With markets alternating between spiking fevers and chills as the coronavirus continues to command global attention, a long-term view of the decade’s top-performing health sector funds is vital as advisors strive to keep clients focused on their long-term investing goals.

The decade’s 20 top-performing health sector funds, carrying more than $80 billion in combined assets under management, started out the year with a loss, according to Morningstar Direct

Keep in mind, however, that when compared to broader markets, their half-point overall loss i only a fraction of the Dow’s near 16% loss, as measured by the SPDR Dow Jones Industrial Average ETF (DIA) and the S&P’s loss of roughly 15%, as measured by the SPDR S&P 500 ETF Trust (SPY), year-to-date, data show.

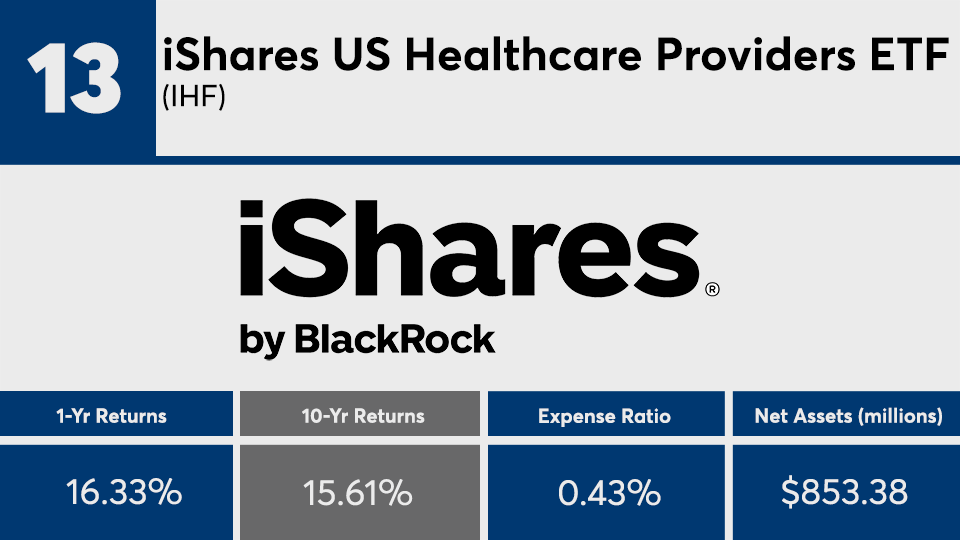

And over the past decade, the same funds have managed a gain of 16.33%, besting the Dow’s 11.07% gain and the S&P’s 11.13% gain, data show.

“For clients with large cash balances, or those under their target stock allocation, they should consider the current market weakness as an opportunity,” says Megan Trask, CFP, managing advisor and director of investment committee at Connecticut Wealth Management. She adds that for any changes clients may consider, advisors must remind them to stick to “their goals, objectives and risk tolerance outlined in their personal financial plan.”

