Morgan Stanley is exiting the Broker Protocol, further disrupting a recruiting landscape that has been undergoing a radical transformation over the past 18 months.

Because of the firm's size — it has 15,759 advisors — the move is likely to carry weight and could inspire others to follow suit, spelling an end to a truce of sorts that has existed between most firms since the agreement came into effect in 2004.

"I think it could be the beginning of the end of the protocol, and that would be bad for advisors and their clients," says Ross Intelisano, an attorney at New York law firm Rich, Intelisano & Katz.

When UBS declared last year that it would slash recruiting efforts by 40%, questions were immediately raised as to what other firms would do. Then, earlier this year, Merrill Lynch and Morgan Stanley did likewise. All three firms said they would reallocate resources from recruiting, which had become increasingly expensive, to their existing brokerage forces.

-

It seems that a long bull market in transition deals may be coming to an end.

May 23 -

"It's always nice when one poker player folds and it's down to two or three players," one recruiter says.

May 12 -

The wirehouse's executives think they've struck on the right formula to boost growth through a simplified comp plan, greater autonomy and an attractive retirement package.

April 17

Morgan Stanley echoed that sentiment in making its newest policy change, saying this would allow the firm to invest more in its current advisor force.

Exiting the protocol, however, would also act as a deterrent to advisors thinking of leaving to join a rival or start an RIA because they could face costly litigation over who owns the clients.

"It's a shame because anyone who remembers pre-protocol will recall how insane it was. There was a lot more litigation that I think everyone thought was unnecessary," says Intelisano, adding he can't recall the last time a major firm left the agreement.

Independent and regional firms have been maintaining strong appeal with new recruits.

The protocol was designed to ensure a seamless transition for advisors and their clients.

Morgan Stanley's exit will take effect Nov. 3. The wirehouse said in a statement that the protocol "no longer sustainable," claiming that the agreement had "become replete with opportunities for gamesmanship and loopholes."

JPMorgan Chase, for instance,

If the other big firms don't follow Morgan's lead, then it's less certian that the protocol is finished, says attorney Brian Neville with New York law firm Lax & Neville. "But for a lot of big producers with whom I have been talking today, this was a shock. A lot of people who might have been on the verge of leaving are probably feeling very uneasy right now."

To some industry observers, the policy shift appears to have been taken more with its current advisors in mind than non-protocol competitors.

Regional brokerages, independent firms and RIA breakaways have been poaching Morgan Stanley's talent for years. Indeed, it's not just Morgan Stanley. The wirehouses are still large, but more and more top brokers have been leaving and joining smaller rivals who promise less bureaucracy and greater freedom.

Through

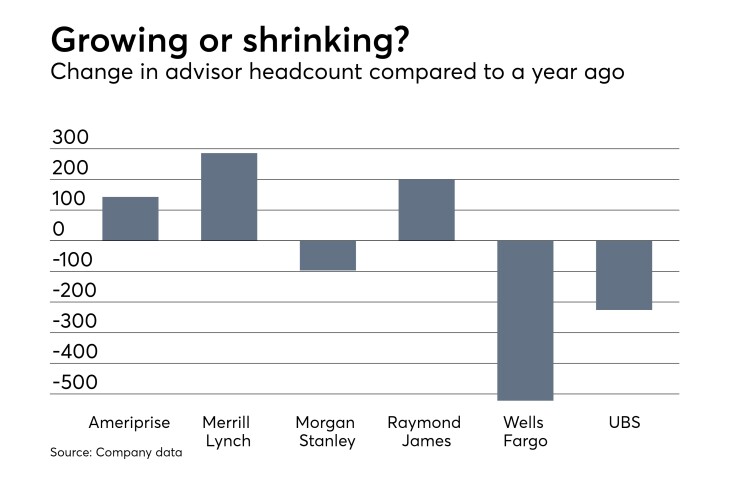

Those departures have been showing up in earnings reports.

Morgan Stanley's brokerage force was down by 97.

Representatives for Merrill Lynch and Wells Fargo could not be reached for immediate comment.

"The wirehouses have been net losers for four years now, by my calculation," says recruiter Danny Sarch. "If you are no longer benefiting from it, then it stands to reason that you either make it better to work [at the firm] or you leave the protocol to scare the heck out of the advisors."

It wasn't clear what Morgan Stanley would do if an advisor or team decided to leave the firm after it exits the protocol. A spokeswoman was not available for immediate comment. But industry insiders were quick to note that the pre-protocol era was characterized by heavy litigation.

"It will take a lot of chutzpah for the first Morgan Stanley brokers to leave the firm," Sarch says.

But even if threatened with potential lawsuits, advisors will still make career changes, recruiter Mindy Diamond contends. "Plenty of people moved pre-protocol, and they'll move again," she says.

Indeed, Dynasty Financial Partners, which has assisted a number of breakaway brokers going independent, has also helped advisors leaving non-protocol firms, says CEO Shirl Penney.

Penney adds that advisor moves between the big firms won't end, even if the protocol does. The value proposition of going independent, meanwhile, will keep rising, he contends.

"The lifeblood of our industry is assets. If you want to understand the market, watch the asset flows. And they've been going one way and that's to independence," he says.

Morgan Stanley's departure from the protocol may even be a recruiting opportunity for other firms, Diamond says. Rivals could tout their protocol membership as a sign that they respect an advisor's primacy in the client relationship.

"Every other firm has a choice," Diamond says. "Do they exit the protocol too? Or do they use it as an opportunity to champion advisors' rights and be the hero in all this."