An analysis of active funds with the best returns of 2020 show why low fees are not always an indicator of outperformance.

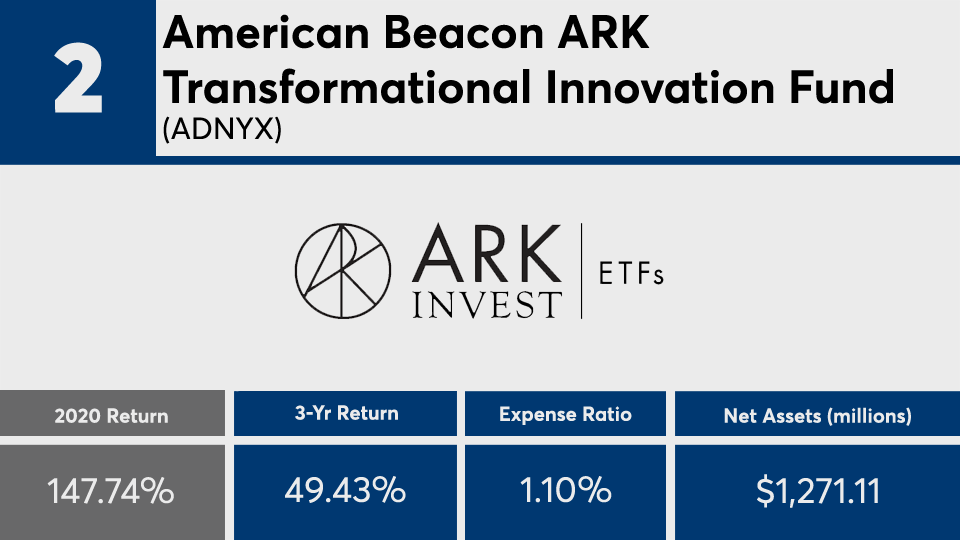

The top 20 performers with a human manager at the helm, and with at least $100 million in assets under management, generated an average gain of more than 107%, Morningstar Direct data show. The funds also carried an average expense ratio of more than three times the broader industry.

“The theme from the active fund winners in 2020 is the ability to be nimble and press hard on your winners,” says Manish Khatta, CIO of Potomac Fund Management. “This isn’t surprising because active management works well traditionally, but only if and when the manager can be tactical and concentrated.”

Compared with broader markets, index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) had returns last year of 18.4% and 9.62%, respectively, over the same period, data show. In bonds, the iShares Core U.S. Aggregate Bond ETF (AGG) recorded a 7.42% return in 2020, data show.

Active funds with the biggest gains last year came with fees as high as 222 basis points, data show. With an average net expense ratio of 138 basis points, these products were well above the 0.45% investors paid for fund investing in 2019, according to

Khatta says analysis of the fees associated with the top-performing active funds can help advisors broaden their discussion of portfolio diversity with clients.

“There is a misperception that active management is only meant to generate outsized gains. In fact, there are plenty of active funds that offer risk management as a value add,” he says. “The ability to shift allocations to defensive asset classes including cash can be a tremendous benefit to clients. The most successful advisors position active as a portion of the overall allocation and steer away from performance chasing.”

