-

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

February 20 -

The firm is tapping a pool estimated by LPL to be as large as 1,200 brokers with $35 billion in client assets.

February 14 -

The Waterbury, Connecticut-based bank wanted to ensure that it was meeting the technology expectations of clients across the wealth spectrum.

February 13 -

Private Advisor Group reported impressive growth even as other practices of its kind have left the No. 1 IBD.

February 12 -

As lure, the firm deploys a $52 million technology platform that is the “best that I've seen.”’

February 8 -

Pole-vaulting advisor Mark Cortazzo’s practice marked at least the second hybrid in three months to leave the firm for Mutual Securities.

February 6 -

Ameriprise is looking to reverse a decline in its headcount.

February 6 -

L&N Federal Credit Union was looking for a boutique-style firm following Invest's acquisition by LPL.

February 5 -

More than $34 billion in client assets moved into the No. 1 IBD’s fold in the first part of the acquisition.

February 2 -

Texas securities watchdog derided the advisor for not considering the costs associated with an equity trading strategy he employed for certain clients.

January 31 -

Life Brokerage Financial has 80 advisors and 40 full-time staff and will join the firm next month.

January 30 -

Advisor Group set a record for its recruiting in 2017, and Securities America announced more than a dozen fourth-quarter grabs.

January 25 -

The RIA aggregator inked another big-figure deal after netting more than two dozen firms last year.

January 18 -

The Short Hills, New Jersey-based bank will look to Cetera to accelerate the program's growth.

January 10 -

Wells Fargo, Merrill Lynch, UBS and Morgan Stanley all lost talent in 2017.

January 3 -

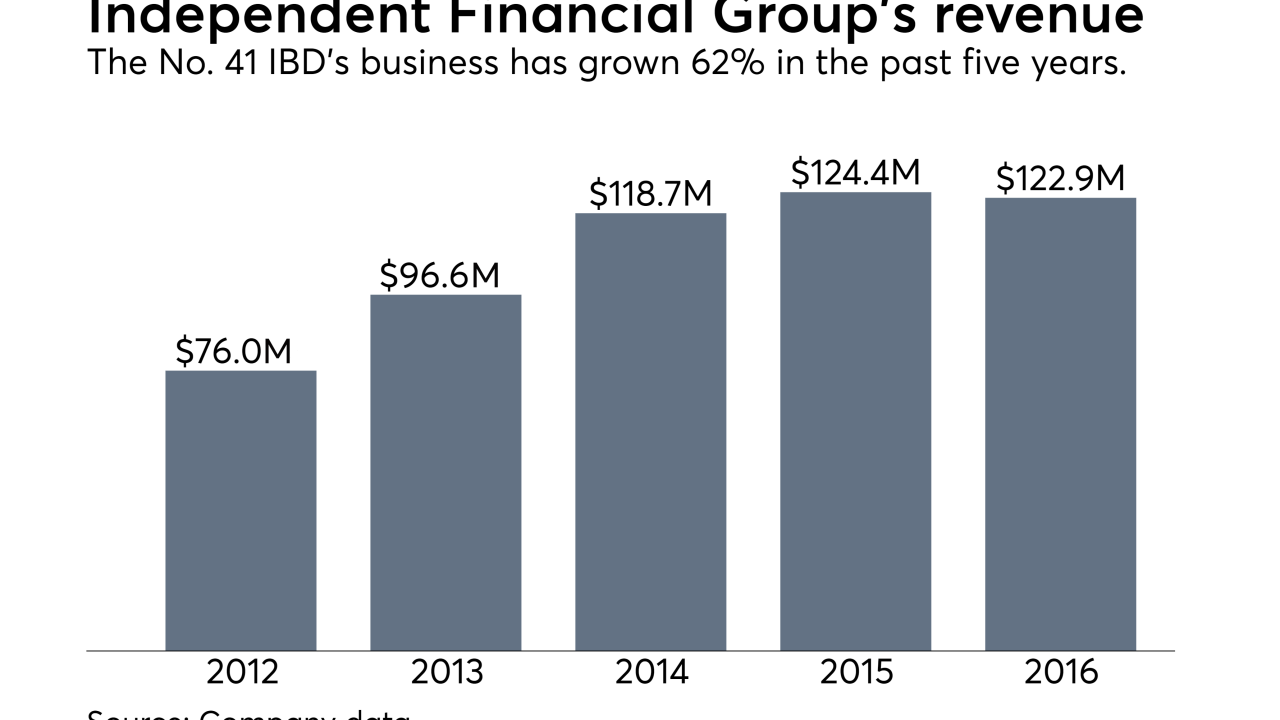

Independent Financial Group has grabbed 14 practices with 44 advisors from NPH firms since the LPL deal.

January 3 -

Caleb Fackrell repeatedly called his behavior “insane” in his testimony, according to transcripts obtained by Financial Planning.

December 22 -

The No. 20 IBD unveiled a total of 15 practices joining its ranks in the fourth quarter.

December 21 -

The bank chose to integrate its program after its acquisition of 18 New York-based branches of First Niagara Bank last year.

December 19 -

The five consultants spent a combined 55 years at the No. 1 IBD, and they set up shop near two of its main corporate offices.

December 18