-

The No. 1 IBD announced the new NTF offerings and additional flattened prices for its corporate RIA.

April 26 -

The products have grown in popularity after undergoing significant changes in recent years.

April 25 -

Former CEO Mark Casady disclosed in arbitration testimony what led to the firing that resulted in a $30 million claim against the firm.

-

Advisor Group firm Woodbury Financial targets the bank brokerage channel.

April 11 -

Bill Hamm’s Independent Financial Partners has grown more than fivefold in 10 years with the No. 1 IBD.

April 10 -

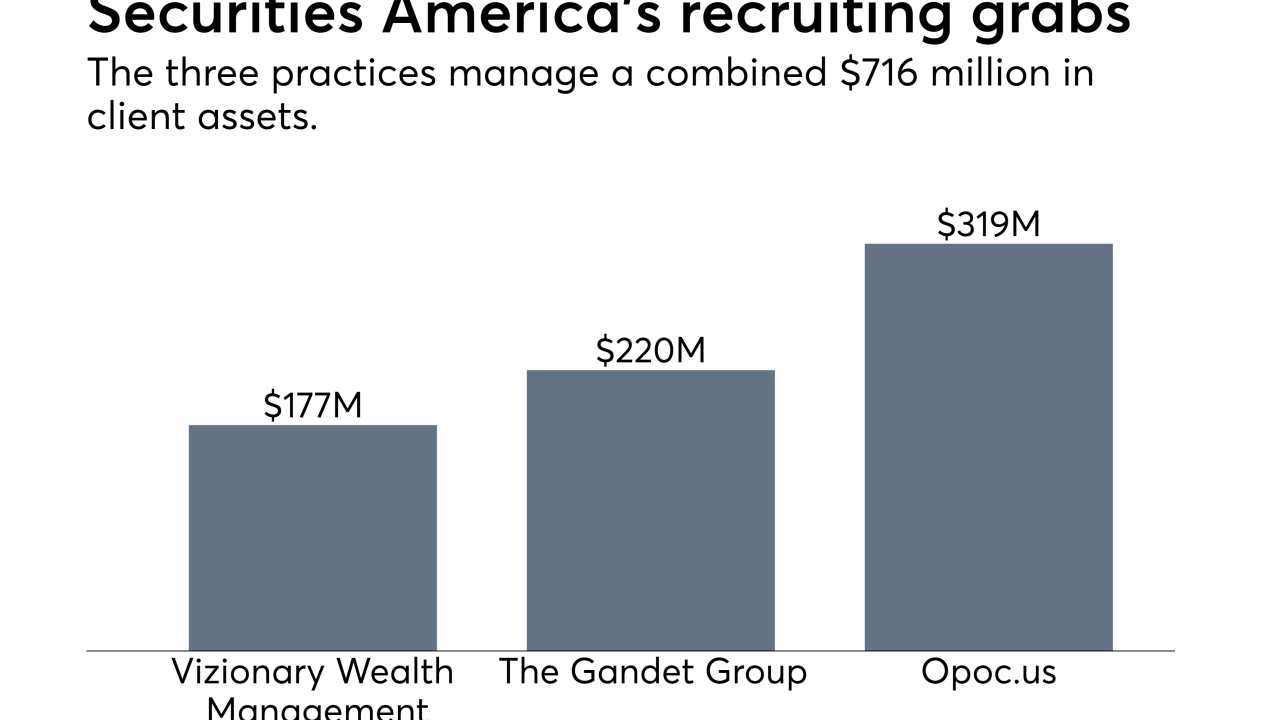

The $263 million practice’s new IBD reported record recruiting for 2017, helped in part by the movement of advisors following LPL’s massive acquisition.

April 9 -

Dan Arnold received a 155% raise in his first year atop the nation’s largest independent broker-dealer.

April 2 -

Cetera has provided financing and other services in more than 250 acquisitions across the IBD network since 2015.

March 23 -

The securities-backed lending platform provides liquidity to borrowers and transparency to advisors, the investment banking giant says.