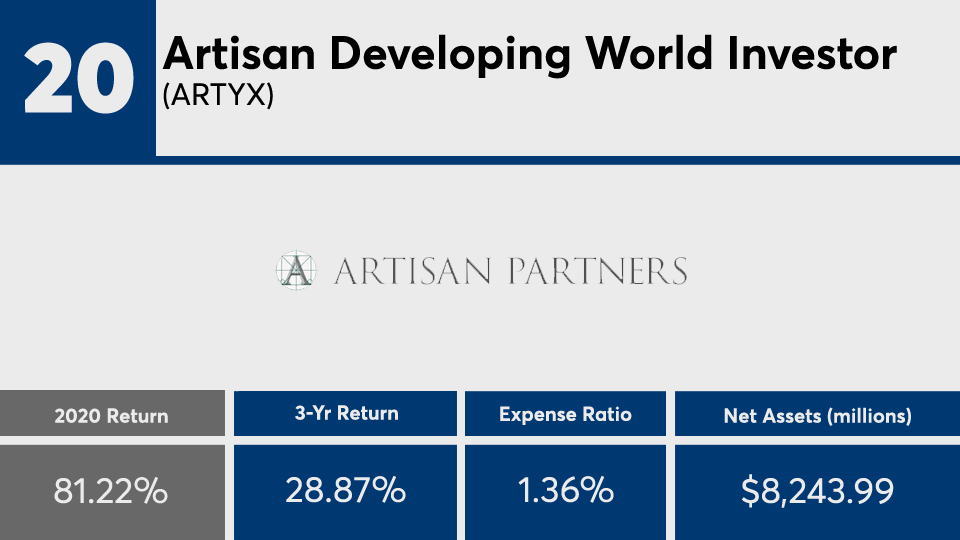

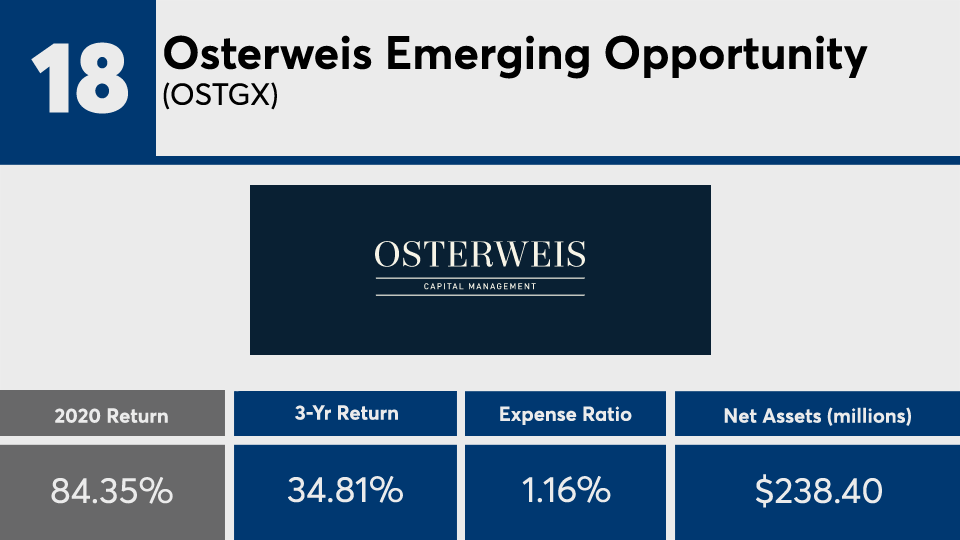

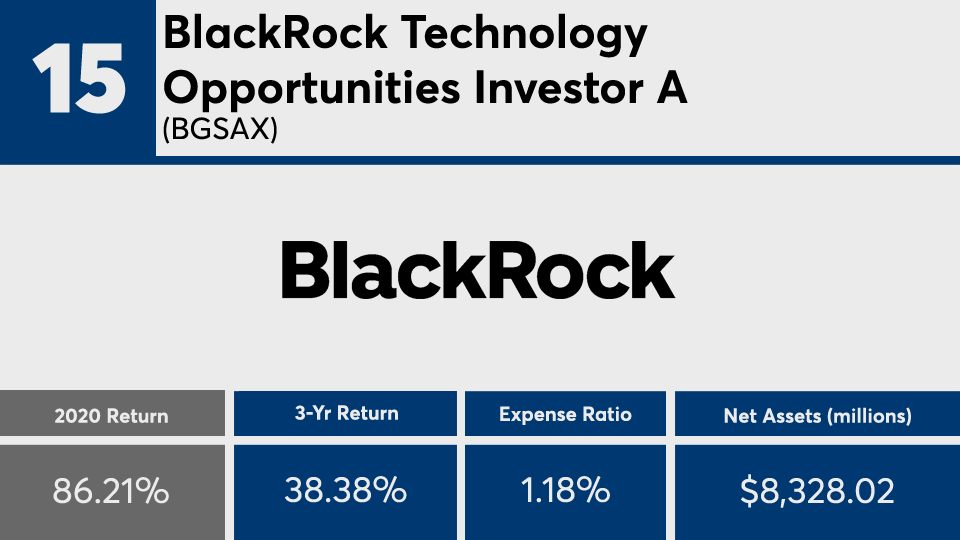

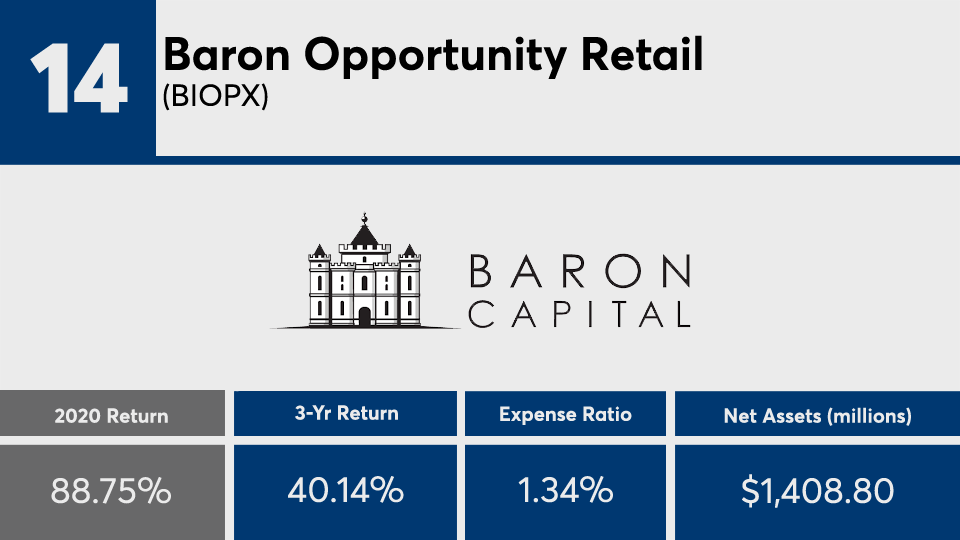

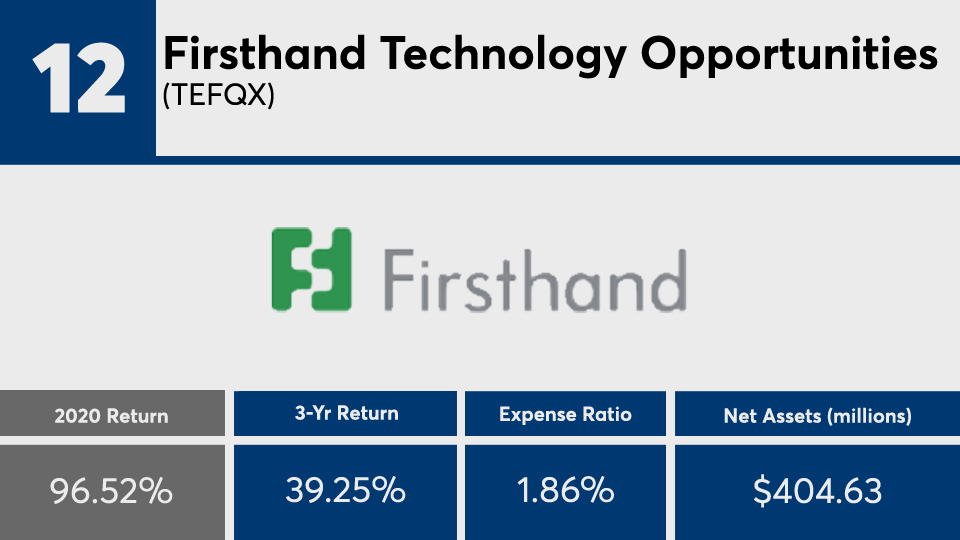

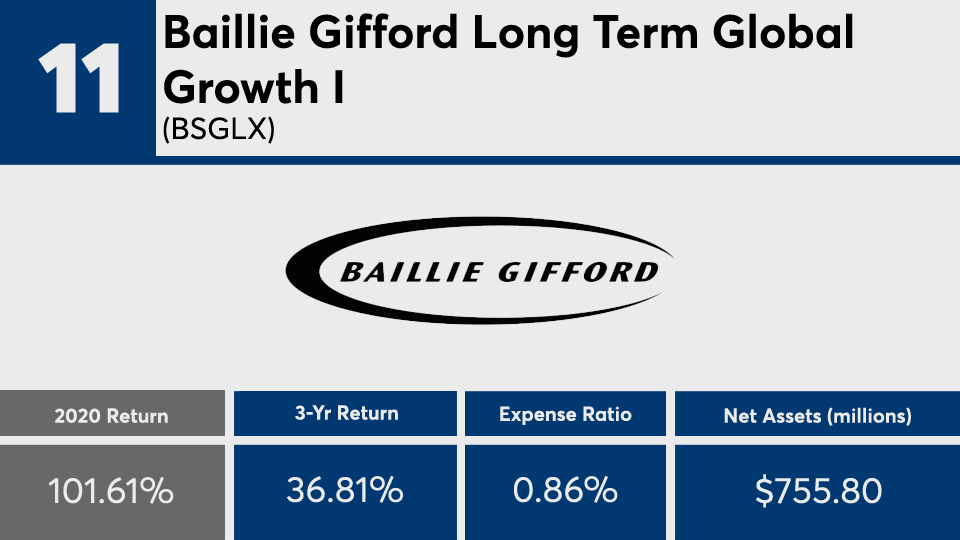

