-

Ross Gerber says he left the firm to avoid its strict oversight of his press interviews and social media.

March 19 -

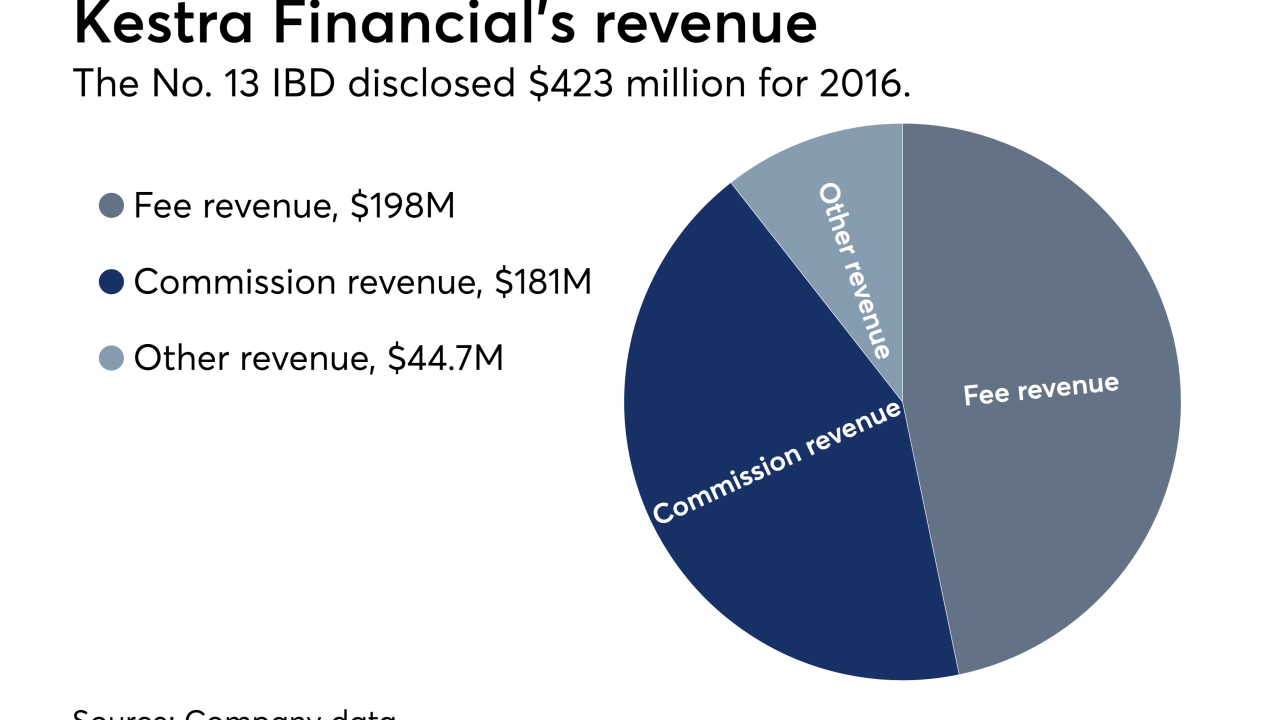

The No. 13 IBD has added 183 advisors through its recruiting efforts in the past two years.

March 19 -

The deal is only the first step in a major growth plan, according to the acquiring firm’s founder.

March 13 -

Advisors with 200 to 300 clients over-performed more so than peers with bigger sales territories, according to a new study by LPL and Kehrer Bielan.

March 12 -

The math works: Banks get a boost to their growth plans, while independent advisors get one more option for their succession planning.

March 9 -

At least three dual practices with nearly $1.5 billion in client assets have left since the No. 1 IBD unveiled the new guidelines.

