The bear market is baring its teeth. How are actively managed U.S. stock funds performing so far?

Not so well, according to Morningstar analyst Jeffrey Ptak, who reviewed fund performance from the beginning of the coronavirus-induced bear market on February 20 through March 12.

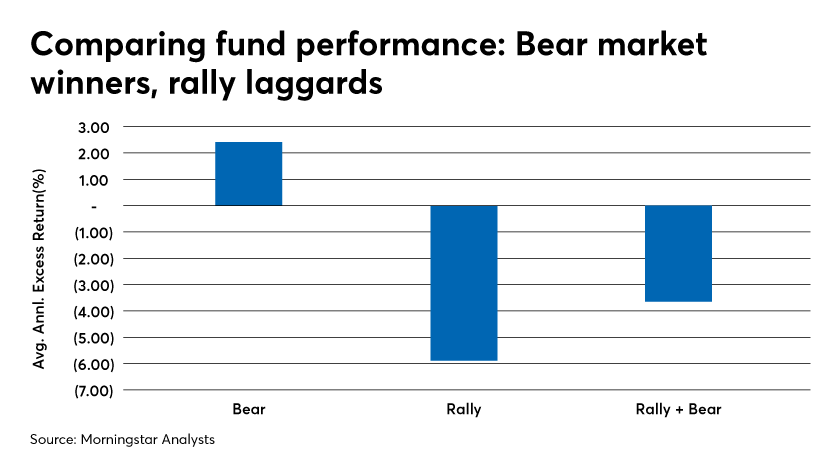

“Funds that beat the market in one period tend to lag in the next,” Ptak says. “Proponents of actively managed funds say the real value will shine through in a bear market. But the data we’ve seen so far doesn’t back that up. There has not been a lot of payoff.”

Slightly more than half active U.S. stock funds beat their indexes during the recent declines through March 12. But only 17% of active U.S. stock funds that have been in existence since December 24, 2018, beat their indexes in the rally and the subsequent downturn.

Here’s a breakdown of what Ptak found: