-

The firm broke off from its OSJ and followed four others of its type in leaving the No. 1 IBD after a change in its RIA rules.

May 15 -

The securities watchdog reprimanded the broker-dealers for allegedly not distinguishing their services from those of the credit unions they did business with.

May 10 -

The largest IBD network is integrating data analytics into its recruiting and client leads after embarking on other major changes in recent months.

May 10 -

The No. 1 IBD has completed the NPH acquisition, but CEO Dan Arnold unveiled further growth initiatives amid challenges to its dominance.

May 4 -

State regulators and the No. 1 IBD struck a settlement after investigators found the firm guilty of negligence and a failure to supervise.

May 2 -

It's been a tough year for bank wealth management, but these bosses kept their advisors on track and boosted business along the way.

May 2 -

Here we present the program managers who topped the list in each metric used to determine the main Top 25 ranking.

May 2 -

Straight from the horses' mouths: the biggest management challenges and business objectives from the Top 25 Program Managers.

May 2 -

Given current market forces — the commoditization of advice being just one — you may be facing elimination if you continue business as usual. Here's a guide to getting on the right track.

May 2 Stathis Partners

Stathis Partners -

A massive acquisition also helped boost the No. 1 IBD’s headcount by 833 advisors year-over-year to 15,210.

April 30 -

The No. 1 IBD announced the new NTF offerings and additional flattened prices for its corporate RIA.

April 26 -

The products have grown in popularity after undergoing significant changes in recent years.

April 25 -

Former CEO Mark Casady disclosed in arbitration testimony what led to the firing that resulted in a $30 million claim against the firm.

-

Advisor Group firm Woodbury Financial targets the bank brokerage channel.

April 11 -

Bill Hamm’s Independent Financial Partners has grown more than fivefold in 10 years with the No. 1 IBD.

April 10 -

The $263 million practice’s new IBD reported record recruiting for 2017, helped in part by the movement of advisors following LPL’s massive acquisition.

April 9 -

Dan Arnold received a 155% raise in his first year atop the nation’s largest independent broker-dealer.

April 2 -

Cetera has provided financing and other services in more than 250 acquisitions across the IBD network since 2015.

March 23 -

The securities-backed lending platform provides liquidity to borrowers and transparency to advisors, the investment banking giant says.

March 22 -

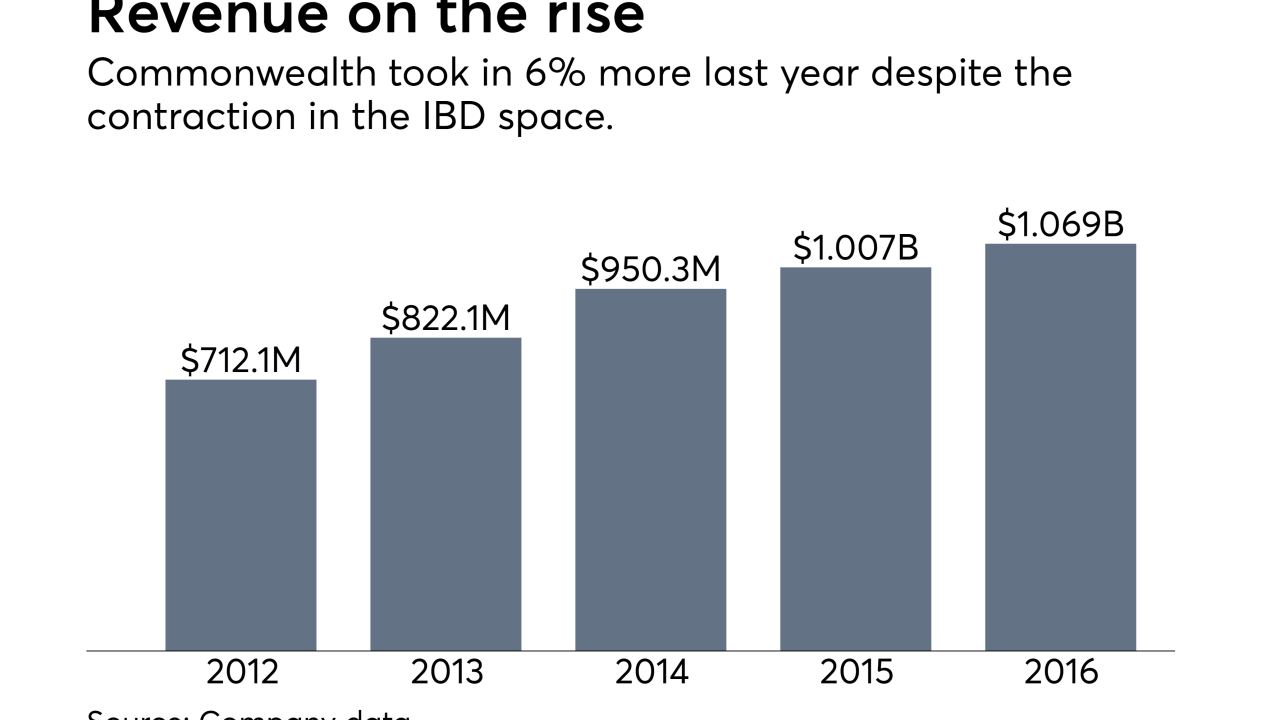

The 1,778-advisor firm constitutes the largest privately held IBD, underscoring the growing appeal of boutique-like models.

March 22