March 22 -

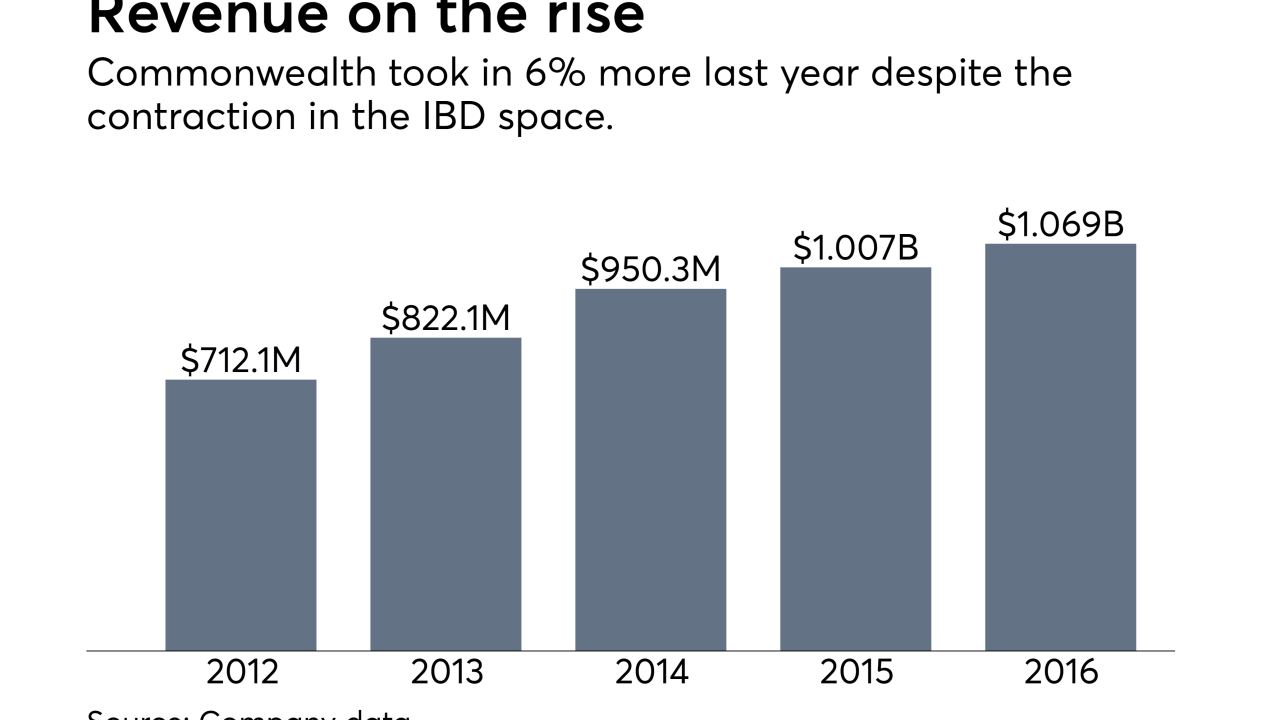

The 1,778-advisor firm constitutes the largest privately held IBD, underscoring the growing appeal of boutique-like models.

March 22 -

Ross Gerber says he left the firm to avoid its strict oversight of his press interviews and social media.

