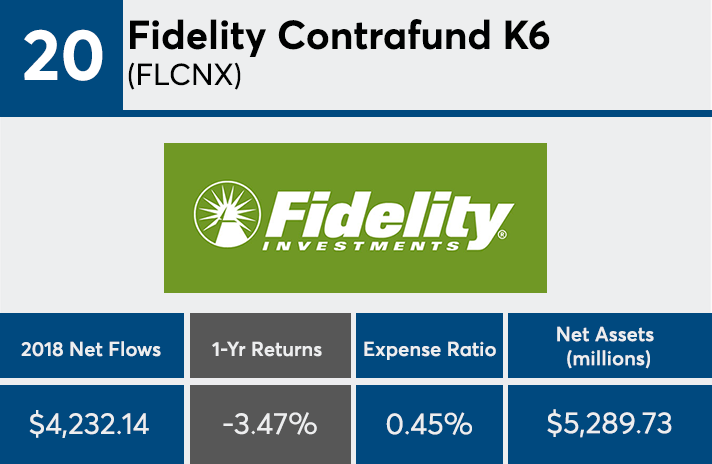

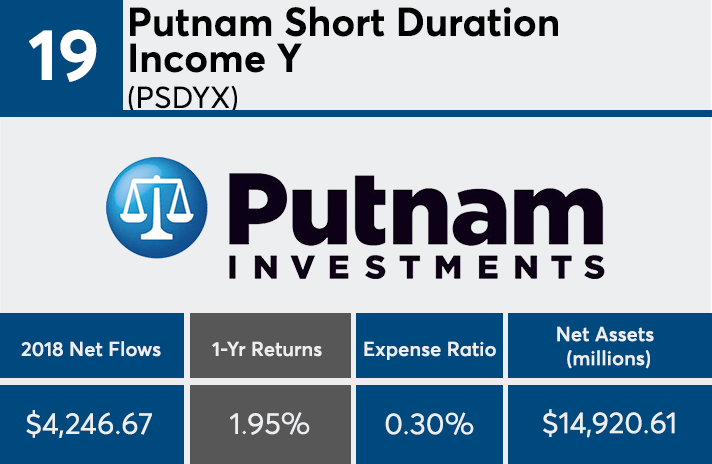

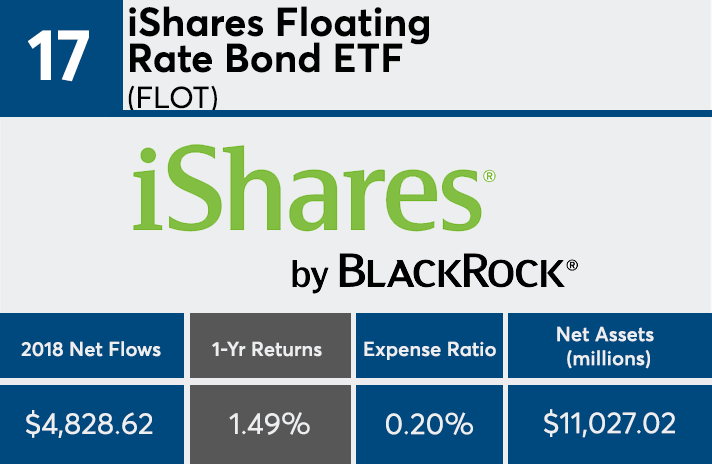

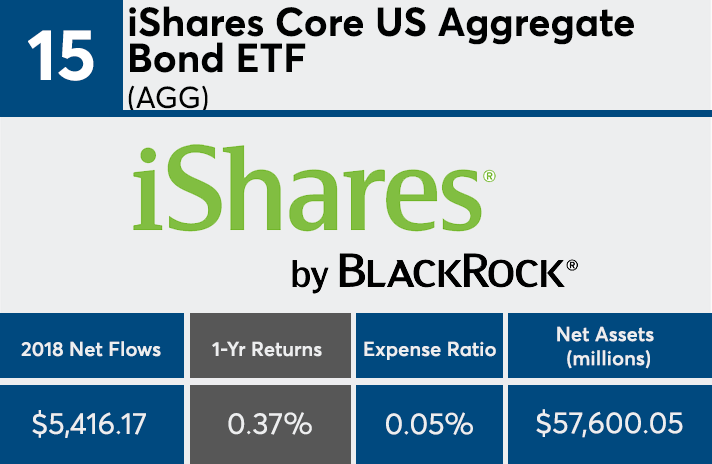

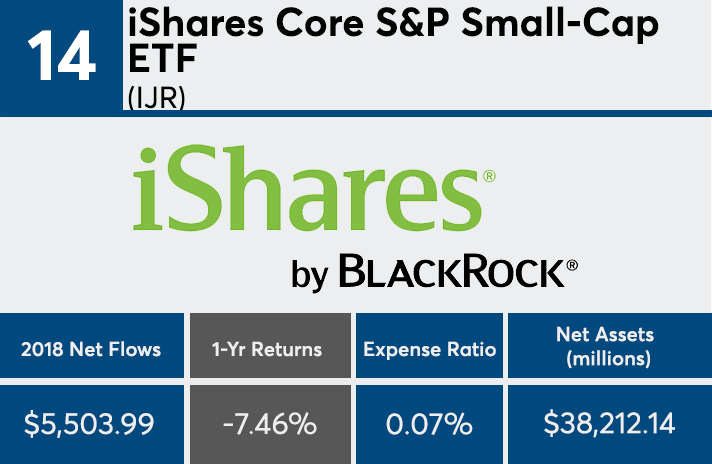

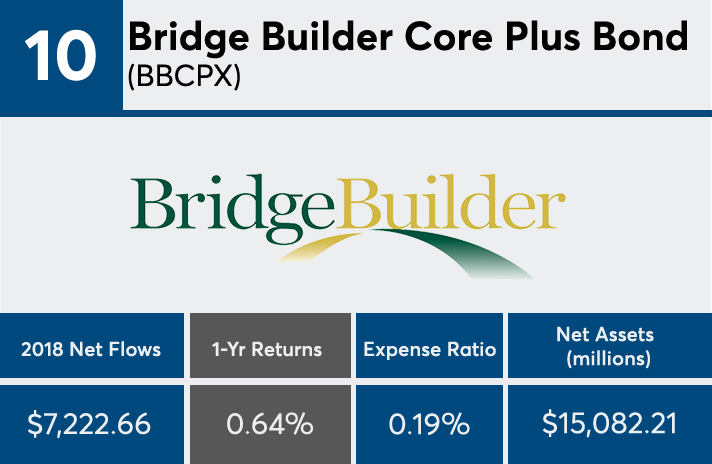

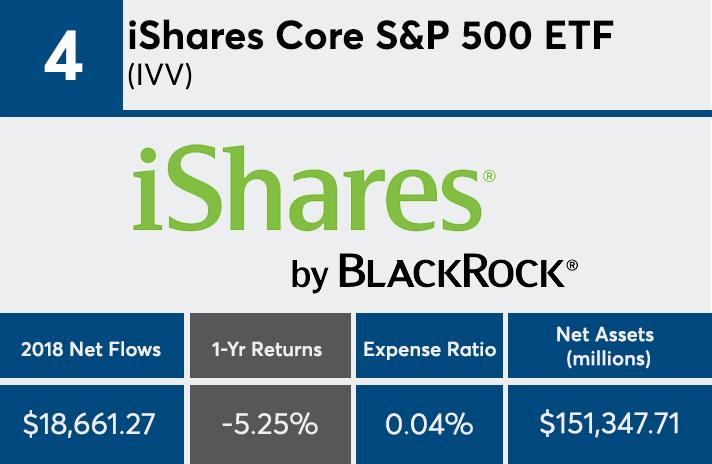

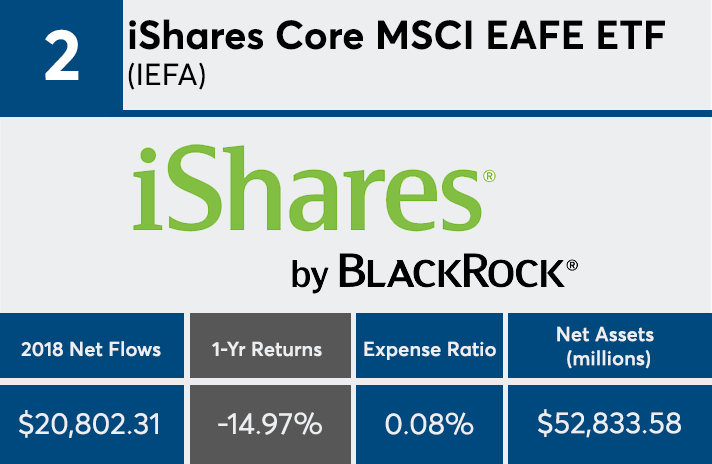

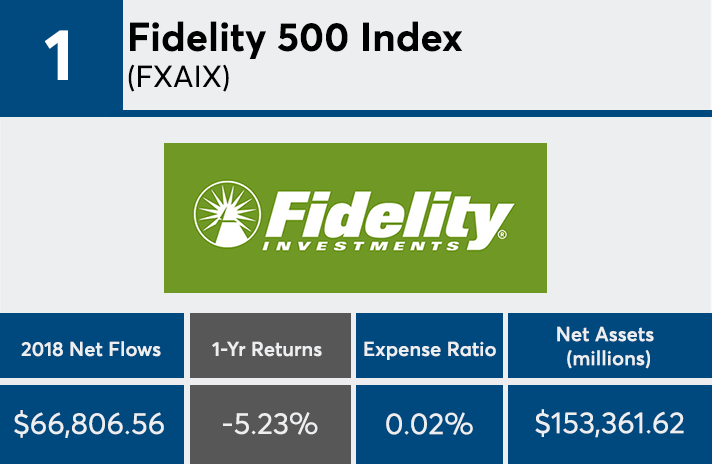

Investors moved nearly a quarter of a billion dollars into the industry’s 20 most popular funds last year, highlighting their persistent appetite for passive. Market volatility, meanwhile, left them with largely negative returns, according to Morningstar Direct data.

Mutual funds and ETFs with the largest inflows of 2018 brought in a combined $241.2 billion in client assets, boosting the funds to nearly $1.2 trillion in combined AUM, data show. Thirteen were ETFs, highlighting investors’ continued demand for passive investments, says Greg McBride, chief financial analyst at Bankrate.

“The trend toward passive investing is evident as index funds dominate the list of funds seeing the biggest inflows,” McBride says.

Despite the flood of new money, funds that made the top 20 also saw an average return of -5.60%, according to Morningstar Direct. Some posted figures well below -15%, data show. Index funds as well as emerging markets and international equity products were among the poorest performers.

“Markets go up, and markets go down — just like the temperature,” McBride says. “Index investors should take these movements in stride and make sure they’re appropriately allocated for their goals and risk tolerance.”

It should also be noted that the average expense ratio among this list of funds was 0.14%, nearly 40 basis points lower than the average fund, according to Morningstar. Investors paid an average of 0.52% for fund investing in 2017, according to a Morningstar study that reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs. That was 8% less than how much they paid in 2016.

Scroll through to see the 20 mutual funds and ETFs with the largest 2018 inflows. Flows were reported on Dec. 31 and one-year daily return figures are as of Jan. 6. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund are also listed. All data from Morningstar Direct.