinations.

October 29