An independent adviser stole $4.5 million from a former NFL player to pay his mortgage and credit card bills among other expenses, federal prosecutors charged.

Kenneth Ray Cleveland was indicted earlier this month on seven counts of wire fraud and three counts of money laundering, authorities said Friday. The U.S. Attorney's Office for the Southern District of Indiana did not name the NFL player, but said he had played for the Indianapolis Colts for several years.

Cleveland, 63, had worked as the alleged victim's adviser for approximately a decade following the player's entry into the NFL after graduating from college, authorities said. The former Colt met Cleveland, a CFP and CPA, through a college business professor.

"People place great trust in those who help manage and invest their hard-earned money," U.S. Attorney Josh Minkler said in a statement. "Exploiting that trust for personal gain through lies and deception is a crime that this office takes very seriously."

'YOU DO YOUR HOMEWORK'

Over the course of about a decade, the alleged victim provided $7 million to Cleveland to invest on his behalf, authorities said. But instead of investing the funds, Cleveland allegedly used part to cover personal expenses, such as credit card bills, and part to repay other clients as part of a Ponzi scheme.

To give the impression that the investments were generating promised returns, the Agoura Hills, California-based adviser also used $240,000 of the alleged victim's funds as purported interest payments back to the victim, authorities claim. Cleveland also created fictitious statements for the ex-client's accounts.