March 19 -

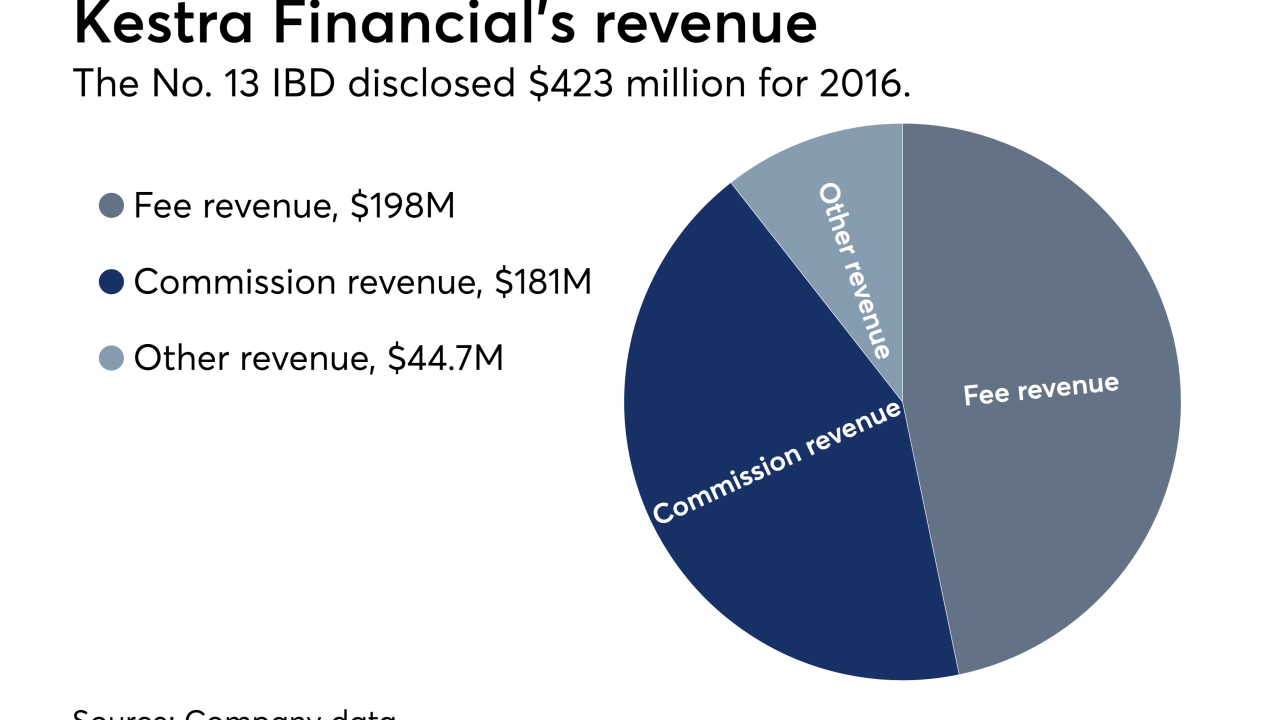

The No. 13 IBD has added 183 advisors through its recruiting efforts in the past two years.

March 19 -

The deal is only the first step in a major growth plan, according to the acquiring firm’s founder.

March 13 -

Advisors with 200 to 300 clients over-performed more so than peers with bigger sales territories, according to a new study by LPL and Kehrer Bielan.

March 12 -

The math works: Banks get a boost to their growth plans, while independent advisors get one more option for their succession planning.

March 9 -

At least three dual practices with nearly $1.5 billion in client assets have left since the No. 1 IBD unveiled the new guidelines.

March 8 -

The No. 9 IBD has emerged as one of the major players in a tough recruiting fight after the massive acquisition.

March 7 -

After acquiring four firms’ assets, the industry giant still faces big challenges ahead.

March 2 -

Funds managed by Marco “Mick” Hellman sold most of their holdings, while CEO Dan Arnold received options worth $5 million.

February 28 -

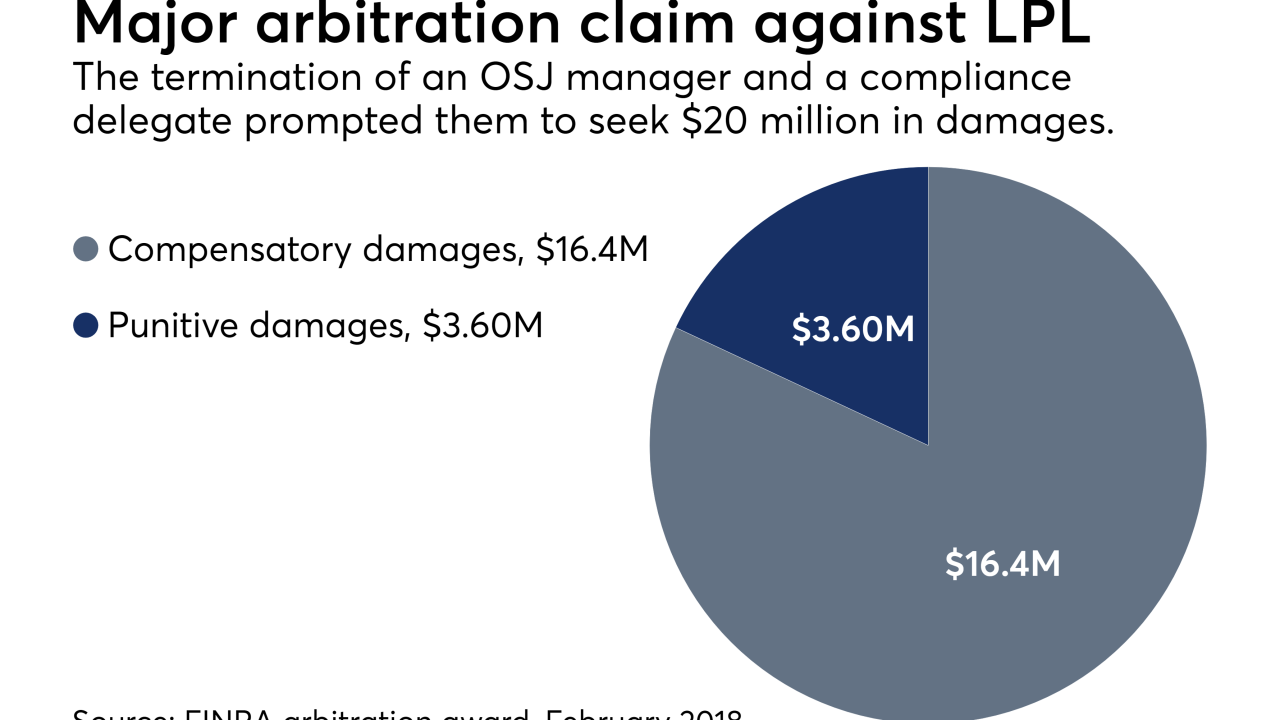

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20