Dividend growth in the U.S. market continues to slow: The S&P 500’s median dividend increase has declined steadily since 2011. Since dividends provide more than 40% of the index’s total return, the slowdown in increases is troubling. The index’s current payout ratio is 44.4% vs. an average of 51.4% over the past 80 years, according to S&P Dow Jones Indices.

For several reasons, the market’s dividend growth is likely to remain sluggish. Even so, advisers whose clients seek growing cash from their equity holdings have some good alternatives in dividend-focused ETFs.

COMING UP SHORT

Dividends follow earnings, which are expected this year to be about 3.4% below the 2014 level. Part of the problem is energy, which contributed 12% of the S&P 500’s dividend in 2014 but only 9.1% as of last month. If oil prices continue to rise, they could boost the sector’s dividend contribution.

What else could cause the index’s dividend to rise? Advisers should look for two significant factors. One would be a decision by non-payers to join the dividend bandwagon, the other a restoration of full payments by companies that previously slashed them.

Which fund categories had the biggest rebounds this year?

If the five biggest non-payers in the index were to initiate a dividend equal to 1% of their market value, it would add $13 billion to the S&P 500’s cash payment. Of the five biggest non-payers, two are share classes of Alphabet (GOOG, GOOGL), the parent of Google. Also on the list are Facebook (FB), Amazon.com (AMZN) and Berkshire Hathaway (BRK.B).

Although Berkshire owns shares of companies that pay dividends, Warren Buffett’s conglomerate prefers not to pay. Instead, Berkshire uses its cash to buy other companies. As long as Mr. Buffett is in charge that is unlikely to change. Given his record, few would argue with the policy.

The other big non-payers have plenty of cash and have not proved as adept as Mr. Buffett in making profitable acquisitions. Amazon.com’s cash and cash equivalents totaled $13.7 billion as of September 30. On the same date, Facebook had $26 billion in cash and short-term securities and Alphabet held cash and equivalents of $83 billion.

Despite having enough to pay dividends, Alphabet, Amazon.com, Facebook and other technology companies have said they have other uses for the cash.

-

These funds have similar goals, but there are significant differences.

November 21 -

With a dearth of income alternatives for clients, advisers need to know that there are still some stocks that can do the trick.

August 18 -

Buybacks are good for company execs. But are they good for portfolios?

July 7

BIG BANK PROBLEMS

Another unlikely possibility for growth is the reversal of major dividend cuts. Two of the S&P 500’s five biggest reductions in shareholder payments were from Bank of America (BAC) in 2008 and 2009. The company now has an indicated rate of $0.30 per share, only about 12% of the rate before its 2008 cut. If it increased the dividend 25% annually, BAC would take 10 years to surpass its 2008 rate.

Citigroup (C) is further back, even though the bank is not in the top five for cuts. If its three dividend cuts had all been done at once, they would have totaled a record $11.5 billion. Citi’s current dividend is only 3% of what it paid before its first cut, adjusted for a 1-for-10 reverse split.

While Citigroup and Bank of America lack the ability to fully restore their dividends, and the major non-payers are unlikely to initiate them, advisers can look to dividend-focused ETFs.

The WisdomTree Total Dividend Fund (DTD, expense ratio: 0.28%) holds more than 800 domestic dividend-paying stocks across all capitalization categories. Advisers may want to look to this fund because it's well-diversified and yields more than the S&P 500.

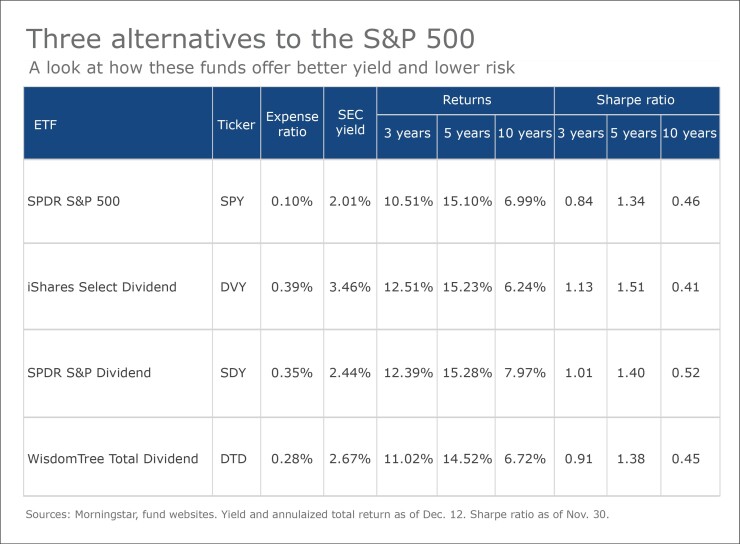

As of December 12, the fund’s 30-day SEC yield was 2.67%, outpacing the 2.01% available from the SPDR S&P 500 ETF (SPY, 0.10%), the largest ETF tracking the benchmark index. DTD’s Sharp ratio bested SPY’s over the latest three-year and five-year periods and slightly trailed over 10 years.

DTD holds payers even if they don’t increase dividends. Two ETFs that do require dividend growth are iShares Select Dividend (DVY, 0.39%) and the SPDR S&P Dividend ETF (SDY, 0.35%). SDY has a 30-day SEC yield of 2.44% and has a better Sharpe ratio than SPY. DVY’s yield is 3.46% and its Sharpe ratio was higher than SPY’s over three and five years, but lagged over 10 years.

These alternatives provide dividend income that may overcome the current drawbacks of both payers and nonpayers in the S&P 500. Clients can improve the income profile of their equity portfolios by moving some assets into these and other dividend-focused ETFs.