A broker-dealer must pay a client over $1 million after she accused the company of fraud in connection with her variable annuity investment, according to a FINRA arbitration decision.

Wilbanks Securities, an Oklahoma City-based firm, sold Grace Huitt on an ING Landmark Variable Annuity by promising her 7% returns, says Huitt’s attorney, Marc Fitapelli. The case, decided last week by a Salt Lake City panel, came as part of a surge in client claims involving annuities amid debate around the Department of Labor’s fiduciary rule.

The broker’s written guarantee of specific gains, along with the fund’s lackluster performance, made for a “very simple case,” Fitapelli says.

“The issue was really that the broker didn’t understand the product,” the attorney says. “It’s really a unique case because rarely do you have a paper trail for something like that, and it’s usually one person’s word against the other.”

Stocks and Puerto Rican bonds are the focus of many cases among clients, advisers and firms.

ABUSE OF PROCESS?

Wilbanks CEO Aaron Wilbanks, who owns an affiliated RIA called the Wilbanks Securities Advisory, did not respond to a phone call and email Thursday afternoon. He denied Huitt’s allegations in his filing, and he accused her of an “abuse of process” because she filed an “ineligible and time-barred” claim, according to a copy of the arbitration award.

He went further in an online comment in response to a news story about the case, saying Huitt filed her claim over seven years after she bought the product. The client made about $200,000 on the investment and $1 million on another one purchased through the same adviser, Wilbanks wrote.

Additionally, the firm did not receive legal representation in the case because its lawyer was undergoing two spinal surgery procedures and unavailable during the hearings, according Wilbanks. The three-member arbitration panel rejected the firm’s requests to postpone the proceeding, Wilbanks said.

“Know and understand that the decision is illegal on its face and borders on criminality,” Wilbanks wrote. “That is why we have federal courts.”

Fitapelli declined to respond to Wilbanks’ claims, noting he has filed a motion on behalf of Huitt to confirm the panel’s decision in Denver federal district court. Wilbanks may seek to vacate the decision.

-

On the heels of a record-breaking year in enforcement, the regulator takes aim at cybersecurity, anti-money laundering policies and protection for senior clients.

April 20 -

The self-regulator is modifying its much-maligned process, addressing transparency and arbitrator qualifications, among other concerns.

February 10 -

The former planner says she was wrongfully terminated and that she did not agree to settle with the wirehouse.

February 8

ANNUITIES IN THE CROSSHAIRS

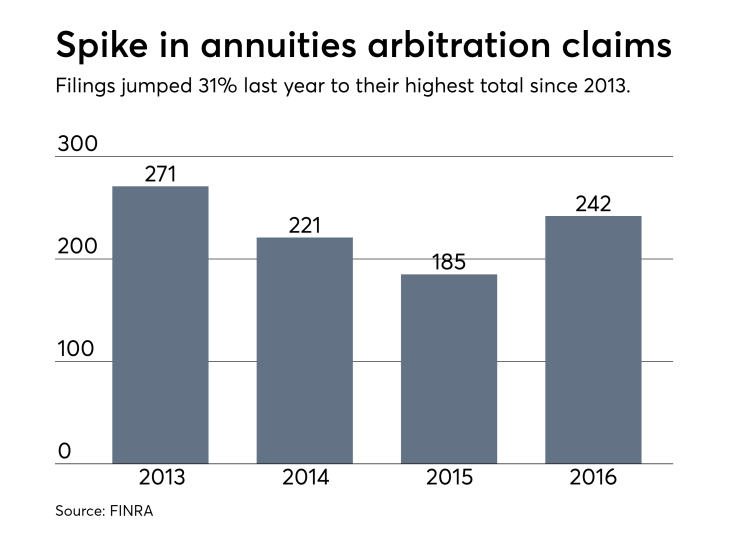

Client arbitration claims involving annuities rose by 31% last year to 242, the fifth most common security involved in a claim against FINRA member firms, according to the regulator. The fiduciary rule, which would place conditions on the sale of annuities, cast a spotlight on the products.

“It’s far too easy for an adviser to sell just one more annuity, regardless of whether it is a prudent choice for the investor, when a free vacation or an international cruise is waiting for him on the other side of the sale,” according to a Feb. 3 report by Senator Elizabeth Warren (D-Mass.).

Warren and other fiduciary advocates have slammed conflicts of interest around annuity investments for years as part of the rationale behind the rule.

‘WELL,YOU’RE WRONG’

Huitt pressed her claim with FINRA in January 2016, according to a copy of the April 13 decision. She accused Wilbanks Securities of common law fraud, breach of contract, breach of fiduciary duty, negligent supervision and a violation of the Colorado Securities Act.

The adviser, who wasn’t identified in the award, guaranteed Huitt that her investment would yield 7% compounded annual growth, according to Fitapelli. When she pointed out that it failed to meet the mark on maturity, the broker complained to the provider that it had reneged on its pledge, he says.

“The annuity company basically wrote back and said, ‘Well, you’re wrong, and we’re surprised that you don’t know how to read an annuity contract,” Fitapelli says.

A spokesman for Voya Financial, the independent spinoff of ING U.S., declined to comment on the lawyer’s account of the case.

Huitt requested $2.7 million from Wilbanks, including both compensatory and punitive damages and attorney fees, the panel’s decision shows. The three arbitrators found Wilbanks liable for $1,073,440 in compensatory and punitive damages, plus interest of 8% compounded annually.

Another FINRA panel will soon reach a decision in the case of another Wilbanks client over the exact same product, according to Fitapelli. He expects the judgment over the next few days, he says.