The last major stock market downturn clearly demonstrated the inadequacy of many risk assessment tools deployed by financial service professionals. With the possible exception of FinaMetrica, which was used by only a very small percentage of the adviser population at the time, the tools available a decade ago proved woefully inadequate at predicting how clients would react during a major market downturn. As a result, far too many clients found themselves with portfolios that were inappropriate. In many cases, this resulted in emotional anxiety and/or financial loss.

With the current bull market over eight years old, it seems like an opportune time to ensure that clients and prospects are not shouldering more risk than is appropriate.

Because of the inadequacies that were exposed almost a decade ago, some enterprising folks saw an opportunity to create better risk assessment tools. Within the last decade, we’ve seen a steady flow of new entrants into the field. Riskalyze has been by far the most successful commercially, but there have been others. These include PocketRisk and Rixtrema.

In light of this, does the industry need yet another risk assessment tool? Kendrick Wakeman, CEO of FinMason, believes is does, and after examining the company’s platform, I think he is on to something.

FinMason offers more than just a risk tolerance assessment tool. It also offers a robust analytics platform that can be used for portfolio monitoring, compliance and more; application program interfaces that can deliver institutional grade analytics and proprietary data sets; and a lead-generation tool. Let’s examine each in turn.

RISK ASSESSMENT

FinScore Pro, the risk assessment tool, can be white labeled for your advisory firm. To begin the process, you can initiate a risk assessment by supplying a link to a prospect or client, or by viewing it with her on a web page. The web-based assessment also displays well on mobile devices.

FinScore Pro starts off by asking a client few simple questions about her knowledge of investments, special circumstances, stock market experience in 2008, age, years to retirement, estimated Social Security payments (a specific number if she knows it, or the platform’s estimate based upon her current income), current contributions to a retirement plan and current investment assets.

Additional questions can be added at the firm or adviser level. The answers to these questions do not directly impact the risk score, but they can alert the adviser to additional issues that can impact the client relationship.

FinMason uses this information to calculate the client’s estimated monthly retirement income based upon two portfolios with different risk characteristics. It then asks her to choose between the two portfolios. For example, Portfolio 1 is estimated to generate $15,084 monthly but lose 30.4% in a crash. Portfolio 2 is estimated to generate $15,291 monthly but lose 35.1% in a crash. The client must decide whether the extra $207 per month justifies a potential extra downside of 4.7 percentage points in a crash.

In the risk chart, the software provides an S&P 500 loss of 52% as a benchmark. If the client selects the less volatile portfolio, she’ll get a lower-yielding portfolio to compare it with. For example, she’ll now choose between Portfolio 1 and a portfolio that generates $14,787 per month, with a downside of 25%. If she chooses Portfolio 1, the exercise is over. The client’s risk score has been reached.

THE COMPARISON PROCESS

If not, she’ll get a new set of portfolios to choose from. Wakeman likens the process to going to the eye doctor, who continues to check the patient’s eyes through various lenses until the optimal set is identified.

The appealing aspect of this exercise is that it constantly forces the client or prospect to balance risk and reward. It illustrates that if she wants greater retirement income, she will need to assume more potential downside risk. Conversely, it shows that if she already has sufficient financial resources, she may be able to scale back risk. The FinMason approach is not unique, but the execution is well done.

FinScore Pro’s approach to balancing risk and reward is akin to going to the eye doctor, who continues to check the patient’s eyes through various lenses until the optimal set is identified.

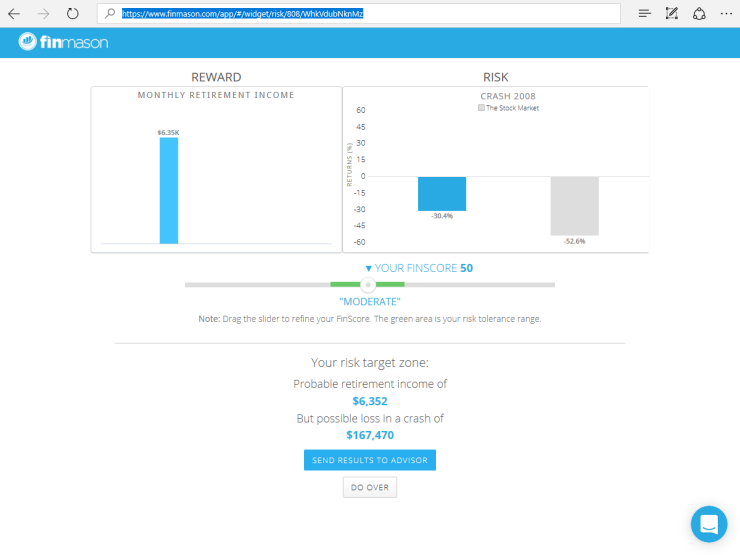

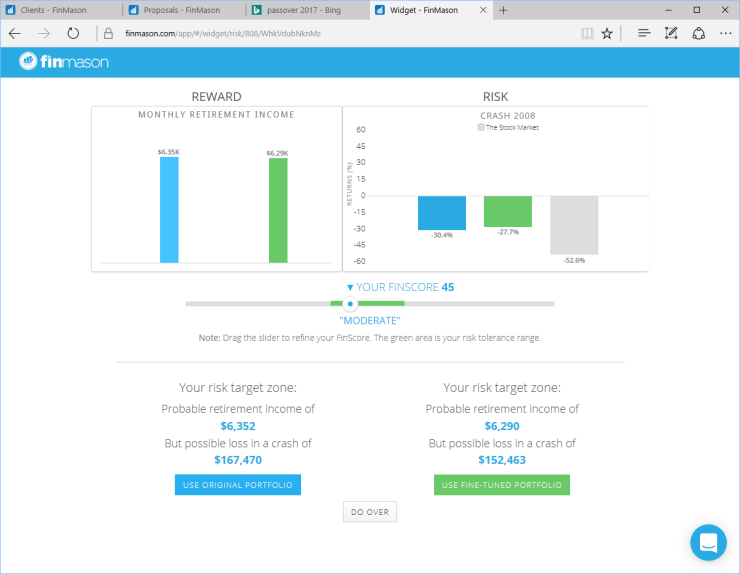

Once the client’s initial score is arrived at, a page displays the score, the estimated downside in a 2008-magnitude market and the estimated reward in terms of monthly retirement income. In this example, the loss is represented as a dollar value ($167,470) as opposed to a percentage.