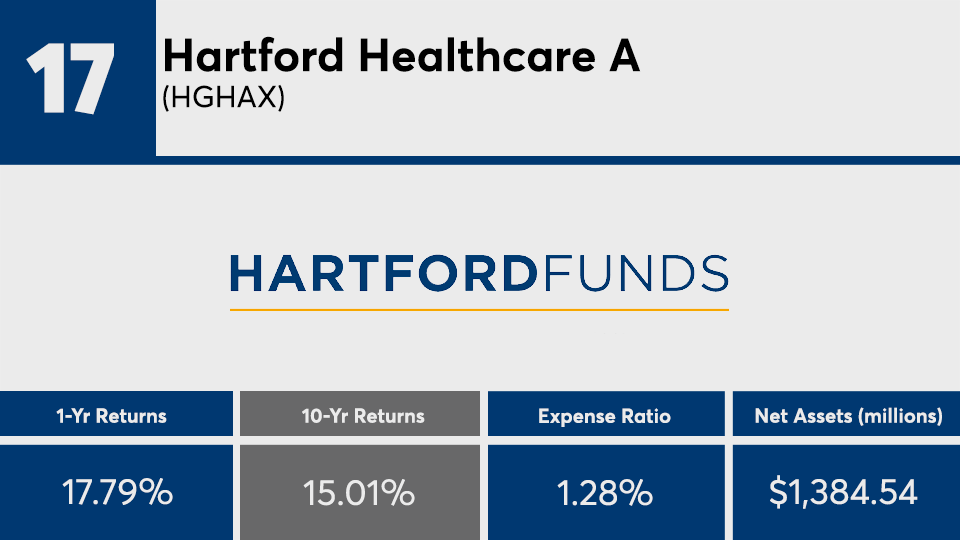

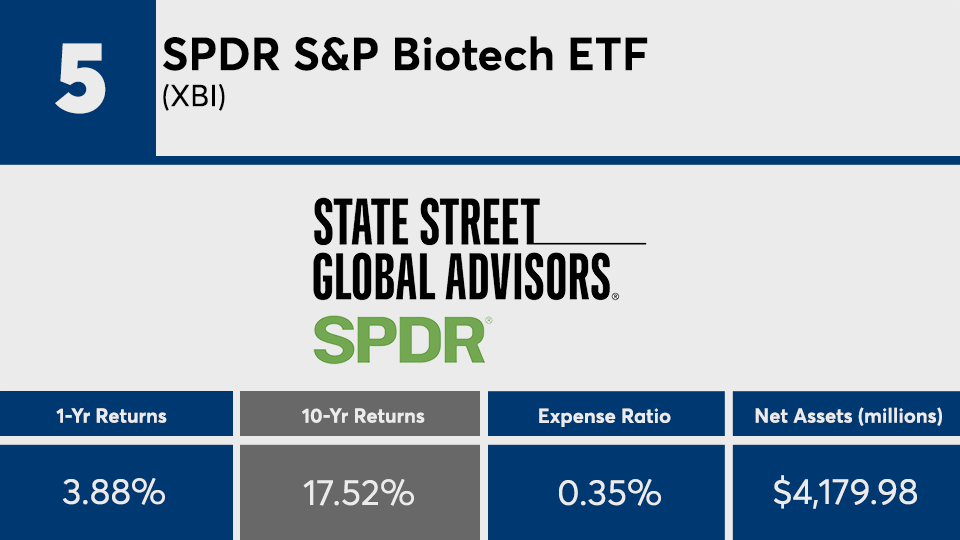

To be sure, the steady gains of the top-20 health funds have a higher price tag than the broader fund industry. At more than 0.68%, the funds were well above the 0.48% industry average, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

The industry’s largest health sector offering, the $43.9 billion Vanguard Health Care Admiral Shares (VGHAX), posted a 10-year gain of 14.12%, a 1-year gain of 11.22% and a YTD loss of 0.95%, data show.

Meanwhile, the industry’s largest overall fund, the $840.9 billion Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), carried a 0.14% expense ratio and a 11.19% return over 10 years, data show.

“It is vital to have a financial plan that has been stress-tested against various market conditions to ensure sustainability and prepare you for volatility,” Trask says.

