Fund costs are down, transparency is up — and yet avoiding controversial fees in a portfolio is still easier said than done due to one of the industry's bugaboos: 12b-1 fees.

Even Vanguard isn’t immune.

The asset management titan, which has built a reputation for driving down costs and improving fund transparency, accepts these fees from clients invested in third-party funds on its retail and robo advisor platforms. It does so even as regulators and industry advocates raise concerns over their usage.

Vanguard's complicated relationship with these fees is indicative of the industry's overall struggle to find a balance between appropriate compensation and transparency.

Share class and fee transparency "is at the mercy of the company’s legal staff,” says Greg O’Gara, a senior research analyst for Aite Group's Wealth Management practice. “I’m not singling out any one fund company. This is ubiquitous across the industry.”

Vanguard receives transaction fees, front- and back-end loads, sales charges and 12b-1 fees for certain transactions in its third-party mutual funds, according to the company’s Form ADV for Vanguard Advisers.

It also receives fees for shareholder services, fees that “may be considered revenue sharing and represent a significant source of revenue” for the company’s broker-dealer, Vanguard Marketing Corporation.

Fees can add up to 40 basis points annually in addition to operational payments in the form of networking or per-position fees of up to $20 for each customer position in a mutual fund on an annual basis, according to the disclosure.

Across the industry, there were 6,082 funds that charge clients a 12b-1 fee as of the end of May, according to Morningstar. The average fee is 40 basis points. Funds and share classes that include 12b-1 fees hold over 20% of invested assets.

Despite their prevalence, they’ve been under fire across the wealth management industry.

“Your average investor doesn’t know what the hell a 12b-1 fee is,” says O’Gara.

Your average investor doesn’t know what the hell a 12b-1 fee is,” says Greg O’Gara, a senior research analyst for Aite Group's Wealth Management practice.

Many advisors aren’t fond of them either.

12b-1 fees are “the devil,” according to Sandra Field, CEO of Asset Planning, a $264 million RIA in Cypress, California, who points to potential conflicts of interest for advisors.

The fee derives its name from Rule 12b-1 of the Investment Advisers Act of 1940, which permits fund companies to act as distributors of their own funds.

Clients can pay this fee out of both mutual funds and ETF assets — it goes to cover distribution (marketing and selling), and sometimes shareholder services, which include responding to client inquiries and providing information about investments, according to the

These fees pay brokers and firms for selling the funds — and platforms like custodians or brokerages that provide shareholder services.

While the fee must be disclosed on a prospectus, a fund can legally charge a 12b-1 fee of up to 25 basis points and still advertise as a no-load fund, according to

While these fees do help scale the fund in terms of assets, the shareholders who foot the bill don’t benefit, according to

Regulators have scrutinized wealth management firms and their advisors’ investment recommendations in this domain. FINRA and the SEC have filed at least 51 enforcement actions against firms regarding mutual fund share class selection in the last five years. In addition, an SEC

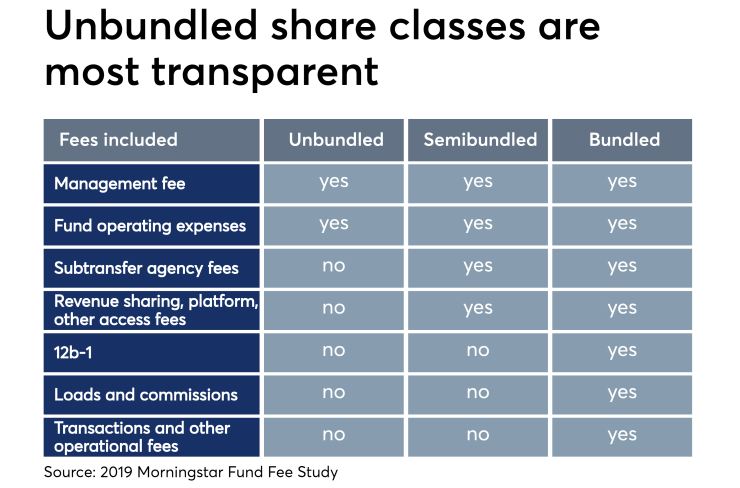

Investors, meanwhile, have started shunning the fees: Bundled share classes — which charge 12b-1 fees — reported net outflows of $288 billion in 2018, and $430 billion in 2017, according to Morningstar data.

Share classes that don’t charge 12b-1 fees, but do charge for revenue sharing, have reported inflows, according to Morningstar. They gained $183 billion in assets in 2018 and $581 billion the year before.

Is revenue sharing any better than a 12b-1 fee?

Semibundled funds “indirectly [charge] for sales distribution” in the form of revenue sharing, according to

12b-1 fees “absolutely are more transparent” than revenue sharing, according to Mercer Bullard, a law professor at the University of Mississippi and founder of investor advocacy organization Fund Democracy.