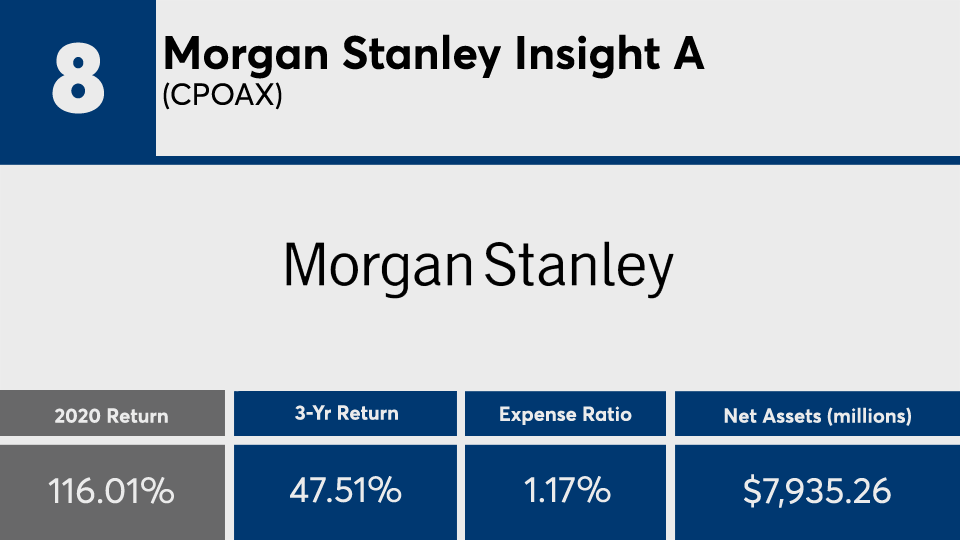

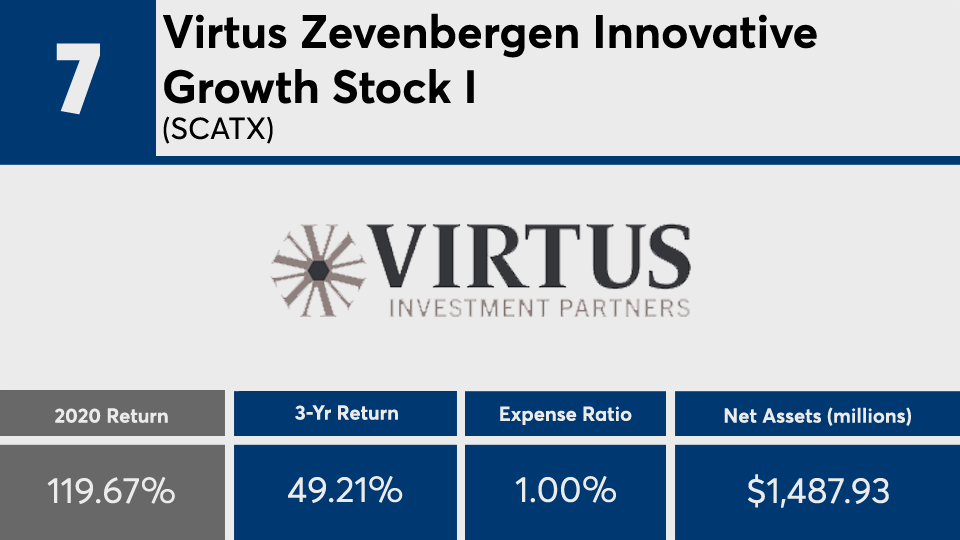

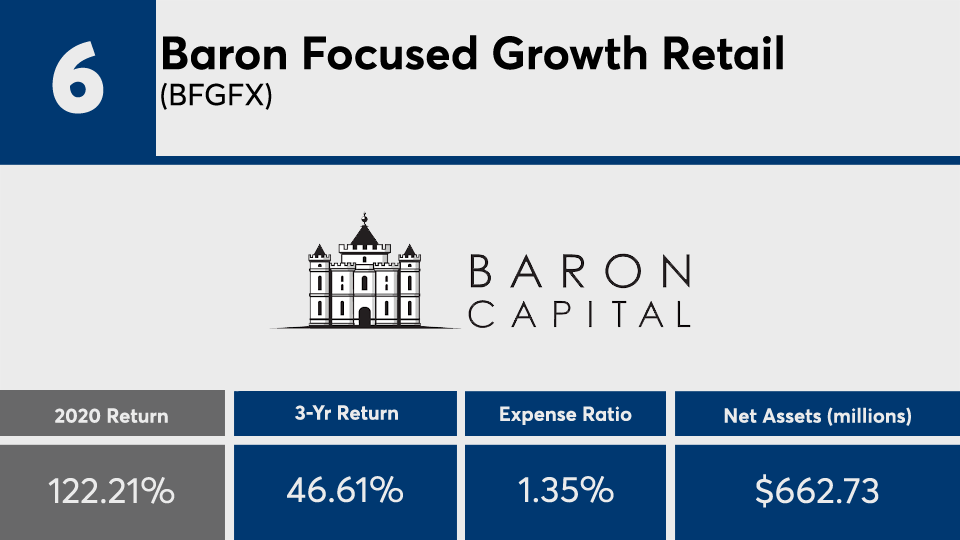

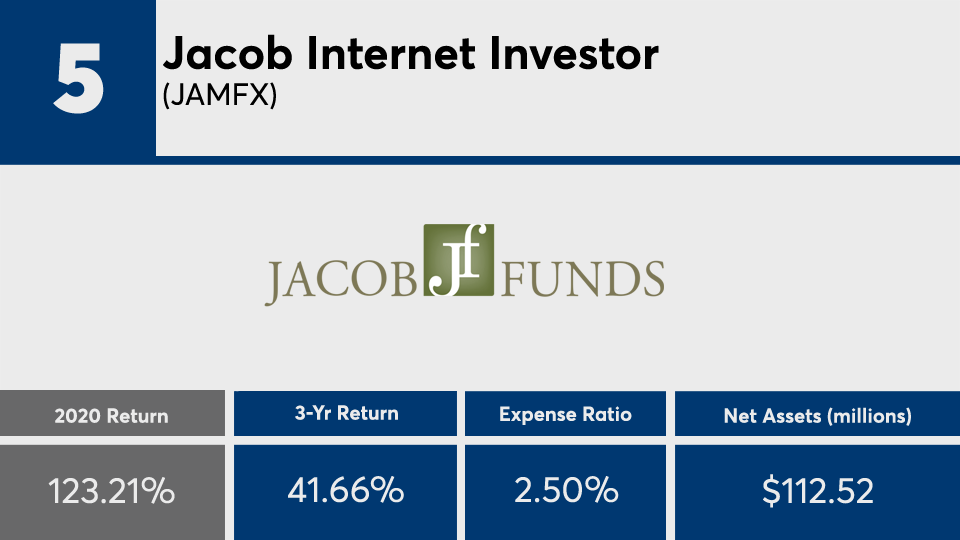

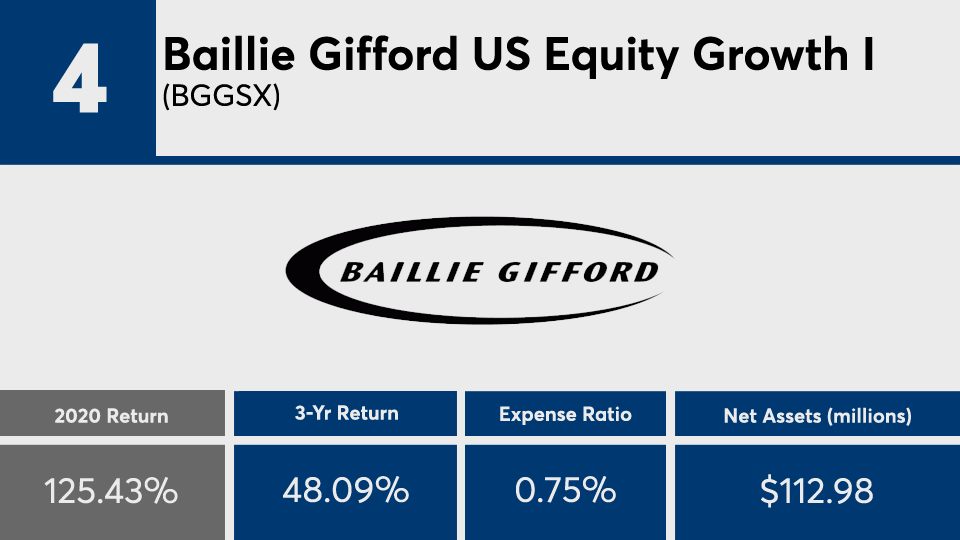

Scroll through to see the 20 actively managed funds with the biggest gains of 2020. Funds with less than $100 million in AUM were excluded, as were funds with investment minimums above $100,000, leveraged and institutional funds. Assets and expense ratios, as well as three-, five- and 10-year returns through Jan. 11 are also listed for each. Minimum initial investments and loads are also listed when applicable. The data show each fund's primary share class and current portfolio manager or managers. All data is from Morningstar Direct.