An LPL Financial hybrid RIA grabbed four teams with combined client assets of $1 billion and acquired another practice with $120 million, as expanding types of affiliation and equity models mark the independent broker-dealer space.

Jeff Concepcion’s Stratos Wealth Network manages $13.3 billion in client assets across two RIAs, an asset manager and its clients’ brokerage accounts. The Cleveland-area firm spanning nearly 285 advisors and 87 offices added the four practices on its RIA-only channel, but it has two other kinds of affiliation.

Offices of supervisory jurisdiction like Stratos and IBDs like LPL and its rivals are

According to Concepcion, Stratos has added between 15 and 20 advisors this year to its three advisor channels: the RIA-only side, a hybrid RIA affiliated with LPL and LPL’s corporate RIA. Stratos’ advisors can also choose to retain full ownership of their practices, sell a portion to Stratos or do full equity swaps.

Stratos has grown to more than 60 employees at its home offices in Beachwood, Ohio, which Concepcion notes is a much larger corporate staff than most hybrid RIAs. The bigger team allows the firm to attract advisors by offering services like compliance, technology and human relations, he says.

“It’s an overused term, except I would say that when we say it, there’s substance behind it, and that’s ‘supported independence,’” says Concepcion. “When they visit our headquarters, they’re able to understand that there’s a lot of support, and it’s in a lot of different areas. And that value proposition makes sense.”

-

Executives from Pershing and Fidelity say smaller firms can find a home in the hybrid space.

February 5 -

Robert Russo says the Independent Advisor Alliance has recruited nearly three dozen IFP reps, and other large enterprises have also made inroads.

August 28 -

Wealth Enhancement Group would grow to nearly 70 advisors nationwide under its second major purchase of the year.

July 25

Planners ranging from sole practitioners to the largest OSJ enterprises welcomed the CEO’s comment that the firm's culture was not aligned with its strategy.

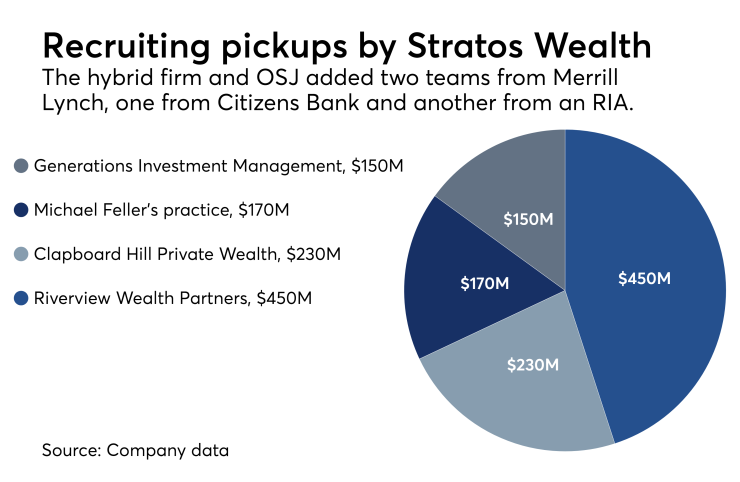

The largest new practice to join Stratos this year, Anthony Pratt and William Baker’s Wexford, Pennsylvania-based Riverview Wealth Partners, came to the firm in late June from Citizens Bank, according to FINRA BrokerCheck. They managed $450 million in client assets at Citizens.

Thomas Pacilio and Daniel Besse’s Westport, Connecticut-based team, Clapboard Hill Private Wealth, oversaw $230 million at RSM U.S. Wealth Management, an RIA, before coming to Stratos in March. And Michael Feller, Jason Hostetler and Tina Migge moved over in the spring from Merrill Lynch.

Additionally, the OSJ purchased Marlton, New Jersey-based Heald Financial Advisors, a former National Planning practice with $120 million in client assets, in its fifth acquisition to date.

Concepcion tapped Lou Camacho, a former senior relationship manager for Fidelity Clearing & Custody Solutions, to serve as the president of Stratos while leading its purchases of minority stakes in practices. The approach gives advisors autonomy with a backstop, in the case of an unplanned exit from the field.

“This is not a major change in strategy for this organization by any means,” says Camacho. “We’re simply building on something that we’ve had a lot of success on doing in the past already.”

Camacho had worked closely with Stratos out of Fidelity’s Chicago office for the past three years. David Canter, head of the custodian’s RIA segment, emailed a statement praising the hiring of Camacho by Stratos.

“We have a longstanding relationship with the firm and look forward to continuing to work together in the future,” Canter said.

Stratos had set a three-year goal in September 2015 to hit $100 million in annual revenue, and the OSJ network says it’s well ahead of its metric. The new goal, according to Stratos, is to reach $20 billion in client assets by 2021, which would be a roughly 50% expansion over its current level.

The firm’s independent RIA, Stratos Wealth Advisors, has $368 million in advisory assets, the firm says. The hybrid RIA, Stratos Wealth Partners, has $5.9 billion, and the asset manager, Fundamentum, has $236 million.

Two of the former Merrill advisors’ BrokerCheck files show employment separation disclosures prior to their moves to Stratos.

Merrill permitted Feller to resign in March over conduct involving the “submission of inaccurate business expense reimbursement reports,” according to BrokerCheck. The firm discharged Hostetler in April because a manager lost confidence due to “personal trading” inconsistent with Merrill’s standards.

Concepcion didn’t discuss the details of the two advisors’ dismissals, but the firm’s new business committee examines all prospective incoming advisors. He estimates the firm would be triple its current size if it didn’t have such a vetting procedure narrowing down the field.

In “rare” cases where new Stratos advisors have separation disclosures, the reasons for their departures are often “odd and difficult to understand whether or not there were other issues and other agendas being served,” Concepcion says.