Three advisors managing more than $350 million in combined client assets joined LPL Financial, as the firm’s recruiting efforts move past retaining a crop of 2,000 advisors from a major acquisition.

Tom Anderton and Ryan Howard bolted Oppenheimer for 626 Financial, a Kalamazoo, Michigan-area practice founded in 2009 by Anderton’s uncle and cousin. Ric Kellogg left Merrill Lynch for IHT Wealth Management, a Chicago-based hybrid RIA launched in 2014 by a fellow Merrill alum.

LPL announced their moves last week. This week, the No. 1 independent broker-dealer will provide details in its earnings report on

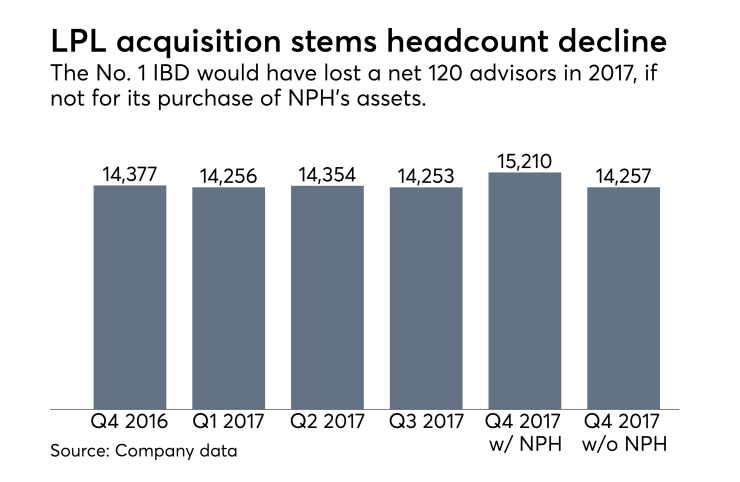

LPL CEO Dan Arnold has estimated that LPL will absorb roughly 70% of their business and 2,000 advisors. The transition already allowed the firm to avoid a year-over-year drop of a

Anderton went indie with the family LPL practice, he says, to serve his team’s 150 to 200 clients with $230 million in assets using a higher level of care as a CFP fiduciary, while gaining more autonomy over investments and interactions with clients.

“It was the technological advantage which frees up our team’s time to allow us to spend more time with clients or research investments,” he says. “And we can do both of those things better.”

A spokeswoman for Oppenheimer declined to comment on the exits of Anderton and Howard, while representatives for Merrill Lynch didn’t immediately respond to a request for comment on Kellogg’s move.

-

The No. 1 IBD announced the new NTF offerings and additional flattened prices for its corporate RIA.

April 26 -

IHT Wealth Management now has $2.4 billion in client assets.

October 19 -

The deal is only the first step in a major growth plan, according to the acquiring firm’s founder.

March 13

One of the biggest notable losses came from Merrill Lynch, which lost a team managing $1 billion to the independent space.

Robert and Brant Shrimplin had preceded their relative, Anderton, in leaving Oppenheimer to open their Portage-based firm nine years ago. Anderton and Howard officially aligned with LPL on Feb. 22, according to FINRA BrokerCheck.

Howard had spent two years at Oppenheimer following tenures at PNC Investments, M&T Securities and MML Investors Services. Anderton began his financial services career in 2006 at Oppenheimer. Registered sales assistant Karen Morse came over from Oppenheimer as well, under the team’s move.

Kellogg, the ex-wirehouse broker managing $123 million in client assets, spent a dozen years at Merrill before joining IHT Wealth Management under LPL on March 29, BrokerCheck shows. He entered the industry in 1995 with AXA Advisors.

IHT made