Morgan Stanley Wealth Management saw fee-based asset flows jump 54% year-over-year, a surge accelerated in part by the wirehouse’s stepped-up recruiting efforts, said CFO Jonathan Pruzan during the firm’s third-quarter earnings call Oct. 15.

“We’re seeing Morgan Stanley become the destination of choice for financial advisors,” Pruzan said.

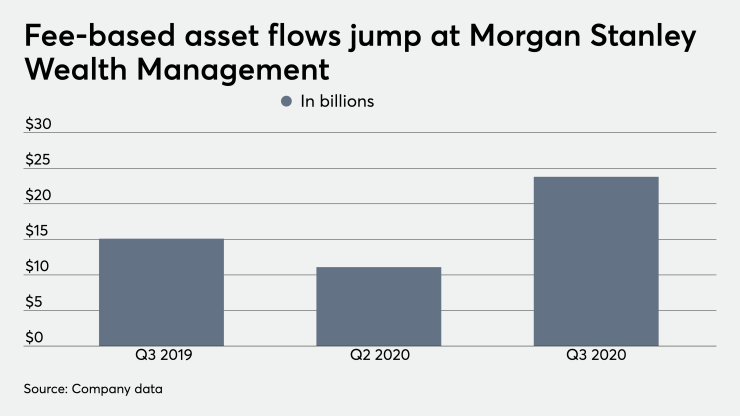

Morgan Stanley reported fee-based asset flows of $23.8 billion for the third quarter, up from $15.5 billion for the same period last year. About half of the wirehouse’s $2.8 trillion in client assets are fee based.

“This is the healthiest I have seen this business in the 14 years I have been here,” CEO James Gorman said during the call.

Advisor headcount at Morgan Stanley rose by a net 70 to 15,469 during the quarter.

“We are attracting big teams with good books of business,” Pruzan said, adding that the wealth unit is also benefiting from low advisor attrition.

The recruiting push represents a strategy shift after Morgan Stanley stepped back from

But the firm has shifted gears and netted some significant hires, among them two teams with

“For two years they were away,” says recruiter Michael King. “Then they upped the deal. And the back-ends are achievable and they have a big name that clients respond to. That’s a factor too.”

Net revenue for Morgan Stanley’s wealth unit rose 7% year-over-year to $4.6 billion, though net income fell 12% to $842 million due to higher expenses.

The wirehouse has also invested heavily in its technology platform, rolling out new or revamped digital tools including its Next Best Action, which uses artificial intelligence to identify client opportunities for advisors.

The firm completed its acquisition of E-Trade Oct. 2, a business that will add to Morgan Stanley’s banking and technology capabilities. Also earlier this month, the company said

On the call, Gorman said the acquisition was “too good of an opportunity to pass up.”