-

Under the proposals, the top 0.1% of earners would be subject to a 43% tax rate on their income.

September 14 -

“Everyone is looking ahead to the elections and what tax policy could look like in various administrations," says Ben Huneke, head of investment solutions in the firm's wealth management division.

September 10 -

The firm expands on both coasts with Glasband Stempel Wealth Management in Florida and Carol Wilshire in California.

September 4 -

Credit Suisse has discovered fraud at its international wealth management business, two years after it was criticized by a regulator in a similar case that rattled the bank and raised questions about controls.

August 28 -

Gifting embedded loss assets can avoid a step-down in basis and preserve capital losses. Here's how to go about it, under several scenarios.

August 24 -

Tax-rate arbitrage is one approach, but it’s far from the only one, according to contributor Michael Kitces.

August 4 -

Any tax increases on high-income individuals and corporations would be offset by massive spending packages targeted at accelerating the country’s recovery from the coronavirus, according to the firm.

July 31 -

Perceptions on relationships, health, and lifestyle have also changed.

July 28 -

The move follows efforts to reduce expenses in the company’s global wealth management business.

July 23 -

“They’re now realizing: Let’s actually get the contingency plan in place,” said Dominic Volek, head of sales at Henley & Partners, the world’s biggest citizenship and residency advisory firm.

July 20 -

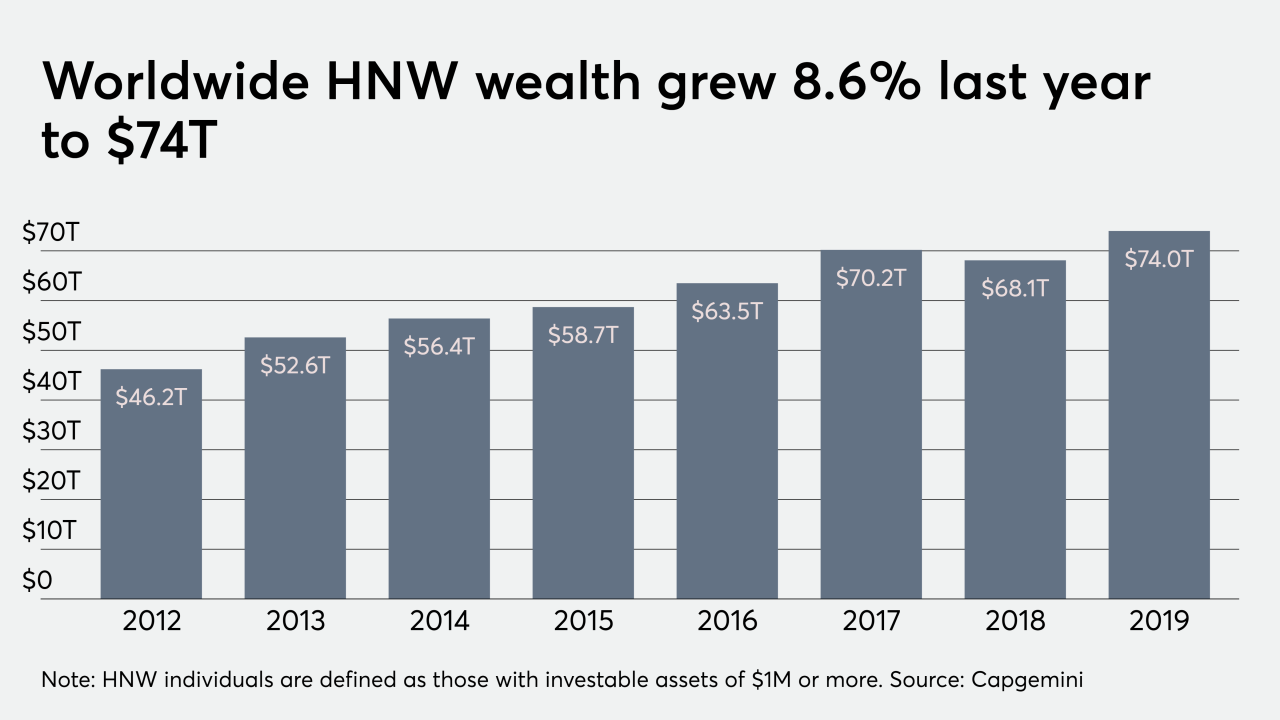

Affluent investors are concerned about transparency, performance and value, according to a new report by Capgemini.

July 9 -

As much as $16 trillion of global wealth may be wiped away this year as a result of volatility and economic fallout from the pandemic.

June 25 -

The wirehouse says it wants to simplify pricing for separately managed accounts and expand client choice.

June 23 -

“The stocks that I hadn’t heard of three months ago all of a sudden are the most active — that’s not where investors go, that’s where traders might go or hobbyists might go,” says a private wealth advisor at UBS.

June 19 -

About 6% of the country’s family offices have more than $5 billion of assets under management, while roughly a third control $500 million or less.

June 16 -

Major donor-advised fund providers said they’re using webinars, podcasts, social media and emails to nudge clients to give.

June 12 -

The central bank’s own data show that slightly more than half of U.S. households own stocks. But that doesn’t come close to telling the whole story.

June 9 -

Advisor Zaneilia Harris has come to a bleak conclusion.

June 3 Harris & Harris Wealth Management Group

Harris & Harris Wealth Management Group -

Nicole Pullen Ross also heads an initiative to handle wealth management for athletes and entertainers.

June 3 -

With many clients already home from work because of the pandemic, advisors are being asked why not now? For most, even the wealthy, the answer is clear.

May 21