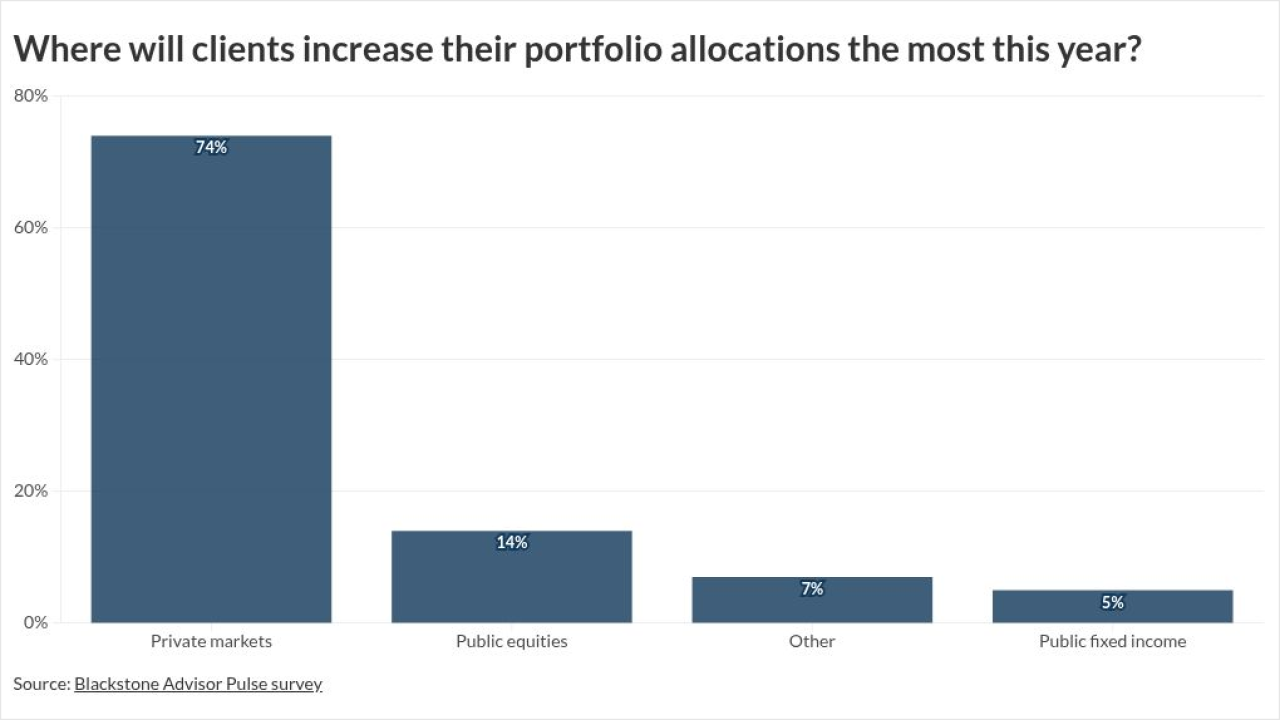

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

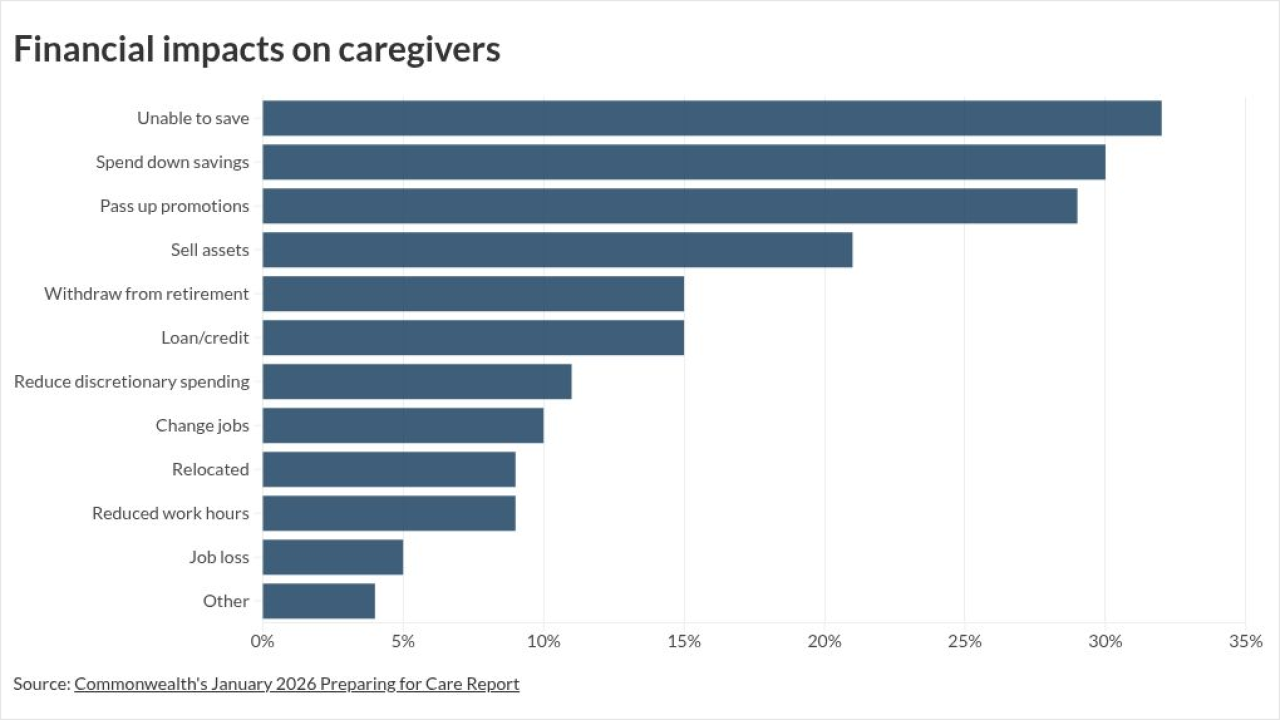

Financial advisors have critical roles for modifying financial plans to cover costs and long-term plans when clients find themselves faced with caring for a family member.

Wescott and Moneta Group present helpful examples of paths for financial advisors and other employees that experts say are essential for growth.

In June 2012, Cleveland emailed his client a story about another NFL player mired in a lawsuit against his agent and financial adviser over missing funds, according to the indictment. Cleveland told his client that "you get the credit for your financial success because you have paid attention, you do your homework, you stay involved, and you OWN your financial success!"

His alleged scheme came to end when his client started asking for his money to be returned and Cleveland could not produce it.

Cleveland's attorney, Michael Donahoe, said neither he nor his client could comment while the case was pending. Cleveland pleaded not guilty earlier this month, according to court documents.

The charges carry maximum sentences of between 10 and 20 years in prison, plus a maximum fine of $250,000, according to Assistant U.S. Attorney Nick Linder, who is prosecuting the case for the government.

The FBI helped investigate the alleged misconduct, according to the U.S. Attorney's office.

With additional reporting from Tobias Salinger.