As historic market volatility in late February and early March prompted clients to jump online in droves to check portfolios, cracks began to appear.

Websites were slow and plagued with technical glitches. Charles Schwab, Fidelity Investments and Vanguard Group experienced service disruptions, while trading app Robinhood

While many challenges stemmed from soaring demand and have since been solved, there will be fallout, according to the findings of J.D. Power’s

These episodes undermine client loyalty, says Michael Foy, J.D. Power’s senior director of wealth and lending intelligence. People re-evaluate brands and services when they are uncertain or have normal routines disrupted. While they may not make an immediate change, Foy says, a poor experience can form lasting impressions.

“A lot of firms are having call centers overwhelmed by volume,” says Foy. “Being able to respond to customers, including with human interaction where necessary, is really a critical driver of loyalty.”

On the flip side, companies that met the surge in demand for information rose in the J.D. Power rankings.

The J.D. Power study, now in its 18th year, is based on responses from 5,511 self-directed investors who either manage investments themselves or seek additional help but don’t use a full-service advisor. The results underscore the value of working with a professional. Overall satisfaction among investors who are able to connect with a human is 21 points higher than those who only use self-directed digital tools.

The most satisfied survey respondents use a combination of web, mobile and human interaction with the investment firm, while the least satisfied either have no interaction or mobile-only ways to connect.

Websites remain the biggest source of problems, accounting for more than a third of all reported issues over the last two years of J.D. Power’s report.

Though the study was fielded from November 2019 through January 2020, Foy says results are meaningful to the current global crisis.

“One of the things we’re doing is trying to think of results not only through the lens of what was happening then — which feels like a long time ago given how the world has changed in the last few weeks — but also think about what those results mean in the world we’re in now,” Foy says.

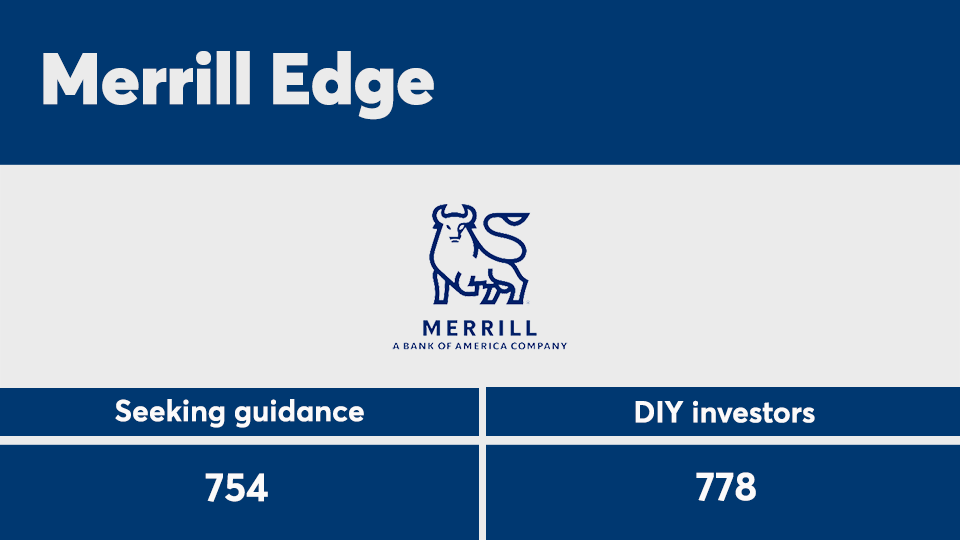

For self-directed investors who seek additional guidance, Vanguard gained 14 points (out of 1,000) and reclaimed the top spot on J.D. Power’s customer satisfaction index. Charles Schwab ranked a close second while Fidelity, last year’s top firm, fell to fourth place.

Fidelity fared better among DIY investors, gaining 30 points and claiming third place.

“Both firms tend to be strong on pricing and value for somewhat different reasons,” Foy said of Schwab and Vanguard. “Schwab has always been a leader … based on things like their accountability guarantee. They have always marketed themselves in terms of providing transparency and value. Vanguard is a leader in low-cost investing.”

Fidelity declined to comment. A Vanguard spokesperson attributed its improved score to investments in people, technology and

The study focuses on firms named by customers as their primary investment firm. For this reason, Robinhood and robo-advisors like Wealthfront and Betterment did not have enough market share to be included, Foy says.

To see how firms stacked up against each other this year, scroll down. To see last year’s results,