-

As part of a two-step deal involving Australian investment bank Macquarie Group, LPL will pick up 900 advisors and $63 billion in assets.

December 2 -

Planners and experts dive into wirehouse pay, charging clients at a higher rate, emerging business models and other key issues.

December 1 -

James Booth’s seven-year fraud bilked investors out of nearly $5 million.

November 24 -

The No. 1 IBD is responsible for nearly half of the dozen mega-moves in its sector this year.

November 24 -

Necessary new approaches include better cultural understanding, more flexibility for new entrants and more outreach, advisors and executives say.

November 19 -

In a surprise announcement, Private Advisor Group tapped Moore as CEO nearly two years after he left Cetera for undisclosed medical reasons.

November 18 -

It’s one of the largest recruiting moves of the year in the independent broker-dealer sector.

November 16 -

CEO Dan Arnold cites growth in traditional channels and in recently launched models that could bring even more opportunities.

November 3 -

The nation’s largest IBD made its first tech deal this year for a firm that has $120 billion in assets on its platform.

October 27 -

The No. 1 IBD is keeping up the recruiting momentum that’s sustaining record headcounts and billion-dollar moves.

October 23 -

The No. 1 IBD’s 2,500-advisor bank channel will add 285 more reps when two massive investment programs affiliate next year.

October 9 -

Bleakley Financial Group also picked up an ex-hedge fund portfolio manager while expanding its national footprint.

September 22 -

The No. 1 IBD has completed three of the sector’s 10 largest recruiting moves of the year.

September 18 -

Lower transaction costs can often come with higher expense ratios at the nation’s largest IBD.

August 26 -

The latest roundup of news in the IBD and RIA channels comes in a time of economic turmoil and big transactions.

August 14 -

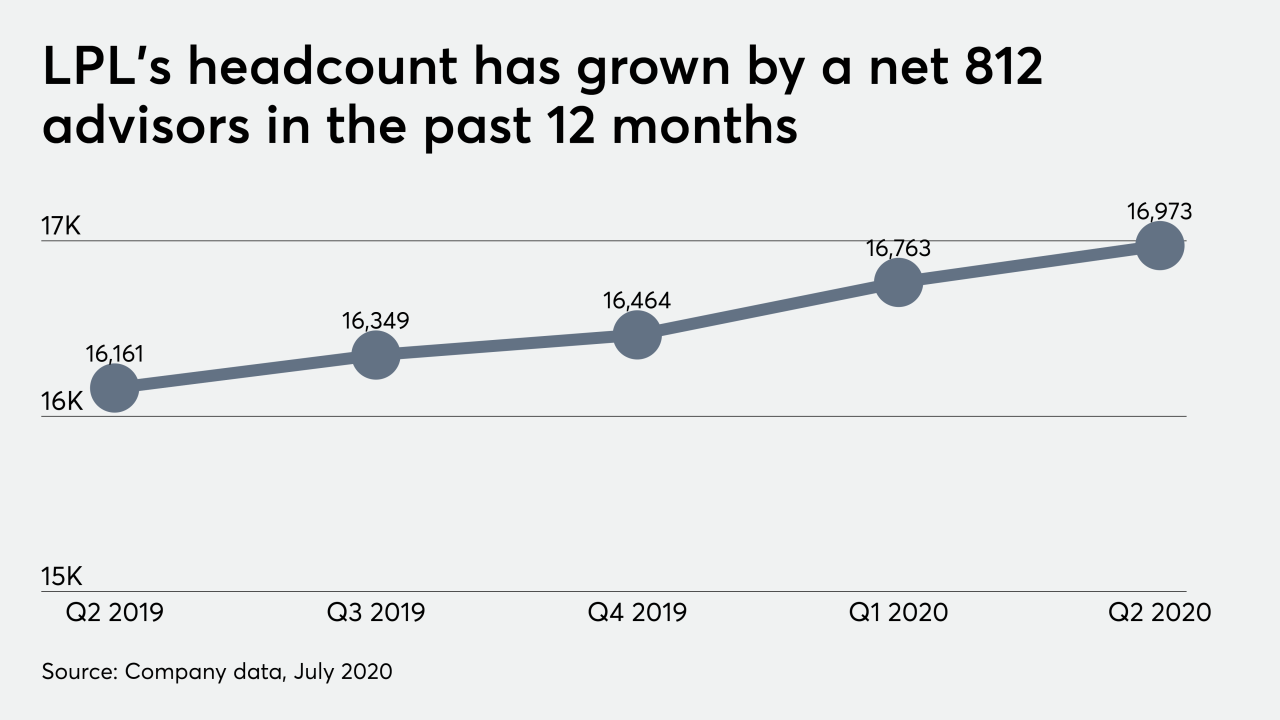

During Andy Kalbaugh’s tenure with the No. 1 IBD, its headcount grew by more than 50% to nearly 17,000 reps.

August 14 -

The firm will also pay a penalty and offer to buy back variable annuities the former broker sold to 21 other investors.

August 11 -

With higher compensation offers and a track record of independence, the No. 1 IBD is “challenging the status quo,” its head recruiter says.

August 7 -

The No. 1 IBD revealed new details of its W-2 affiliation after it followed rivals into the employee channel with an acquisition it made last year.

August 5 -

The independent broker-dealers big enough to serve the most financial advisors enjoy advantages but face distinct challenges.

July 31