March 8 -

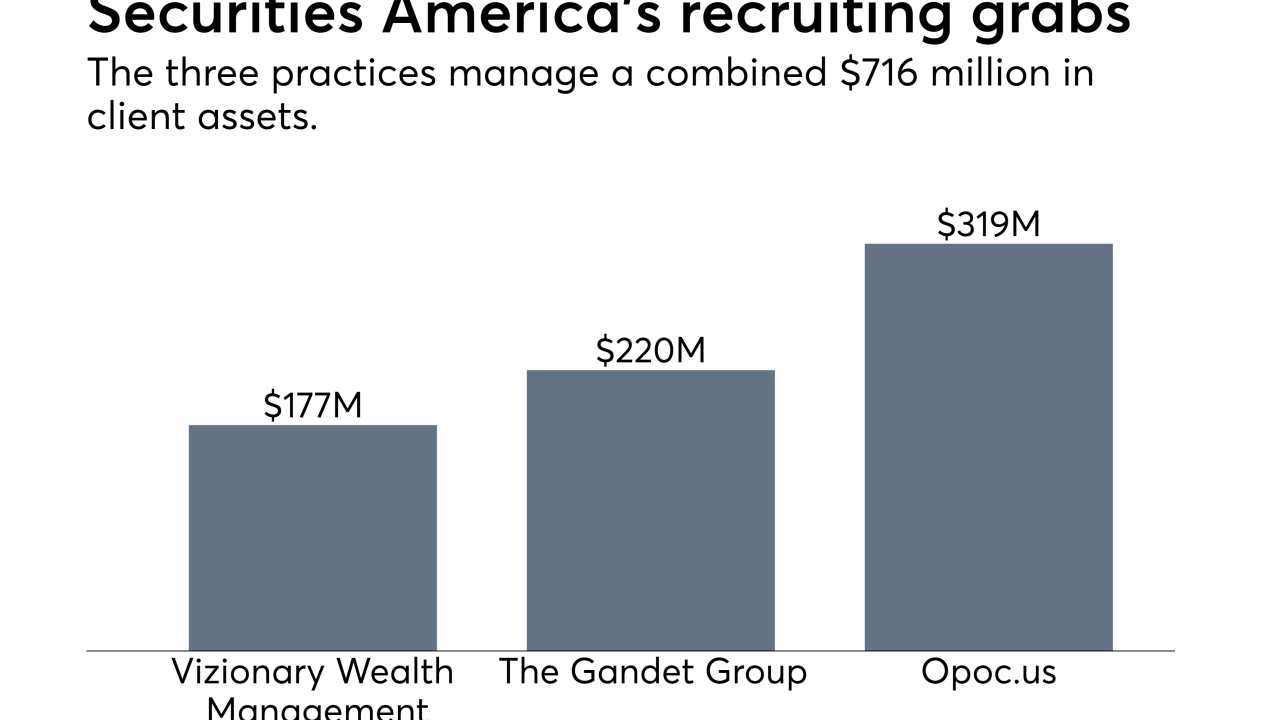

The No. 9 IBD has emerged as one of the major players in a tough recruiting fight after the massive acquisition.

March 7 -

After acquiring four firms’ assets, the industry giant still faces big challenges ahead.

March 2 -

Funds managed by Marco “Mick” Hellman sold most of their holdings, while CEO Dan Arnold received options worth $5 million.

February 28 -

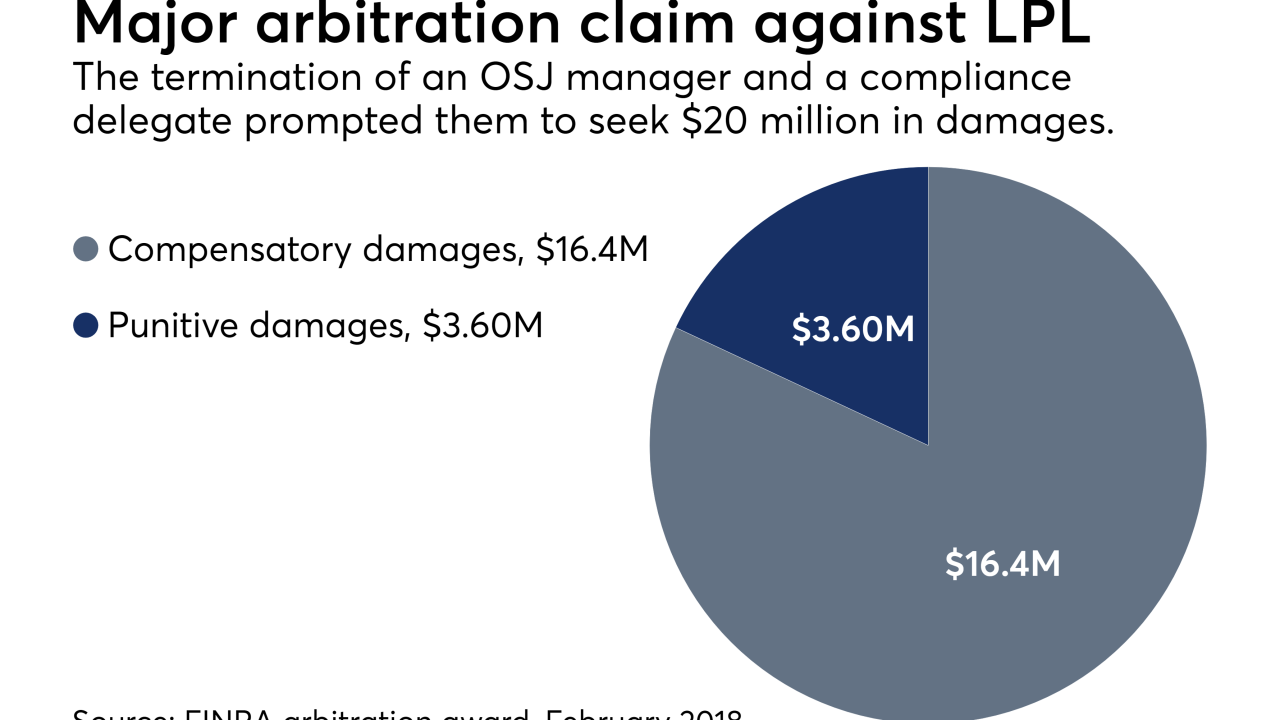

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20 -

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

February 20 -

The firm is tapping a pool estimated by LPL to be as large as 1,200 brokers with $35 billion in client assets.

February 14 -

The Waterbury, Connecticut-based bank wanted to ensure that it was meeting the technology expectations of clients across the wealth spectrum.

February 13 -

Private Advisor Group reported impressive growth even as other practices of its kind have left the No. 1 IBD.

February 12 -

As lure, the firm deploys a $52 million technology platform that is the “best that I've seen.”’

February 8 -

Pole-vaulting advisor Mark Cortazzo’s practice marked at least the second hybrid in three months to leave the firm for Mutual Securities.

February 6 -

Ameriprise is looking to reverse a decline in its headcount.

February 6 -

L&N Federal Credit Union was looking for a boutique-style firm following Invest's acquisition by LPL.

February 5 -

More than $34 billion in client assets moved into the No. 1 IBD’s fold in the first part of the acquisition.

February 2 -

Texas securities watchdog derided the advisor for not considering the costs associated with an equity trading strategy he employed for certain clients.

January 31