As a final check, the report allows the user to drag the score up and down within a limited range. The application then contrasts the original score with the updated one. If the client is unwilling to suffer a potential loss of $167,470, the score is adjusted, which might result in an estimated income of $14,929 with a potential loss of $152,463. The client selects this new portfolio and with a click sends the results to her adviser.

The prospect is then asked to provide her current investment portfolio details. Data on assets can be collected in one of three ways: account aggregation, detailed manual data entry or asset allocation total assets plus percentages in equities, fixed income and cash. Apparently, to date the most popular method is the latter.

PORTFOLIO PROPOSAL

The adviser can then create a portfolio proposal, choosing from a FinMason model, his own model or one supplied by a third party. The FinMason models tend to be basic (my sample proposal for a $550,000 account contained only SPY, BND and GLD). The proposal includes all of the key information supplied by the client, her risk score, target monthly income and minimum monthly income requirement. You can add notes, include your fee and customize the report in a few other ways.

The appeal of FinScore Pro is obvious. Client expectations about potential risk and reward are clearly delineated and captured. The report can serve as a behavioral aid in times of market turmoil, and it can serve to protect the adviser from frivolous claims.

Once the proposal is ready, a link is generated that can be shared with the client. Assuming the client accepts the proposal, she clicks the accept button. The acceptance is displayed in the adviser dashboard, and the recommendation can now be implemented.

The appeal of FinScore Pro is obvious. Client expectations about potential risk and reward are clearly delineated and captured. The report can serve as a behavioral aid in times of market turmoil, and it can also serve to protect the adviser from frivolous claims.

Priced aggressively at $49 per month for a single user, and with volume discount available, FinScore Pro deserves more attention than it has garnered to date.

INSTITUTIONAL ANALYTICS

Another product offered by FinMason, FinScope, is a powerful tool that can extend the capabilities of FinScore Pro. FinScope is powered by Algonath, an institutional analytics platform. It merges two computational platforms: a data agnostic computational platform with analytics on six million investment assets globally and an extensive global macroeconomic modeling tool covering 25,000 economic inputs and 1,800 factor outputs.

Each night, FinScope looks at millions of portfolios and calculates how much each portfolio would potentially lose in a market crash. It then flags any portfolio where an estimated crash loss is expected to exceed the loss documented within FinScore Pro. The adviser can then review each flagged portfolio and take appropriate remedial action. FinMason supplies a full audit trail, storing each estimate and metric for 20 years.

Unfortunately for many readers, FinScope is available only at the enterprise level today. Given its broad appeal as well as FinMason’s apparent determination to make it available to a broader audience, we expect this situation to remedy itself soon. The most likely scenario is for FinMason to team up with custodians or portfolio management and accounting platform providers. This would allow FinMason to run analytics on all the necessary portfolios on a given platform nightly and to pass through volume enterprise discounts to all users on a given platform.

-

Totum Wealth says its new platform can analyze risk while also creating a custom portfolio. Our tech communist gives it a try.

February 19 -

Just about everyone in financial services wants to offer these retirement planning advice to wealthier boomers, but this firm rises to the top, says Tech Tools' columnist Joel Bruckenstein.

June 28 -

There seems to be a disconnect between advisors’ tech goals and their tech behavior.

December 29

FinRiver is a product that most advisory firms will not interact with directly, but they are likely to benefit from it. It allows other technology firms (custodians, broker-dealers, their party providers) to make use of FinMason’s application program interfaces to run analytic on their portfolios using the FinMason engine. The analytics available include factor exposures, scenario analysis, fee analysis, Monte Carlo simulations, expected returns and more.

LEAD GENERATION

Finally, there is the FinMason LeadGen tool; currently, I’d label this LeadGen Lite. It is essentially a customizable form that advisers can put on their websites inviting prospects to take the FinScore Pro risk assessment. It captures the prospect’s name, company name and email address, then emails them a link to the risk assessment, which can include extra questions created by the adviser; so, for example, if you are an adviser who sells life insurance, you can ask about current coverage.

Once the process has been completed, the prospect has the opportunity to share the results with the adviser. If she does, the adviser has the information necessary to initiate a conversation. There is no extra charge for the LeadGen tool, and it is a nice complement to FinScore Pro.

So, what firms is FinMason a good fit for? My answer is: enterprises that can leverage FinScore Pro, FinScope and FinRiver to create a highly customized experience for their clients. The risk assessment combined with the FinScope can ensure that all portfolios are aligned at all times with client risk tolerances. FinRiver offers the opportunity to provide advisers with other valuable insights.

Independent RIA’s will have to carefully consider the methodologies of the various products on the market and decide which one they prefer. Each provider’s approach claims to be backed by rigorous testing, and I’m not sure that there is one right way to do risk assessments, although I do feel confident that the tools available today are far superior to those most advisers were using a decade ago.

Bull markets don’t last forever, and many clients have short memories. Now is the time to make sure that clients are not assuming more risk than appropriate. If you wait for the next major market downturn, it could be too late.