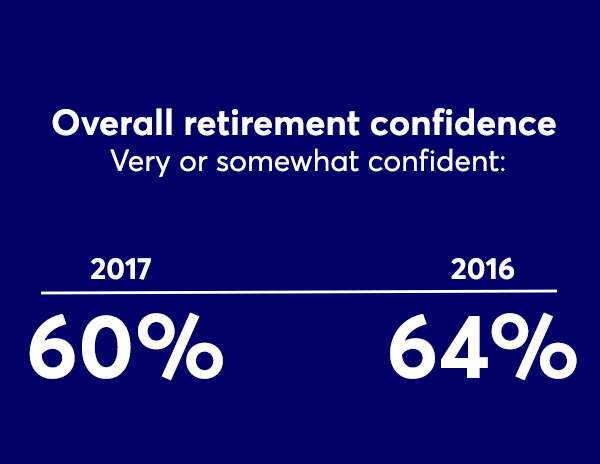

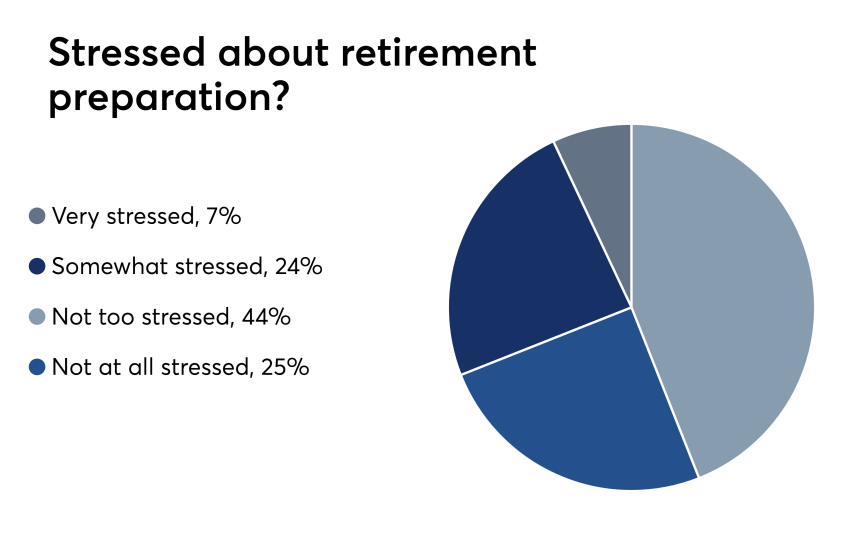

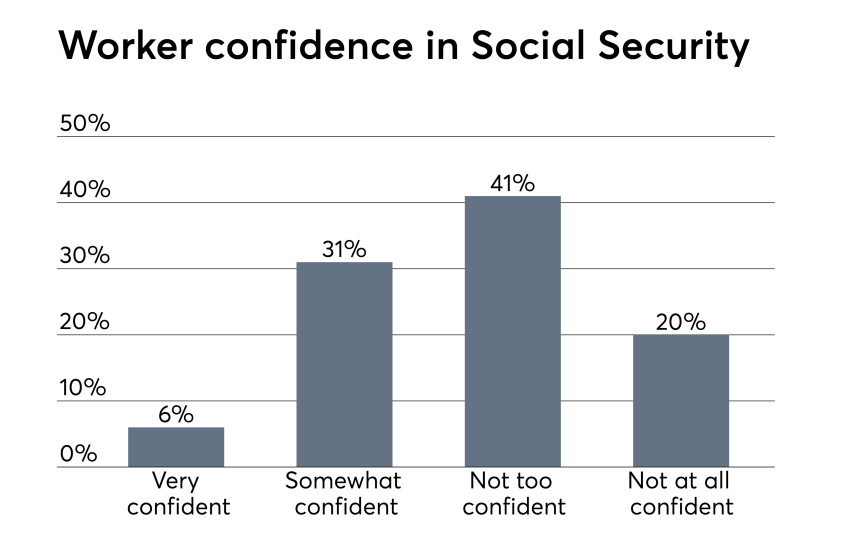

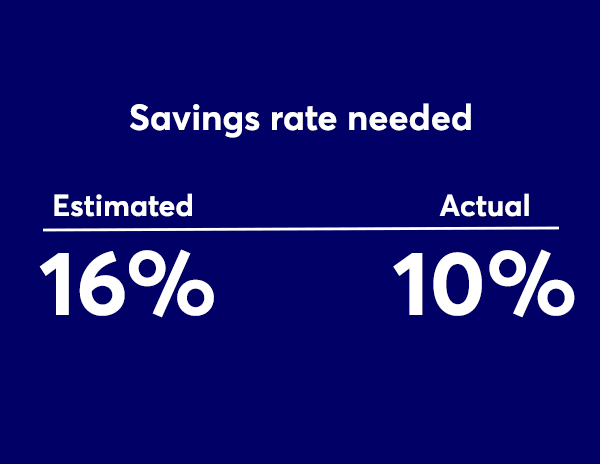

The Employee Benefit Research Institute recently published its 2017 Retirement Confidence Survey, the 27th annual installment and the longest-running such survey. It covers the waterfront on retirement analysis, including worker and retiree confidence (in their own finances, as well as Social Security, among other aspects); stress levels, savings levels and financial education programs.

Scroll through to see a few of the statistics from the survey. All data from EBRI.