What [revenue sharing] really stands for is hidden marketing, hidden distribution,” says Mercer Bullard, a law professor at the University of Mississippi.

“At least the 12b-1 fee, the [client] sees that in the fee table,” Bullard says. If a custodian or brokerage platform is being paid from revenue sharing, that distribution expense won’t show up at all. “What it really stands for is hidden marketing, hidden distribution,” he says.

Who is profiting from 12b-1 fees and revenue sharing? Brokerages and firms across the industry, including Vanguard.

In response to several questions sent to Vanguard, spokesman Freddy Martino provided this statement:

“Offering non-Vanguard mutual funds provides additional choice to our clients so they may complement their Vanguard holdings. Some mutual funds pay fees to intermediaries, like Vanguard, to cover the costs of offering them on their platforms. Without these payments, the cost of offering third-party funds would be borne by Vanguard shareholders. Importantly, we make sure these fees are clearly disclosed to clients (see

In contrast to its competitors, Vanguard is one of a select few fund companies known for refusing to charge clients revenue sharing or 12b-1 fees on any of its own funds. Asset manager Dimensional Fund Advisors says it also does not charge clients these fees. Companies including American Funds offer specific share classes known as “clean shares,” where marketing and distribution costs are not included in fees.

“Vanguard has a longstanding policy of not paying distribution fees that incentivize sales,” Martino said. “Adding such fees would ultimately raise the cost of owning Vanguard funds.”

In addition to cost, Vanguard says 12b-1 fees are not sufficiently transparent to the end client.

“[12b-1 fees] can be explained. They can be understood, but it’s not the most straightforward method of charging,” Tom Rampulla, head of Vanguard’s Financial Advisor Services division, told Financial Planning in an interview in May.

The mutual fund behemoth's decision not to charge these fees has put it at odds with some brokerages and custodians.

Fidelity, TD Ameritrade and Morgan Stanley have adjusted their fee or product lineups, making it more expensive to invest in Vanguard funds, according to

“With some of our distributors, it’s a real source of contention,” Rampulla said. “Often times Vanguard will be the largest fund provider on the platform, and we don’t pay them. They still make a lot of money. They charge the ticket fee, but they don’t like that.”

[12b-1 fees] can be explained. They can be understood, but it’s not the most straightforward method of charging,” says Tom Rampulla, head of Vanguard’s Financial Advisor Services division.

Vanguard can afford to refuse to pay these fees, while still accepting them, based on the company's scale and high demand of its funds, according to O’Gara.

“Vanguard is an 800-pound gorilla in the mutual fund industry,” he says. “The popularity of Vanguard funds is so ubiquitous among U.S. investors that, although custodians are not happy with the economics they receive from Vanguard, they have to make some of these funds available to clients.”

Solving transparency issues around fund distribution won’t necessarily be an easy fix — distributors need to get paid for the work they do, according to Alec Lucas, who leads Vanguard research at Morningstar.

Vanguard says in its ADV that the fees reimburse the company for sub-accounting services, dividend calculation and posting, accounting, reconciliation, as well as preparation and mailing of client confirmations and tax statements.

Firms like Vanguard that offer third-party funds on their platforms are providing legitimate services to clients, according to O’Gara, citing an

Further, it’s not easy for a brokerage platform to refuse 12b-1 fees that are charged to clients by third-party fund companies, Lucas says. Asset managers would first have to create a new share class, which could spawn new problems if fund families only offered the new share class to Vanguard, according to Lucas.

“If you’re a fund company, it would introduce complications to make a special deal with Vanguard that you didn’t make with TD Ameritrade or [Schwab or Fidelity],” he says.

-

The regulator is going back to some of the firms that voluntarily settled, requesting information on revenue sharing.

March 26 -

It’s time to consider payment schemes that are more transparent and better aligned between who pays the cost — and who enjoys the benefits.

April 3

Ultimately, clients should be less concerned with the fees as they are with the product quality, Lucas says.

“It’s really about the net investment return that matters,” says Lucas, who himself invests in a third-party fund on Vanguard’s brokerage platform.

“It’s OK for a firm to be compensated for providing a service,” Lucas says. “The question then becomes: What is the appropriate level of compensation? And Vanguard has been a disruptor in this industry.”

Vanguard is in the business of reducing expenses for its shareholders, and is currently situated to do just that through accepting distribution fees, according to Bullard.

“It is not contrary to their philosophy of trying to reduce their expenses as much as possible so they can be the lowest cost provider,” he says.

Does accepting the fees also benefit the company’s track record of transparency?

“It would have been interesting to hear what [Jack] Bogle’s view of that would be,” Bullard says of the company’s iconic founder, who died this year.