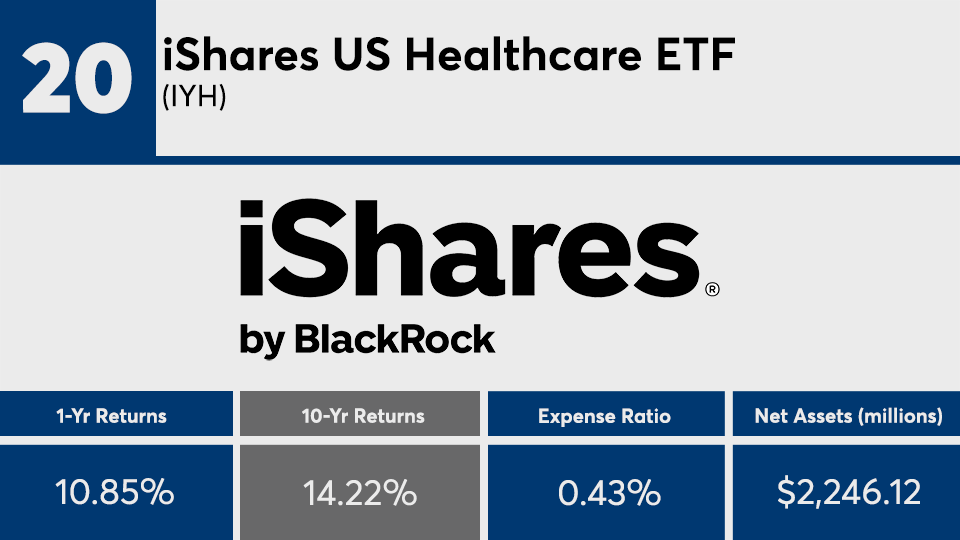

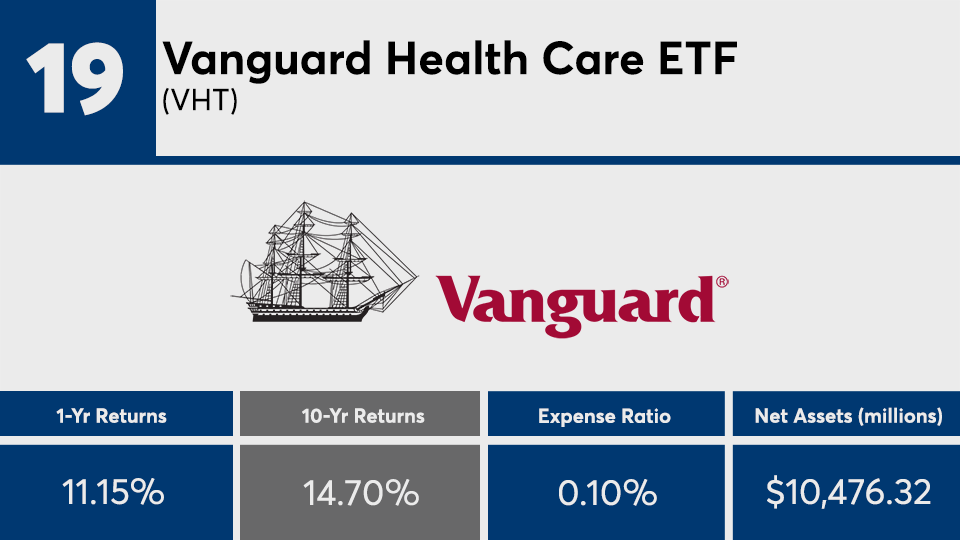

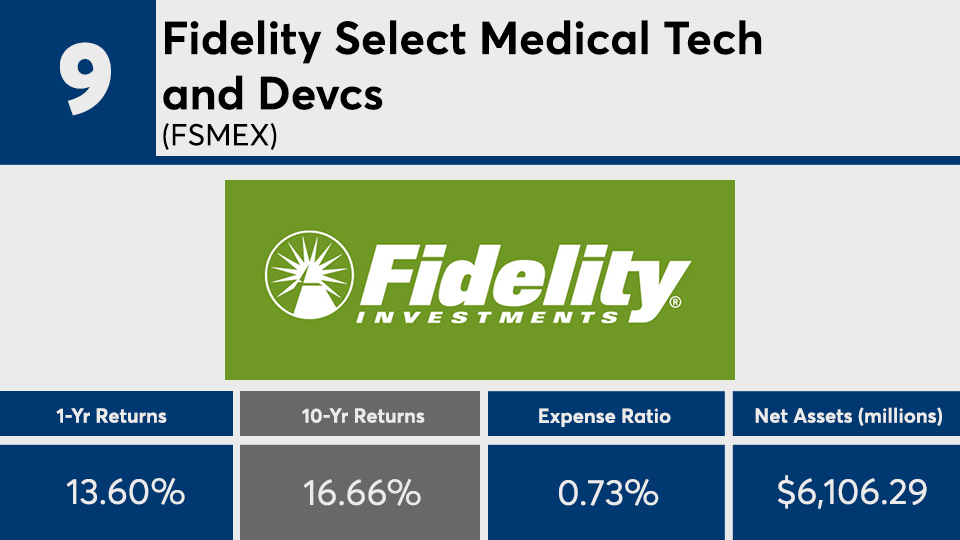

Scroll through to see the 20 health sector funds with the best returns over 10 years through March 4. Funds with less than $500 million in assets under management and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios are listed for each, as well as year-to-date, one-, three- and five-year returns. The data show each fund's primary share class. All data from Morningstar Direct.